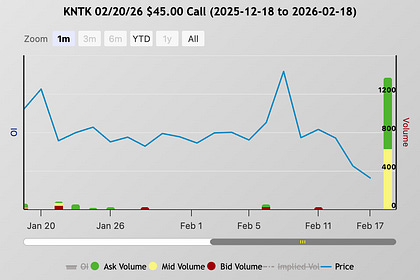

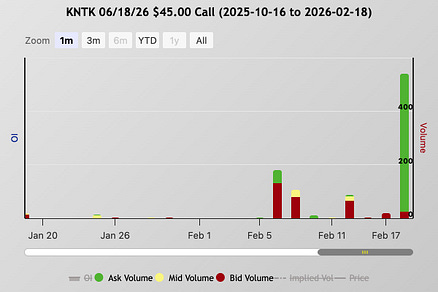

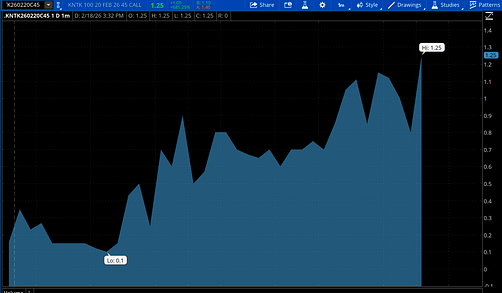

8:15 PM EST Was about to go work out, but then I got a ping. It’s Henry. “You’re going to be sick to your stomach.” Oh great. I quickly look at the futures, did they sell off? Did US bomb Iran? Nope, futures are flat. The typing bubble is moving. Financial Times. Kinetik Holdings has received takeover interest from Western Midstream Partners. Backed by Occidental Petroleum. Sale process initiated. $7.2 billion. Before I could type back... “Yes, I checked multiple sources. You were close, but I know it probably stings.” Took a look at the after-hours price. $48 x $50, up another 9%. Looked at my positions. Nothing. Started doing the math. Looks like these could open up at $4.00 tomorrow. That stings. Would’ve been an $80,000 trade. Knew we didn’t have any, but maybe there was a chance. Nope. Those Feb 45 calls I cancelled six hours ago. 200 contracts. First at 20 cents and then 25 cents, waited and prices just kept increasing. Cancelled the order. Another one -- so close. Right on their heels. Brought up the activity again. 12:28 PM EST Scanner just lit up. KNTK — Permian Basin midstream. Pipeline company. Henry asked, what made this stand out today? Haven’t heard of the stock before today. 1000 contracts on the Feb 45 calls. Paid 15 cents. Stock was up 6% on the day. No news. Someone paid $15,000 betting something happens in two days in an under-the-radar stock. $15,000 doesn’t sound like a lot. But it’s how the order was executed. They used a special order routing system, hit 17 exchanges simultaneously — 32 trades in 0.122 seconds — to buy call options that expire in 2 days. And then at 12:34: 529 contracts in June $45 calls filled at $3.50 from 14 exchanges, 0.004 seconds. The bid/ask was $1.50 x $3.50. What’s wild is those Feb 45 calls were up 400% on the day. They’re sitting on 400% in a few hours. Even if we got filled, we’d have sold into that move. You take the money. Never know how good the information is they’re acting on. They timed it right, with the right information. Spotted at 12:28. FT confirmed it at 8:15. Posted the activity on X earlier. Maybe the SEC will see it. About This Journal: Every entry documents what really happens at my desk. The losses, wins, and everything between. Trading Alliance -- every alert, every research report. Group Mentorship -- the craft behind the trades. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Kamis, 19 Februari 2026

The $80,000 Cancelled Trade

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar