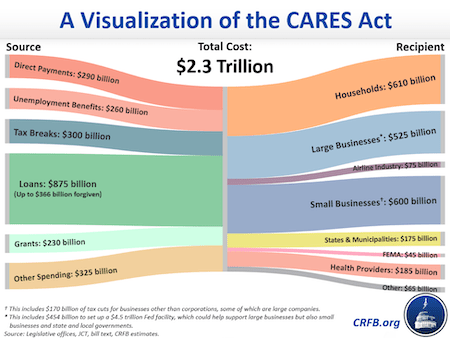

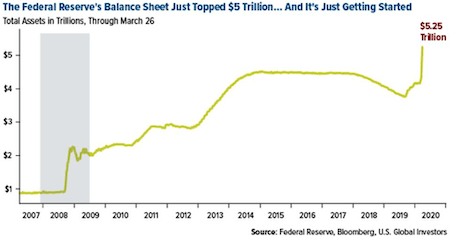

| Surviving and Thriving During the Global Pandemic of 2020 How to make sense of a financial world turned upside down Dear Reader, The new stimulus is here… the final vote in the Senate for the CARES Act was a unanimous 96-to-0. Here's how Forbes describes their courage: "This demonstrates to me just how united lawmakers are in getting help to struggling families and businesses." Really… not one statesman with a dissenting opinion. Reminds me of the saying, "If everyone in the room is thinking the same thing, then many of those people are not thinking at all." I'm going to give you a dissenting opinion… one that could help you preserve your wealth. Open a Hard Assets Alliance account today… so that you can protect your money the same way the wealthy do… <<<By Owning Gold and Silver>>> Now back to our esteemed thinkers, nonthinkers and the president who signed into law the CARES Act this week… whether we like it or not. The act became the largest economic stimulus bill in modern history. Double the amount of the stimulus act passed in 2009 by the Obama administration during the financial crisis. You can see a nice infographic of the expected use of CARES (gotta give 'em credit for the acronym) below…  Source: www.crfb.org Thanks for CARing… but what about the Fed? I thought they were the ones to fix the economy for all of us. Don't worry, they've kicked into high gear as well. As Jim Rickards reports in The Daily Reckoning… The Fed's balance sheet is going straight up. But corporate earnings are going straight down. The Fed is keeping the lights on in the financial system and preventing the credit markets from freezing up, but not much else. There is spending. There is printing. But there is no "stimulus."  Source: Forbes.com Jim continues… Giving people money may be needed, but it does not rescue the economy if people save the money or pay down debt (which many will do). There's no velocity if people won't spend the money. So, yes, the bailouts are needed. But that doesn't mean you can expect a fast recovery. No fast recovery? Blasphemy! The Fed has teamed up with the U.S. Treasury — together, maybe they can prop up the economy. On Friday, the Treasury got about $450 billion from Congress as part of a $2.2 trillion U.S. stimulus package. Treasury Secretary Steven Mnuchin told Fox News on Sunday he believed the additional funds could help the Fed and Treasury provide about $4 trillion in loans. $2.2 trillion stimulus package, $4 trillion in loans, and our first responders don't have enough face masks to protect themselves while they treat the critically ill. By now the coronavirus is having a major impact on your daily life… your work… your family… schools… bars, restaurants… your ability to travel and enjoy life as you have come to know it. Since all of this is true, I'd like to offer you an opportunity to vaccinate your investment portfolio — free of charge — starting just minutes from now. You Can Do This With Gold and Silver Today However, most methods of investing in gold and silver will cause as much pain as the rest of the markets. It must be done properly, in order to protect your wealth and not leave you stuck with no way to liquidate your position. That's why we believe in investing through Hard Assets Alliance. As one of my friends and fellow writers also said, "This is either an appropriate-level response, or it's the worst man-made catastrophe in the history of man." Meanwhile, as the "self-imposed quarantine" continues, it's time to take matters into your own hands to protect your wealth. Our publisher, Matt Insley, at St. Paul Research reminded us yesterday: Based on the monetary history of the past century, a collapse meant that the major financial and trading powers of the time sat around a table and simply rewrote the "rules of the game"… For example: In 1922… Genoa, Italy, where after WWI, the world returned to a partial gold standard… In 1944… Bretton Woods, New Hampshire, where the gold-backed U.S. dollar became the de facto world reserve currency… In 1971… the "Smithsonian Agreement" in Washington, D.C., where the gold window and fixed exchange rates were forever altered and the current "age of inflation" began… In 2008… the "Global Bailout" transferred wealth between nations and created insurmountable debt, forcing the price of gold to skyrocket. Fact is… These "rule changes" happen in major crises, much like we're seeing today. And… For you and me, this can have devastating effects. You see, when the elites and the global deep state sit around the table and rewrite the rules, the changes are always in their favor. But they may not be in ours. In other words… When the monetary collapse comes, zombies aren't coming for your family… they're coming for your wealth. But here's why this is so urgent… We're on the edge of a gigantic, global monetary "rewrite." The music is about to come to a grinding, drastic halt. I'm sure you know what I'm talking about. This should be a big… red… wealth warning. Flashing on your screen. It's also the same reason that gold is starting to move higher. The way I see it, the "new rules" of the game will likely include gold. (That's because gold has always been in the mix.) I agree… That's why I'm issuing an URGENT action on gold today Hands down the best way to buy, sell and trade this one asset today is with an account from… Hard Assets Alliance It's easy to set up. Easy to use. And best: The setup is free. Free of charge. We say this with as much urgency as we can muster: Open an account and put a portion of your assets in gold. Yes, gold — the one asset used to store value for thousands of years. This pandemic is downright biblical, so you need an asset that has passed the test of time since before the Bible was even written. Hard Assets Alliance has a state-of-the-art trading platform where you can buy and sell fully allocated gold bullion. You can buy, sell and trade silver and other precious metals too. Their fees are low, so you get the lion's share of the profits when you sell. And better yet, at the point of purchase, Hard Assets Alliance allows you to either take delivery, or… get this… You can store your metals in one of six different vaults around the world… New York and Salt Lake City here in the U.S., or you can also store your gold outside the United States in ultra-secure offshore vaults in London, Singapore and Australia. Opening an account is secure, and it takes just nine minutes to go from opening an account to funding to buy your gold and silver. In 20 years of business, we've come across many gold companies that want us to put their products in front of you. Many of them promised us huge commissions. Translation: that meant huge markups for you. We have consistently said no. Instead, we did the hard work on your behalf… finding the best way to buy, sell and store gold… in an easy platform… with super-low costs. We found all of that — and more — in the Hard Assets Alliance platform. We liked it so much, in fact, that we bought a stake in it. So while we're providing you with an easy way to vaccinate your portfolio today, you should also assume we're going to benefit from increased trading activity. You CANNOT afford for time to pass Just ask yourself… What if the pandemic does get worse? What if the economy continues to collapse? What if Trump uses this as an excuse for the government to nationalize the airline industry… nursing homes… cruise ships… and more? We don't seem very far from that already. What if true panic sets in? Will you be prepared by adding gold as a hedge against collapse? Or will be you one of the sad few left behind when the chaos hits?  Source: The Oakland Press No more pasta, toilet paper or water to buy. Not at any price. Soon those "gold shelves" could run empty, too… What happens when you wait and there's no more gold to buy? Not at any price? It's still NOT too late. Gold and silver prices still haven't reacted to the massive stimulus the government has already put into law. Gold and silver can still be bought and sold at Hard Assets Alliance, and as we've said repeatedly, HAA is the best, cheapest and most efficient way to do so. I trust you'll continue to make the right decisions… Open your account here… Regards,

Addison Wiggin

Founder, Agora Financial

Parent Company of Laissez Faire P.S. Once you open your account, you'll gain immediate access to a live event we hosted: Part II of Surviving and Thriving During the Global Pandemic of 2020. We have with us for Part II of this series Steven Feldman.  Hosted by Addison Wiggin, bestselling author and founder of Agora Financial. Addison also shares some personal anecdotes of the pandemic… Hosted by Addison Wiggin, bestselling author and founder of Agora Financial. Addison also shares some personal anecdotes of the pandemic…

On the call with Addison will be Steven Feldman to share his market perspective and the high-level evaluation methods he uses to make decisions in the marketplace. Mr. Feldman is the CEO and co-founder of Hard Assets Alliance.  Mr. Feldman was a partner at Goldman Sachs, where he was the founder and head of the global infrastructure fund with over $10 billion under management and served on numerous corporate boards. Mr. Feldman was a partner at Goldman Sachs, where he was the founder and head of the global infrastructure fund with over $10 billion under management and served on numerous corporate boards.

Steven will be giving us his unique perspective and insight into the current economic climate, answering questions like: - Why does HAA work? What makes it different?

- As this quantitative easing, increasing the money supply, operation gets underway, how do you see this affecting the precious metals market and the savers? Do the savers get the short end of the stick here?

- A lot of media sources are reporting that there is a shortage of gold. Is this true? If so, why is that, and how long will it last?

- Where do you see gold in six months to a year? And where do you see the markets in six months to a year?

- What do you say to those who say that they already missed the gold opportunity… "That ship has already sailed"?

All of these urgent questions — and more — will be answered in Part II of the free summit Surviving and Thriving During the Global Pandemic of 2020. Please note: We're NOT selling access to this summit. We're NOT charging any fees. The only way you can gain access to Surviving and Thriving During the Global Pandemic of 2020 is to open your account with Hard Assets Alliance. Once you do, you'll gain access to the summit for free, immediately. We want you to have an account with Hard Asset Alliance so it's easy for you to execute the trades we'll be recommending throughout the pandemic. If you show you're the serious reader we're looking for… by opening an account today… we'll send you access to the summit FREE of charge. The account opening is free. There are no minimum funding requirements. And once you've completed the short account-opening process, you'll be able to shop for the type of gold bars and coins you want to buy right away. P.P.S. Don't wait for the pandemic to spook the markets any longer… click the button below and vaccinate your financial portfolio today. <<<Open an Account Now>>> Remember, when you open your account with Hard Assets Alliance, you'll gain immediate and free access to the summit Surviving and Thriving During the Global Pandemic of 2020 immediately for FREE. Open your account today. Again, a quick disclaimer… we like the service that Hard Assets Alliance provides so much that we've purchased a stake in the company itself. So you should assume we will receive some sort of compensation if you choose to do business with them. |

Tidak ada komentar:

Posting Komentar