In This Issue: • A Tale of Two Quarters (In Pictures)

• ETF Talk: Socially Conscious Investors May Like This Short-Maturity ETF

• The Sweet Taste of Adversity | | A Tale of Two Quarters (In Pictures) | | Win Up to 87% of the Time -- Even in Volatile Markets My "5 Tips for Overcoming Market Volatility" can make you great returns in both good -- and volatile markets.

These strategies can turn even the most unstable markets into cash opportunities. Click here now to learn how protect and grow your money, regardless of market conditions. | | | The Dickensian aspect. That's a phrase sometimes used when one explores the financial, social and moral turmoil in a culture the way that Charles Dickens did in his masterwork, A Tale of Two Cities.

Here's the epic opening to that novel. Once you read it, you'll know why I chose it to describe what's happened in markets and the economy through the first two quarters of the year:

"It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way…"

As I wrote in the last issue of The Deep Woods, so far, 2020 is shaping up to be the worst year ever.

We've been hit with the worst global viral pandemic in over a century, a virtual shutdown of the American and global economies and we witnessed a gut-twisting plunge in the S&P 500 of some 30% in just a matter of weeks.

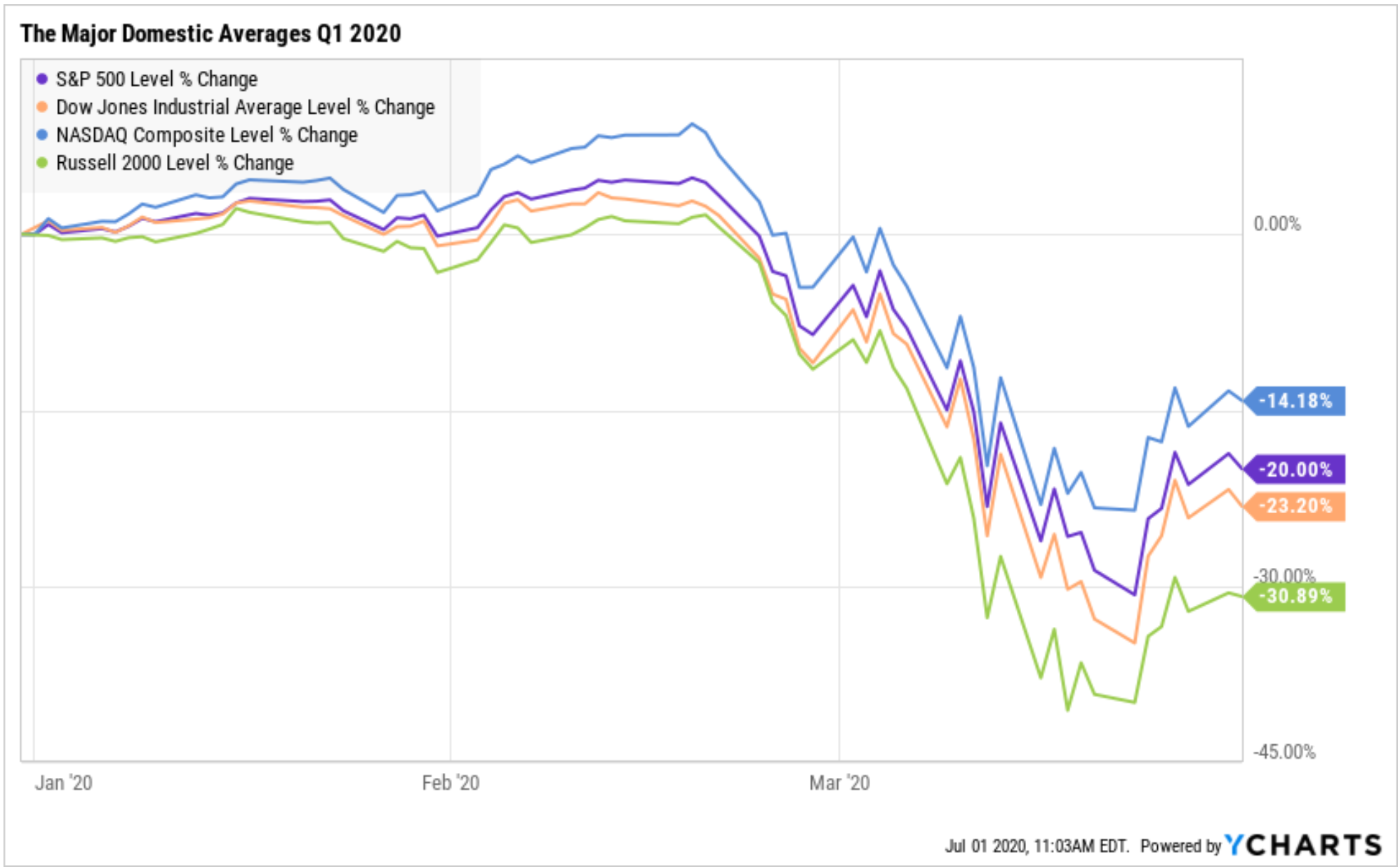

All of this pain was reflected in the worst first-quarter performance for markets since 1938. That drubbing can be seen here in the chart of the major domestic averages in the first three months of this year.

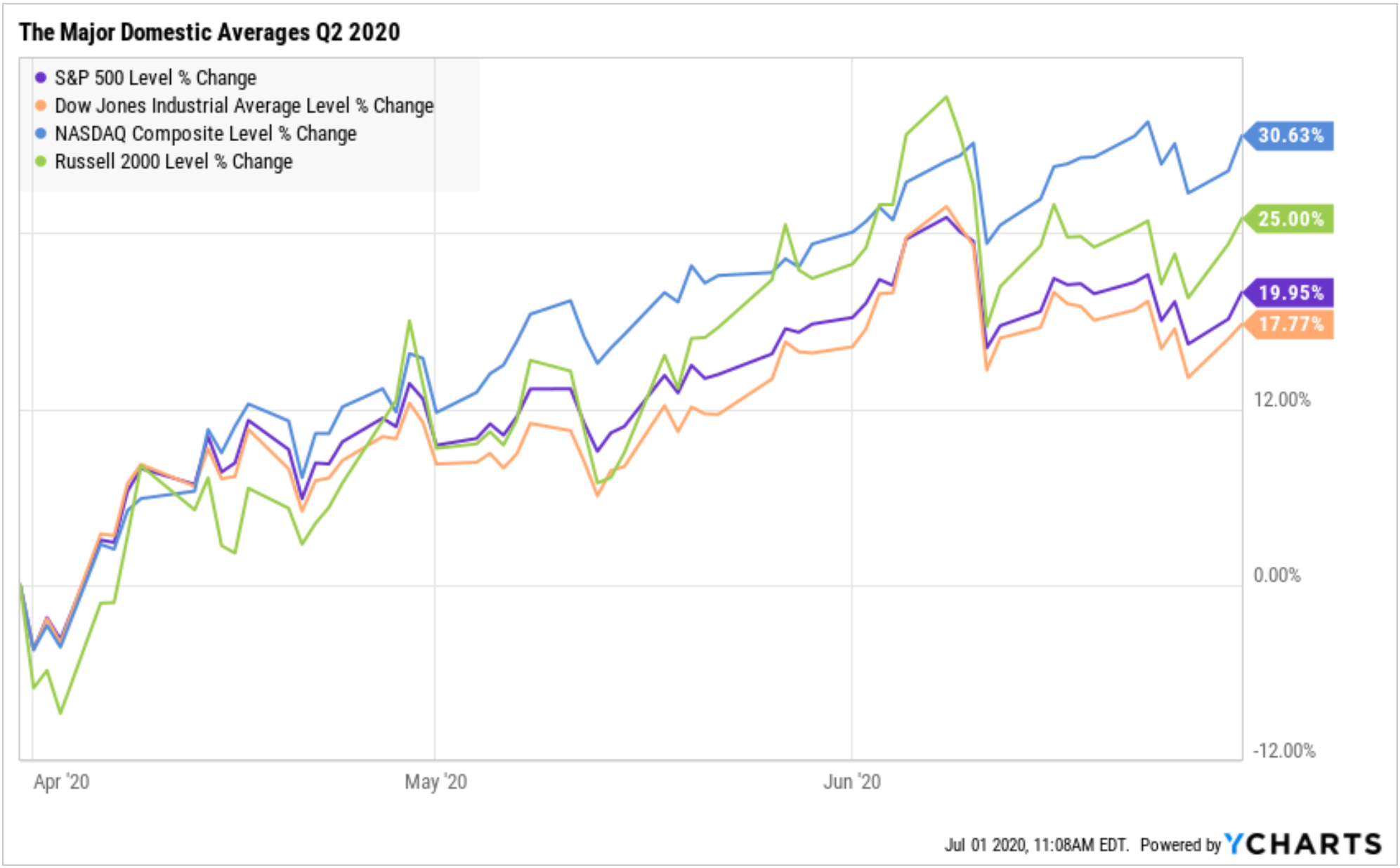

Yet through these "worst of times," individuals, acting in pursuit of their own rational self-interest, took action and have largely ushered back in the "best of times" during the second quarter. The chart here of the major domestic averages in Q2 shows a virtual reversal of the big selloff in Q1.

Of course, it wasn't just individuals who acted to pull the market up by its bootstraps. In March, the Federal Reserve announced unprecedented and virtually unlimited money printing that was designed to "rescue" the economy and the markets. Then, we had the federal government step in to issue massive, multi-trillion-dollar stimulus via beefed-up unemployment checks and Paycheck Protection Plan (PPP) loans to businesses.

Those combined efforts helped extricate stocks from their downward spiral. Though the trajectory in Q2 was occasionally volatile, by and large, the market staged a near-complete reversal of fortune from April through June.

Finally, let's look at the widened view of the major domestic averages through the first half of this crazy year. As you can see, while the NASDAQ Composite is firmly in positive territory, the Dow Jones Industrial Average, S&P 500 and Russell 2000 remain in the red year to date.

As you can see, 2020 has been a year riddled with tumult, and one can easily apply the Dickensian aspect here, as it is been the best of times and the worst of times for markets.

So, what's in store for the second half of this extraordinary year?

I think any real speculation here is mere folly, as the winds of change in this market are as unpredictable as the hot summer Santa Ana winds that blow through my beloved Southern California mountains.

Yet one thing I think we can say with virtual certainty is that this market, this economy and this society will continue to experience the best of times, and the worst of times.

Consider yourself forewarned. | | The #1 Question We're Getting From Our Readers: "With worldwide fears causing all these ups and down in the market...

...What should I do with my money?"

Fortunately, one of the world's top-ranked stock pickers has the answer:

His "fail-safe" system has kept investors safe from every bear market and crash for the last 43 years.

Click here for a free look at the fail-safe system -- including how his readers have fared since his system last signaled on February 27. | | | **************************************************************

ETF Talk: Socially Conscious Investors May Like This Short-Maturity ETF

(Note: Third in a series of environmental, social and governance (ESG) ETFs)

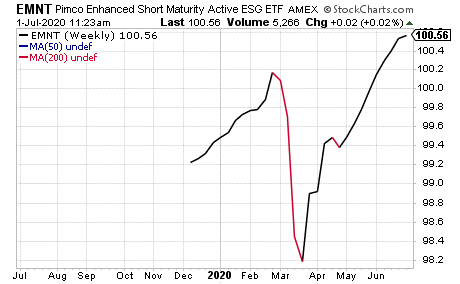

Socially conscious investors looking for an alternative to money market mutual funds may want to consider PIMCO Enhanced Short Maturity Active ESG ETF (NYSE:EMNT).

As an actively managed exchange-traded fund (ETF), compared to a money market fund, EMNT seeks greater income and total return potential by investing in short-term debt securities with an environmental, social and governance (ESG) screen. That approach makes EMNT ideal for socially conscious investors.

In looking to provide higher income than the average money market mutual fund, EMNT holds a variety of high-quality and ultra-short-term U.S. dollar-dominated debt, along with investment-grade securities. Investors will not solely be exposed to U.S.-based debt, since they will be exposed to U.S. dollar-denominated securities from developed countries and emerging markets, too. The fund aims to keep the average holding duration under one year and seeks to maintain a dollar-weighted average for less than three years.

This open-ended fund has a net expense ratio of 0.24% and $87.54 million in assets under management. Year to date, the fund has a total return of 1.30%. As depicted in the chart below, EMNT dropped sharply in mid-to late-March. However, starting in early April, the fund began to climb. Plus, the fund hit an all-time high market open of $100.56 on July 1. This showed a rise of 0.05% from the previous day's close.

PIMCO, the creator of PIMCO Enhanced Short Maturity Active Exchange-Traded Fund (MINT), is looking to find equal success with this ETF, as the investment management company found that not only were investors looking to move away from money market mutual funds, but ESG was becoming a priority as well. In order to satisfy this pool of investors, EMNT is unique as it works to avoid investing in securities of issuers whose business practices, in terms of ESG, are not up to par with PIMCO's proprietary assessments.

Though PIMCO has a set of criteria for its EMNT investments, it initially may engage with issuers whose ESG practices are suboptimal in hopes that through the initial engagement, their practices may improve.

For socially conscious investors who are looking for a greater income and greater return potential, Enhanced Short Maturity Active ESG ETF (NYSE:EMNT) may be worth consideration.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk. | | Arizona Man Develops Coronavirus Kryptonite I wish I had news about a vaccine for this deadly disease, but that still looks a long way off. But this is certainly the next best thing… a "cure-all" for the daily damage the coronavirus is doing to your retirement prospects.

One Arizona man has found an easy way to bank himself huge, ongoing profits from all the craziness and volatility in today's stock market. What's his secret? Join him now for a live update and join him in feasting on this frenetic market! | | | *********************************************************************

The Sweet Taste of Adversity

"Sweet are the uses of adversity, which, like the toad, ugly and venomous, wears yet a precious jewel in his head."

--William Shakespeare, "As You Like It"

If there's anything that this year has taught us, it's that adversity is omnipresent and always boiling under the surface of existence like the hot magma in the Earth's inner core. And while that adversity has come to the surface via a global pandemic in 2020, we don't have to completely bemoan it. Instead, we can learn from this ugly and venomous circumstance -- provided we acquire a taste for the sweetness of adversity.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report). Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report).

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar