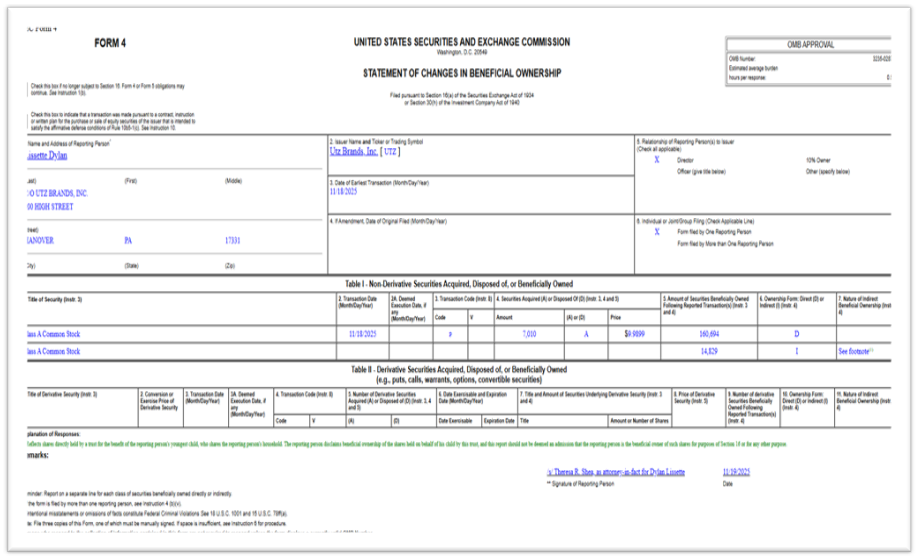

The January TrapWhy Most Investors Start Every Year the Wrong Way Every January looks the same. New year. “Top 10 Stocks for 2026” Wall Street turns the calendar and immediately turns up the volume. January is peak noise. Everyone has a take. Everyone has a forecast. Everyone sounds confident. And almost nobody actually knows anything. The average investor starts the year drowning in opinions from people with no real edge. Commentators react to price. Influencers react to headlines. Analysts react to other analysts. Meanwhile, the smartest money on Wall Street is doing something very different. They are not making predictions. They are watching behavior. Why Corporate Insiders Operate in a Different Information UniverseThere is a small group of market participants who do not need to guess. Corporate insiders. Executives. These are the people closest to the business itself. They are not reacting to earnings calls. They are preparing them. They understand things the market does not see yet. Contract pipelines. Important point. These individuals cannot share this information. That would be illegal. But they are allowed to act on it legally in their own accounts. And when they do, they leave a paper trail. Why Insider Buying Is One of the Few Signals That Cannot Be Mass-ProducedInsider buying matters more than commentary for one simple reason. It shows true conviction as the insiders are laying real skin in the game. Every insider trade is filed publicly on a Form 4. They are not opinions. One insider buying is interesting. Clustering matters because it signals shared conviction among people who understand the same business from different angles. Timing matters because insiders tend to buy before things become obvious. Before regulatory approvals. This is not theory. It has worked for decades. History Is UnambiguousMarket history is filled with examples where insider behavior told the truth while headlines told a story. Executives buying heavily during sentiment collapses. Boards stepping in near cycle lows. Clusters forming before turnarounds the market refused to believe. In past writeups, I have shown how insider accumulation often appears when price action looks broken and narratives feel uncomfortable. That is precisely why it works. This is not about predicting markets. The insiders are not early because they are lucky. And yet, almost nobody follows this consistently. Stop Listening. Start ObservingIf you want to make a real change in 2026, start with a better resolution. Less opinion. More verifiable behavior. This is not about trying to outsmart insiders. Instead of asking what everyone thinks, ask what the most informed people are doing. That single shift changes everything. And for a short time, we are opening the door wider than ever. A Limited Window to Start 2026 DifferentlyAt the start of a new year and a new market cycle, we are opening access to our Insider Alerts on the most favorable terms we have ever made available. Each month, I comb through thousands of insider filings to isolate the few trades that actually matter. Not activity for activity’s sake, but situations where informed buying, size, and timing line up in a way that historically precedes meaningful moves. When a setup qualifies, I share it with you in full. Who bought. How much they committed. Potential catalysts on the horizon. And how I structure the trade, including price levels and, when appropriate, options strategies designed to enhance the opportunity. No predictions. No guesswork. Just verifiable behavior from the most informed participants in the market, distilled into a small number of high-conviction opportunities. If you want 2026 to be the year you stop reacting to noise and start following real signals, this is where that shift begins. Get started below and get access to my current open portfolio with trades still in the buy zone. New year. If you are serious about changing how you invest in 2026, this is where it starts. The Market Rewards Information, Not OpinionsEveryone has an opinion. The most informed traders in the world are already acting. You can keep listening to the noise. Start the year aligned with the people who actually know. You’re currently a free subscriber to Market Traders Daily. For the full experience, upgrade your subscription. DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Global Profit Systems International are for your informational purposes only. Neither Global Profit Systems International nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user’s own risk.

|

Jumat, 02 Januari 2026

#1 Mistake Investors Make Every January

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar