By Jeff Clark, editor, Market Minute Volatility is exploding higher. The Volatility Index (VIX) is hitting highs we haven’t seen in years. Stocks are falling. The market is collapsing. And folks are willing to pay huge premiums to buy put options as a hedge against even more downside. At a time like this, traders need to remember this phrase: Periods of low volatility are always followed by periods of high volatility, and vice versa. It seems like now is a good time for some of that “vice versa.” | Recommended Link | Is this man the next Head of U.S. Space Force? Here are the facts: He's a graduate from Purdue University's famed "School of Astronauts"… He was recently spotted at the Pentagon… He's attended meetings in highly secured chambers beneath Capitol Hill... He spent time on Nasa's Ames campus... And he's a massive supporter of President Trump's impact on the stock market — the tech market in particular. Is there something going on here? Could this man be the next Head of the U.S. Space Force? It's hard to tell… But he sure seems like the kind of guy Trump would want to head the U.S. Space Force. | | | | Take a look at the following chart of the VIX…

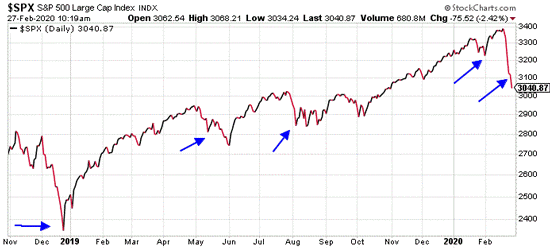

The VIX traded above 33 at one point on Thursday. And, the Bollinger Band width (at the bottom of the chart) expanded beyond where it was on Christmas Eve, 2018 – which was arguably the best time over the past year and a half to buy stocks. The blue arrows point to those times over the past year and a half when the VIX closed above its upper Bollinger Band – indicating an extremely high level of volatility – AND when the Bollinger Band width (at the bottom of the chart) expanded to an extreme level. Here’s how the S&P 500 performed following each of those occurrences…

On five of the six occasions, the S&P 500 rallied immediately off of oversold conditions. But, even following the one occasion where the market continued lower – last May – stocks recovered and were sharply higher two months later. Volatility is high right now. The VIX is more than 100% above where it was trading just one week ago. Now is not the time to be betting on an even further increase in volatility. Traders should be looking for volatility to contract. That means traders should be looking for stocks to bottom… and start to rally from here. Best regards and good trading, Jeff Clark

Editor, Market Minute

Like what you’re reading? Send your thoughts to feedback@caseyresearch.com.

In Case You Missed It… Top CEO: "If the internet was the appetizer, [this tech] is the main course." It's the most disruptive technology of the decade… Top tech CEOs expect it to create more wealth than the internet. Robin Li, CEO of Baidu (one of the 10 largest internet companies in the world), says: "If the internet was the appetizer, then [this technology] is the main course." Amazon's Jeff Bezos says, "We are now solving problems with [this tech] that were in the realm of science fiction… It is a golden age." But here's the most exciting part for you… Investors in this space already had the chance to see an incredible 737% gain in just 5 weeks. For a short time, you can get in with as little as $257. Click here to see how.

Source: ITU Pictures |

Tidak ada komentar:

Posting Komentar