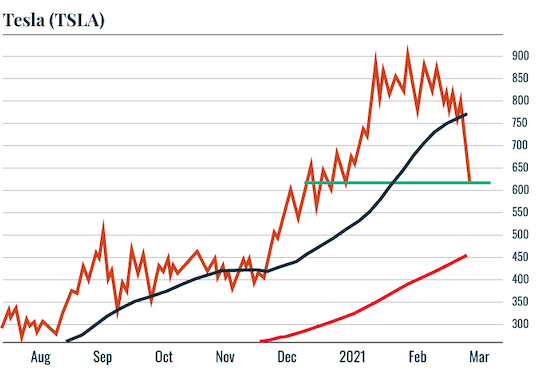

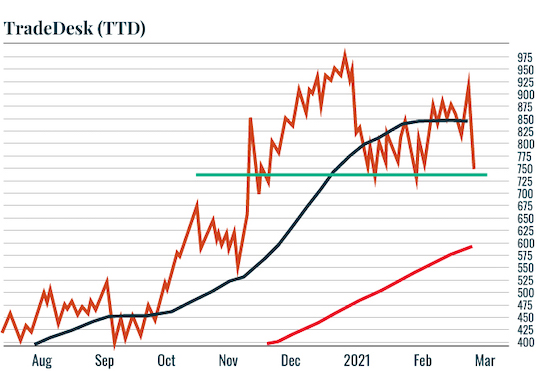

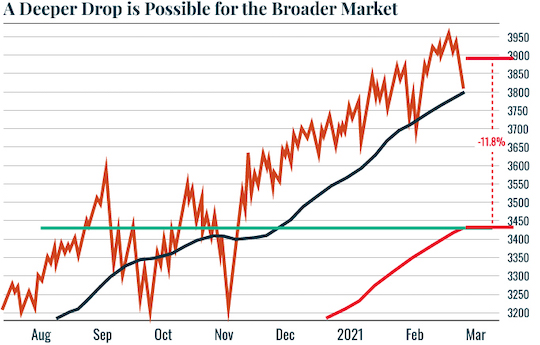

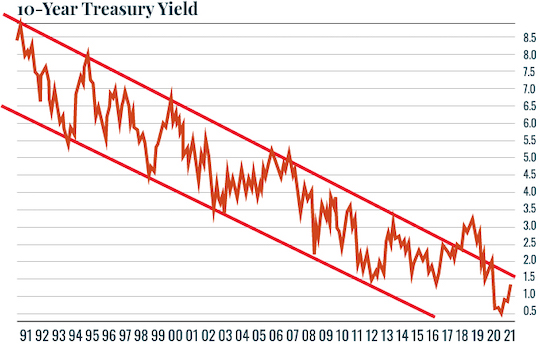

| Tesla (TSLA) has been one of the most important market leaders for stocks since the March lows. It sliced through its 50-DMA with little to no trouble. Support held, but this was a very negative development and opens the door to a test of the 200-DMA.  It’s a similar story for TradeDesk (TTD) another market leader: support held, but we sliced through the 50-DMA like a hot knife through butter. Again, the door is now open to the 200-DMA.  These are market leaders. If they pull back to test their 200-DMAs, the broader market will likely end up doing the same.  That’s a pretty significant drop. Again, the market action of the last week is quite problematic. While the S&P 500 looks contained, market leaders have seen tremendous damage to their charts. With this in mind, the potential for a nasty drop is higher than at any point in the last six months. The Glue Holding the Market Together is Coming Apart This all ties back to what I’ve been arguing for weeks now: That the inflationary forces rippling through the financial system will eventually HURT rather than help stocks. The reason for this is that the ONLY thing that allows stocks to remain in a bull market are calm and stable debt markets. And that, they are not. The yield on the all-important 10-Year Treasury Note has more than doubled since August and is now on the verge of breaking its 40-year downtrend.  This is a HUGE deal. The last time that downtrend broke was in 2018 and it resulted in the stock market losing 20% in a matter of weeks. And that may only be the beginning. The Fed was able to rescue the market by crushing interest rates and flooding the financial system with cheap money. This time they may not be so lucky. I’ve put together a brief presentation that explains how we got to this point — and what I believe will be the four distinct stages that will lead to a major collapse. A collapse that could ANNIHILATE most investors’ portfolios. You can see it here… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar