This year has already been my most successful year of investing by far. I’ve consistently been bagging gold gains in the order of five- and six-figures. I’ve never seen anything like it. Subscribers are having similar experiences and they’ve never seen anything like it either. This gold trading strategy is already paying off while the rest of the world and markets are witnessing mayhem. My email box is full of letters from concerned investors who have no idea what to do right now. Hundreds of companies in the S&P 500 are experiencing negative earnings growth…. Oil actually went negative at one point this year... You can’t rely on this recovery... | 🔥 PAYDIRT 2020 REBROADCAST! 🔥 TODAY is the day! You deserve to live a truly wealthy life... If you missed our exciting online event that happened on Thursday, you can still see what all the buzz is about... And Gerardo Del Real can show you to the front of the line. With so much money sloshing around in the $189 billion gold market (which is already WAY UP from just a few months ago!), gold investors can’t help but make a lot of money. It’d be a shame if one of them wasn’t you! TODAY is the first time ever that Gerardo is making the Paydirt Profit Cycle available to the general public... But we're keeping his video up for just a little while longer... Click here to view the PAYDIRT 2020 rebroadcast!

|

Over 50 million Americans have cumulatively claimed jobless benefits and earnings are in the toilet. Tens of thousands of new layoffs are announced daily. And everyone knows that when stocks do go up... they’re only going up because of Federal Reserve money printing and stimulus to the tune of trillions of dollars. “Don’t fight the Fed,” they say. But if the Federal Reserve can print unlimited dollars as it has now said... why can’t we all just get unlimited free dollars and be rich? Because of course, that’s not how reality works. In reality, all that printing and debt just drives gold prices higher. That’s exactly what’s happening now. And there’s no end in sight. The Federal Reserve announced in response to COVID-19 that quantitative easing would be UNLIMITED... That means there is no limit to how much paper money the Fed will create to combat this ongoing crisis. They’ve already printed much more than they did in 2008. |

Netflix Gets the Most Emmy Nominations in History The nominations for the 72nd Emmy Awards are in, and Netflix shareholders are rejoicing. Because for the first time ever, the streaming service received a record-shattering 160 nominations! Netflix had more nominations than Hulu, Amazon Prime, and Disney+. Even network giants like HBO and ABC couldn’t hold a candle to it! Clearly Netflix isn’t going anywhere, and this news will only give Netflix more market momentum. Investors want to get involved, but the stock’s almost $500 a pop right now. That’s way too pricey. So I found a straightforward play that capitalizes on Netflix’s growth, but requires zero of its stock. It doesn’t involve strategies like options, and you could earn gains upwards of 1,000% in the coming months. Click here to learn all about it. |

Federal Reserve Chairman Jerome Powell even went on 60 Minutes and told the nation that as a central bank he has “the ability to create money digitally.” PELLEY: Fair to say you simply flooded the system with money?  POWELL: Yes. We did. That's another way to think about it. We did. PELLEY: Where does it come from? Do you just print it? POWELL: We print it digitally. So as a central bank, we have the ability to create money digitally.

That digital toilet paper is just fuel for gold’s fire. Not even in 2008 did the Fed have a printing press with no cap. Unlimited CRUSHING DEBT, that’s what is being created. And now we’re already starting to see inflation and higher costs creep in. The debts are now much larger than the entire GDP.

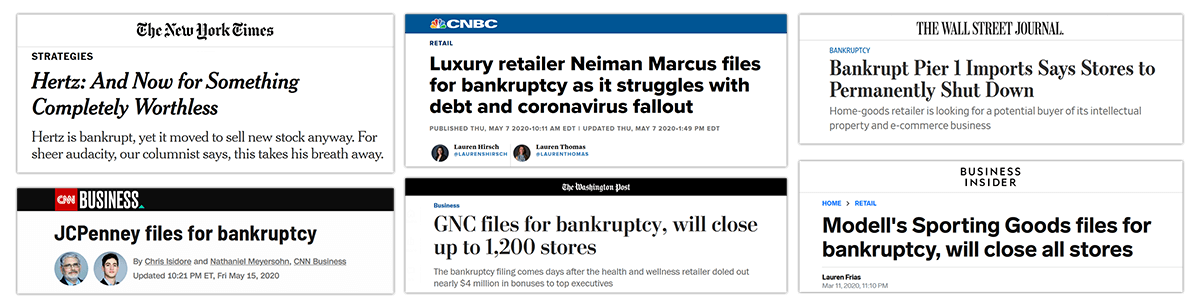

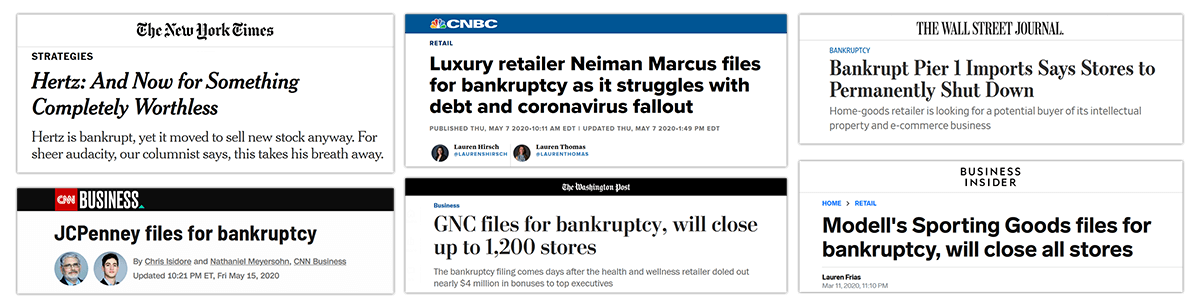

And corporations are in the same boat. You’ve seen how most major corporations can’t survive two months of interruption before facing bankruptcy.

That’s why they need all these costly bailouts... and yet more money from the federal government. | Medical Authorities Are Getting Behind This Instant COVID-Detecting Technology It’s not a vaccine. And yet incredibly enough, the world’s most powerful health agencies are backing this COVID-fighting device. The Center for Disease Control (CDC) announced that schools can reopen... ONLY if they use this technology. Dr. Fauci says it merits “serious consideration.” Even the FDA is on board, lifting regulatory restrictions on this technology’s use. So what is it, and which 50-cent tech stock owns all the patents? Click here to find out.

|

To say there is a severe disconnect between the reality of the economy and the performance of the stock market is an understatement. Billion-dollar deficits are now trillion-dollar deficits with leverage piled on. There is a coordinated effort around the world by central bankers to reward asset owners and punish savers and those who don’t have exposure to financial assets. Central Bankers are openly embracing an unsustainable reflation of financial assets that will eventually cause the greatest asset bubble we've seen in our lifetime... and maybe ever. The good news for us is that the bubble will send gold to historic highs. Not only during the reflation... But after the bubble pops as capital rushes into gold, seeking refuge. Buffett’s now on board with gold stocks for this reason. It’s also why Ohio’s pension fund just approved an allocation to gold. Billionaires and funds coming into the gold space are what will create a sustainable gold market that keeps prices at record highs. And that’s what will allow us to continue making the five- and six-figure gold gains we’re already making using this strategy. Call it like you see it,

Nick Hodge  @nickchodge on Twitter @nickchodge on Twitter

Nick is the founder and president of the Outsider Club, and the investment director of the thousands-strong stock advisories, Early Advantage and Wall Street's Underground Profits. He also heads Nick’s Notebook, a private placement and alert service that has raised tens of millions of dollars of investment capital for resource, energy, cannabis, and medical technology companies. Co-author of two best-selling investment books, including Energy Investing for Dummies, his insights have been shared on news programs and in magazines and newspapers around the world. For more on Nick, take a look at his editor's page. *Follow Outsider Club on Facebook and Twitter. |

@nickchodge on Twitter

@nickchodge on Twitter

Tidak ada komentar:

Posting Komentar