In This Issue: • Do the Twin 'Ds' of Deficits and Debt Still Matter?

• ETF Talk: Accessing Current Income and Low Volatility

• How You Can Enhance Quarantine Communication

• The Honesty of Wealth | | Do the Twin 'Ds' of Deficits and Debt Still Matter? | | How We're Staying Safe in This Market With worldwide virus fears causing the markets to spiral, investors everywhere are wondering if the crash of all crashes is still to come. But not for readers who follow my "Fail-Safe" indicator… You see, for 43 years, my Fail-Safe has kept them safe from EVERY bear market and EVERY market crash.

In fact, it has been the one thing they can rely on to keep their portfolios from getting completely ravaged. Which is why -- at this critical junction -- I want to give you a free look right now. | | | Do the Twin 'Ds' of Deficits and Debt Still Matter?

One of the most frequently asked questions I receive from investors, whether it is at a conference such as the MoneyShow or FreedomFest, via email from readers or at any social gathering where people know about my occupation, has to do with what are sometimes called "the twin Ds," i.e. deficits and debt.

This subject has become of particular interest to many, given the massive deficits and debt headed our way due to the government's multi-trillion-dollar stimulus packages to fight the coronavirus pandemic. But just how massive is that debt?

Well, last week, the U.S. Treasury sold 20-year Treasury bonds for the first time in 34 years in response to the colossal amount of debt that needs to be raised to pay for the various stimulus packages. Not surprisingly, the resurrection of that bond further fueled a debate about whether the exploding debt that is funding the coronavirus response will be a long-term negative for the economy, the dollar and, by default, investors.

Up until this pandemic, the question of deficits and debt wreaking havoc on the economy was more of an academic argument. That's not the case any longer. Why? Because most adults know that it's impossible to always spend more than you take in and simply keep adding more and more debt without something really bad happening. And that personal knowledge is being extrapolated out to the U.S. government's finances as the multi-trillion-dollar stimulus packages rack up.

To help me unpack the question of whether the ramp-up in the twin "Ds" is going to represent a serious threat to the economy and the markets, I turned to my friend and brilliant colleague, macro analyst extraordinaire Tom Essaye of Sevens Report Research.

Tom is a regular contributor to my Successful Investing and Intelligence Report newsletters, and he's also the editor of a highly recommended daily publication called the Sevens Report.

Here are a few thoughts we bandied around during a recent discussion we had on this hot topic.

Jim Woods (JW): I am constantly being asked about deficits, debt and the buildup of both as they relate to the potential negative consequences they can have on the economy and the markets. These days, those questions are more relevant than they've ever been. What's your assessment of this situation?

Tom Essaye (TM): I think the concerns over the massive new levels of spending and the resulting deficits and debts to follow, are justifiable. Yet while we should be concerned, the deficit and debt are unlikely to derail the U.S. economy or the market over the longer term.

JW: Why do you say that?

TM: The reason comes down to one key factor, and it's the so-called "TINA" trade, i.e. "There Is No Alternative" to either U.S. Treasuries or the U.S. dollar. Yes, it's totally true that an already "not good" U.S. fiscal situation has been made exponentially worse by the coronavirus fallout and stimulus packages. Numerically speaking, consider that the U.S. deficit-to-GDP ratio will spike from about 4% in 2019 to nearly 20% in 2020!

Put in real dollar terms, the U.S. federal deficit was about $1 trillion per year at the end of 2019. It is expected to be $3.7 trillion by the end of September, and that's not including the latest $3 trillion stimulus bill working its way through Congress. Meanwhile, U.S. GDP in 2019 was about $21 trillion. Let's say it's down 5% to $20 trillion in 2020. That means that the budget deficit for 2020 will be around 18%. That's much higher than the 10% peak following the financial crisis. In fact, that's the highest deficit-to-GDP percentage since World War II!

JW: Given that increase, you would think that global investors would be selling the U.S. dollar and Treasuries. But instead, the opposite is happening.

TE: Yes, and the reason why is because every other country is in a similar situation. In fact, every major economy, including the countries of the European Union, Britain, China and Japan, all are having to raise massive amounts of money to offset the negative impact from the coronavirus. And since currencies and global bonds are all relatively priced, the net effect is that everyone's fiscal standing has been downgraded, not just the United States'. Given that, there remains no alternative (TINA) to U.S. Treasuries.

Put plainly, the United States is in not good fiscal shape, but so is virtually everyone else, and since capital needs to be placed in assets where investors are confident it will hold value, there remains nothing that can challenge the size and stability of the U.S. Treasury market. It may confound economic fundamentalists, but the simple truth is that demand for U.S. debt is surging despite the explosion in the deficit, and that's because Treasuries remain the safest, most-liquid sovereign bond in the world -- despite the exploding deficits and debt.

JW: I suppose that until something (i.e. a sovereign bond) can challenge that, which I don't see on the horizon, then the global market will tolerate a deteriorating U.S. financial situation far longer than the economic purists might think.

TE: Exactly. And as for the dollar, well, it remains the world's reserve currency, and that also helps give the U.S. a "pass" on a lot of her fiscal problems. Last week, I read that approximately 50% of the world's debt is priced in U.S. dollars. That means the world needs a lot of dollars, and that puts the U.S. in a very powerful position. It also incentivizes the global economy to support the value of the dollar and keep it stable, because if it becomes unstable, everyone loses. So, while it's not fiscally responsible, the U.S. debt and deficits don't matter to stocks as long as the U.S. is able to sell Treasuries to finance the gaps.

JW: I guess that means that U.S. deficits and debt won't matter until they become so bad that global investors don't want to buy Treasuries anymore.

TE: Yes, and that won't happen until the U.S. fiscal situation gets a lot worse, or there becomes a viable alternative to U.S. Treasuries or the U.S. dollar in the global bond and currency markets. None of those events are looming, and as such, despite the negative headlines, the deficit and debt are unlikely to hurt the equity rally or the economy near term.

Now, just to be clear, I'm not telling you or your readers that deficits and debt will never matter. I think that if left unchecked, and the deficit runs through 30% in the coming decades, then yes, at some point the market will begin to shy away from Treasuries. At that point, financial hell will break loose. And if things don't change in the trajectory of the U.S. fiscal position, that will happen one day, but it's very unlikely to be a day anytime soon.

JW: So, while deficits and debt make for interesting conversation, they aren't going to be an immediate market influence unless there's a massive and rapid deterioration.

TE: I think that's right, and I think that while it's something to have on our radar, for now it's not a reason to let fear of the twin Ds keep you from investing and growing your money.

JW: Thanks Tom, as always, you've been a rational lighthouse in a fog of COVID-19 uncertainty for myself and my readers.

P.S. Did you watch my live summit, "Action Plan for the Wipeout and Recovery" this afternoon? If so, I hope you found it interesting and actionable. If you missed it, then don't fret. This timely emergency briefing on how to handle this volatile market is too valuable, so we made sure you can watch a replay of the event right here. Don't miss this special presentation, and don't miss out on learning about three of my favorite trades designed to double your money! | | How to Predict Market Trends 72 Hours Ahead Are you eager for opportunities to profit by scoring quick, explosive gains? Believe it or not, even in today's turbulent market, there IS still money to be made!

We are the industry leader in A.I. forecasting for traders, and we've been fine-tuning our technology for over 40 years. In this FREE online training session, our experts will show you the next three top stock picks and a LIVE demo. Click here now to reserve your spot! | | | **************************************************************

ETF Talk: Accessing Current Income and Low Volatility

(Note: Second in a series of the biggest actively managed ETFs)

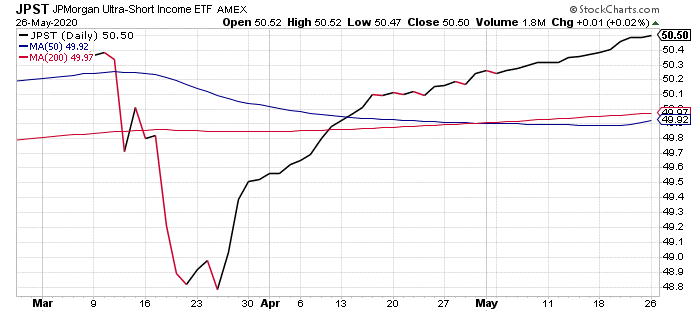

The JPMorgan Ultra-Short Income ETF (BATS:JPST) is an exchange-traded fund (ETF) whose aims are to maximize income and preserve capital through the use of U.S. dollar-denominated debt securities that have an effective duration of one year or less.

As an actively managed ETF, the fund does not need to depend on the weighting standards of an index. Instead, JPST's managers can adjust the portfolio holdings to aid returns and to reduce risk.

Drawing on the formidable economic research that is going on at JPMorgan Chase, JPST's managers have invested in fixed, variable and floating-rate debt in the form of corporate issues, asset-backed securities, U.S. government debt and mortgage-related debt. Not surprisingly, most of JPST's assets are concentrated in the U.S. banking sector, although foreign-issued debt sometimes appears in the portfolio.

Some of this fund's top holdings include the U.S. Dollar (11.68%), JPMorgan Trust II US Government Money Market Fund Institutional (4.47%), Federation des caisses Desjardins du Quebec 2.25% 30-OCT-2020 (0.93%), Toyota Motor Credit Corporation 1.15% 26-MAY-2022 (0.86%), DNB Bank ASA 2.125% 02-OCT-2020 (0.79%), Fixed Income (Unclassified) (0.76%), U.S. Bank National Association FRN 21-JAN-2022 (0.74%) and BPCE SA FRN 14-JAN-2022 (0.68%).

This fund's performance has risen after the recent market slide. As of May 21, JPST has been up 0.67% for the past month and 0.24% for the past three months. It is currently up 0.63% year to date.

Chart courtesy of www.stockcharts.com (accessed on May 27, 2020)

The fund has amassed $11.07 billion of assets under management and has an expense ratio of 0.18%.

In short, while JPST does provide an investor with a chance to profit, actively managed ETFs may not be appropriate for all portfolios. Thus, interested investors always should conduct their due diligence and decide whether the fund is suitable for their investing goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk. | | Arizona Man Develops Coronavirus Kryptonite I wish I had news about a vaccine for this deadly disease, but that still looks a long way off. But this is certainly the next best thing… a "cure-all" for the daily damage the coronavirus is doing to your retirement prospects.

One Arizona man has found an easy way to bank himself huge, ongoing profits from all the craziness and volatility in today's stock market. What's his secret? Join him now for a live update and join him in feasting on this frenetic market! | | | ********************************************************************

In case you missed it…

How You Can Enhance Quarantine Communication

You've been cooped up with your significant other, your kids, your grandkids, your roommate, etc. for the past several months due to the COVID-19 quarantine. Now, to say that this has been both a beautiful blessing and caustic curse for most Americans is probably stating an uncomfortable reality.

Yes, you love spending quality time with family during the lockdown. Yet, you also are likely suffering from heightened tensions due to the constant proximity and general sense of cabin fever that the current conditions have created.

Now, the country is fortunately reopening, with all 50 states beginning to lift restrictions on shelter-in-place orders. And while that is great for the economy, it's also great for the many Americans who have been under a lot of psychological pressure due to their intensified personal interactions.

So, what can we do about this situation? How can we enhance communication with our families, children, roommates or whomever we are in constant contact with?

To answer this question, I consulted master communicator, public speaker, writer and personal finance expert, Heather Wagenhals. Today, Ms. Wagenhals was kind enough to provide us with a few key techniques on how we all can improve our communication skills.

Jim Woods (JW): Okay, Heather, The Deep Woods readers want to know, what are your best tips on how to enhance communication?

Heather Wagenhals (HW): The first thing to do is realize that a conversation is not a 50-50 engagement. It is 100% both ways. Try to approach every communication as less about getting your point across and more about understanding. Consider it your obligation when communicating to try and achieve a clear sense of mutual understanding. We all approach the same things in a different way. So, it is helpful to remember that in any communication, especially ones that are strained during times of duress, to set aside our personal opinions of what we think is going on or how someone "should be" handling things and connect with people where they are.

JW: What about the concept of Mehrabian's Rule? Does that apply here to familial communications?

HW: Indeed it does. Mehrabian's Rule tells us that more is spoken without words. This rule is viewed as a ratio that explains how much emphasis we put on parts of communication, which is 55-38-7. So, 55% of our communication is nonverbal. This is body language, gestures, facial expressions, posture, etc. We say the most without even saying a word. Then 38% of our communication is audible. This is what we hear that includes volume, rate, pitch and vocal inflection. Only 7% of our ability to communicate is the actual words we use. So, make sure what you are communicating with words is what you are communicating with the other 93% of yourself.

JW: What about the importance of listening in good communication? I feel my interactions are enhanced when I pay close attention to the listening aspect.

HW: Listening intensely, and in full focus, is critical. Try to avoid thinking about what you are going to say next, avoid interrupting and just truly listen. Failure to do this will result in you missing out on quite a bit of information. The value of listening intently is that you will learn where people stand, and you will have even more information. Most people will tell you exactly what's on their mind if you listen with both your eyes and ears.

JW: Excellent. Any final tips?

HW: Yes, and this is the most important -- always think before you reply. By remaining calm and not engaging in instinctive and possibly overly emotional reactions, we can find ourselves in our highest resource states. These are the states that allow us to think objectively and clearly. This is where we review the information we have just received, and we can adequately evaluate the meaning of our conversation. Did the other person give us enough information to elicit our understanding? Is a follow-up question necessary for clarification so that we do not make any assumptions? Unless we stop and think about it for a moment and be genuinely contemplative, a knee-jerk reaction in communication can have an adverse impact, not only on that conversation, but potentially the entire relationship.

JW: Excellent. It is always a pleasure to get your insights, and I did think about that response before I replied.

HW: Well, then, you've listened well.

*********************************************************************

The Honesty of Wealth

"When you are rich, you can afford to be honest."

-- Dr. Mark Skousen

This week's quote comes to us from my friend and Fast Money Alert co-editor Dr. Mark Skousen, and it's one of his many brilliant insights. Here, he reminds us that having financial means gives you freedom to do the things you want to do. Perhaps more importantly, it allows you to say the things that must be said, even if they upset or offend.

Of course, we shouldn't say things for the purposes of offense, but rather because truth is a virtue and dishonesty is an injustice to reality. So, invest wisely, get rich, tell the truth and be noble. It will make you feel good, and it will help the world be better.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report). Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report).

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar