Dear Reader,

There's a strange calm around commodities right now. Not because nothing is happening — but because most investors aren't even looking.

They're too busy debating rate cuts, parsing AI earnings calls, or chasing whatever shiny narrative is dominating the financial media this week.

That's usually how it starts…

The Market's Blind Spot Is Getting Expensive

Every major commodity supercycle begins the same way: silence.

Not panic. Not euphoria. Silence.

Commodities don't need a crowd to move. They just need reality to show up and remind everyone that modern life is still built from physical things.

We're at that moment again.

Gold and silver have already raised their hands…

They were the first to respond to a world drowning in debt, mistrusting currencies, and quietly hedging against political and financial instability.

That wasn't speculation. That was instinct.

Now the rest of the complex is starting to stir, and the market hasn't fully connected the dots yet.

That disconnect is the opportunity…

You Can Financialize a Lot of Things — but Not Reality

For more than a decade, markets rewarded abstraction.

Digital services, platforms, leverage layered on leverage.

It worked because globalization smoothed over shortages and cheap energy masked inefficiencies. The physical world was treated like a solved problem.

But the reality is that it never was…

The uncomfortable truth is that every technological leap still depends on materials dug out of the ground.

Servers need copper. Power grids need zinc. Defense systems need tungsten.

Energy systems need fuel — lots of it. And no amount of financial engineering changes that.

If you can't grow it, you have to mine it. And if you don't mine enough of it, prices eventually remind you who's in charge.

That reminder is now underway…

The #1 Rare Earths Stock to Own Right Now

China controls 85% of rare earth metals, leaving U.S. tech and defense industries vulnerable.

One tiny American mining company could end this reliance, with its vast reserves of rare earths and potential billions in government contracts.

Keith Kohl calls it "the most explosive rare earths stock of the decade."

Get the name and ticker now, before it's too late.

Precious Metals Moved First for a Reason

Gold didn't rally because investors suddenly got nostalgic. It rallied because it was doing its job — pricing in risk that spreadsheets struggle to model.

Sovereign debt is ballooning. Monetary credibility is fraying. Geopolitics has turned transactional. Central banks are acting like trust is a finite resource.

And gold responds to that environment whether investors are ready or not.

Silver followed, pulled along by the same monetary concerns but supercharged by industrial demand…

It's one of the few assets that sits at the intersection of money and manufacturing, and when both sides of that equation heat up, silver rarely stays quiet for long.

But what matters isn't just that precious metals moved…

It's that they moved before the consensus narrative shifted. That's the tell.

When the canary leaves the coal mine early, it's usually a good idea to stop pretending everything is fine.

Industrial Metals Are Starting to Clear Their Throats

Copper doesn't scream. It signals.

When copper prices begin to firm up, it's rarely about speculation. It's about demand that can't be postponed…

Electrification, grid expansion, data centers, automation, transportation infrastructure — these aren't optional projects anymore.

They're prerequisites for economic and technological survival.

And here's the part Wall Street doesn't like to dwell on: Supply isn't keeping up.

Years of underinvestment, regulatory friction, and capital misallocation hollowed out the project pipeline.

New mines don't appear overnight. Existing ones don't magically expand because prices tick higher.

The lag between discovery, development, and production is measured in years, often decades.

That mismatch between rising demand and constrained supply is how long, grinding uptrends begin…

Quietly at first. Then all at once.

Energy Is the Foundation Everyone Assumes Will Always Be There

Energy commodities are sitting in an uncomfortable corner of the market. Too essential to ignore, too politically inconvenient to celebrate.

Yet every economic plan, every transition strategy, every growth forecast assumes abundant, affordable, reliable energy.

Assumptions have a way of breaking markets.

Natural gas, in particular, is a study in contradiction…

It underpins power generation, industrial production, heating, and fertilizer. It stabilizes grids that intermittent renewables can't yet support on their own.

And yet it's been shunned by capital as if it were obsolete.

Markets love to misprice what they misunderstand. When energy tightens, it doesn't just affect one sector — it ripples through everything.

Costs rise. Margins compress. Inflation reappears where it was assumed defeated.

Energy doesn't need hype to rally. It just needs demand to persist while investment lags.

That setup looks increasingly familiar.

Trump vs. Musk Explodes — But DOGE Payouts Keep Flowing

Musk may be out, but Trump's DOGE program is still redirecting billions to taxpayers.

- Up to $8,276 every 3 months

- Federal employees banned

- Start with just $10 and 5 minutes

Claim Your DOGE Payout Before the Next Round Hits.

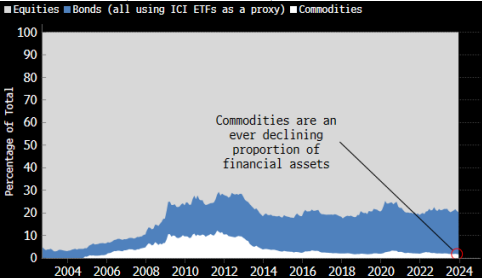

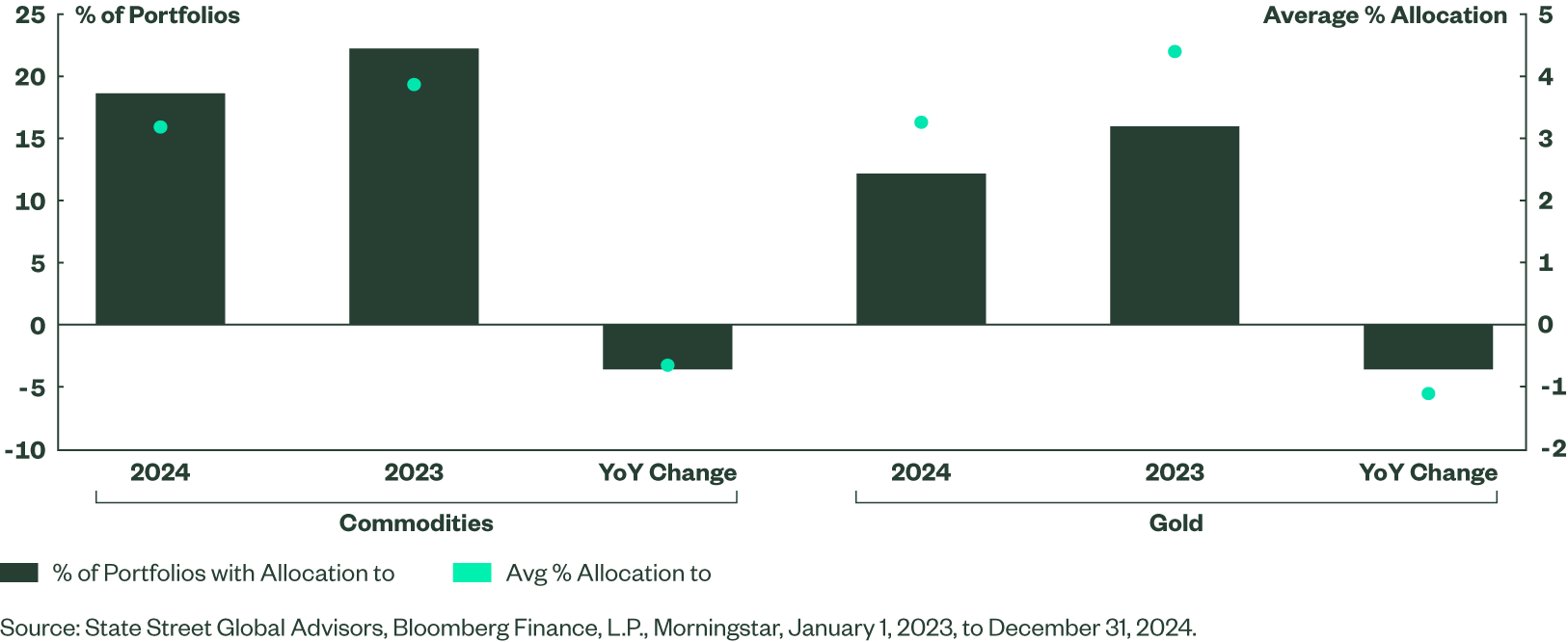

Nobody Owns Commodities — and That's the Point

Here's where the contrarian alarm should be blaring…

Institutional allocations to commodities remain near historic lows.

Many diversified portfolios barely acknowledge their existence. Younger investors, raised on stocks and crypto, often have zero exposure at all. Those that do have been reducing it.

That's not a bearish signal. It's the opposite.

When an asset class is unloved, under-owned, and under-discussed, it doesn't take much to move prices.

A modest shift in capital flows can have an outsized impact, especially when supply is inelastic and inventories are tight.

This is how smart money operates. It accumulates when assets are boring, politically awkward, or ignored. Then it waits for necessity to do the marketing.

And necessity is undefeated.

Resource Nationalism Is No Longer a Theory

The era of frictionless global supply chains is over. Countries learned — often painfully — that dependence on distant suppliers for critical materials is a strategic vulnerability.

The response has been swift and unapologetic…

Stockpiles are being built. Export controls are being imposed. Long-term supply agreements are locking up future production.

Commodities are no longer just inputs… they're leverage.

And that shift changes how prices behave.

Markets aren't just balancing supply and demand anymore. They're pricing security, access, and control.

When materials become strategic, scarcity carries a premium that doesn't disappear just because sentiment turns sour.

This is especially true for commodities tied to defense, energy security, and infrastructure resilience.

AI Is STEALING From You

(Claim up to $41,430 a Year as Payback)

It's time to delete ALL of your social media accounts.

Why? Because AI firms are downloading every part of your digital identity to train AI models like ChatGPT WITHOUT your permission or any compensation.

OpenAI openly states that "your data is used to improve model performance."

Your private conversations and personal information are building fortunes for billionaires, so it's about time you got paid too.

Luckily, I've found a government-backed income stream that could pay you up to $41,430 a year in "AI equity checks."

Best of all, it takes only five minutes and as little as $10 to get started!

Follow these three simple steps to receive your first check.

The Overlooked Materials That Actually Matter

While investors debate headline assets, some of the most important materials in the global economy remain virtually invisible.

Tungsten is one of them.

It doesn't trend. It doesn't excite. It just happens to be indispensable for high-temperature applications, advanced manufacturing, and defense systems.

Its physical properties are difficult to replicate, and its supply chain is anything but diversified.

Barite is another.

It rarely makes headlines, yet it's critical to energy production, particularly in drilling operations.

Without it, wells can't operate safely or efficiently. Energy security quietly depends on it every day.

Then there's zinc.

Unassuming, widely used, and absolutely essential.

It protects steel from corrosion, supports infrastructure longevity, and plays a key role in both traditional and renewable energy systems.

When zinc is scarce, the cost shows up everywhere — from bridges to power plants.

These aren't speculative curiosities. They're the nuts and bolts of modern civilization.

Super Cycles Don't Announce Themselves

Commodity super cycles don't start with fireworks. They start with neglect, underinvestment, and a widespread belief that "this time is different."

Then reality intrudes. Demand proves stubborn. Supply proves slow.

And prices adjust upward not because of excitement but because they have to.

We're in that early phase now.

Precious metals led the way. Industrial metals are following. Energy is tightening.

Strategic materials are being quietly secured behind the scenes. And most investors are still positioned as if none of this matters.

That's the window of opportunity.

Before the Crowd Remembers What the World Runs On

This isn't about chasing price moves after they've already happened. It's about recognizing that the foundations of the global economy are being repriced in real time.

The physical world is pushing back after years of being taken for granted.

The next leg higher in commodities won't wait for universal agreement. It never does.

That's why the smart move now is education and positioning…

Understanding which companies have real exposure to the materials that matter, and getting invested before the rotation becomes obvious.

Because you can ignore commodities for a while. Markets often do.

But eventually, the world reminds everyone of the same inconvenient truth: Progress still runs on what we pull out of the ground.

To your wealth,

Jason Williams

@TheReal_JayDubs

@TheReal_JayDubs

Angel Research on Youtube

Angel Research on Youtube

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Tidak ada komentar:

Posting Komentar