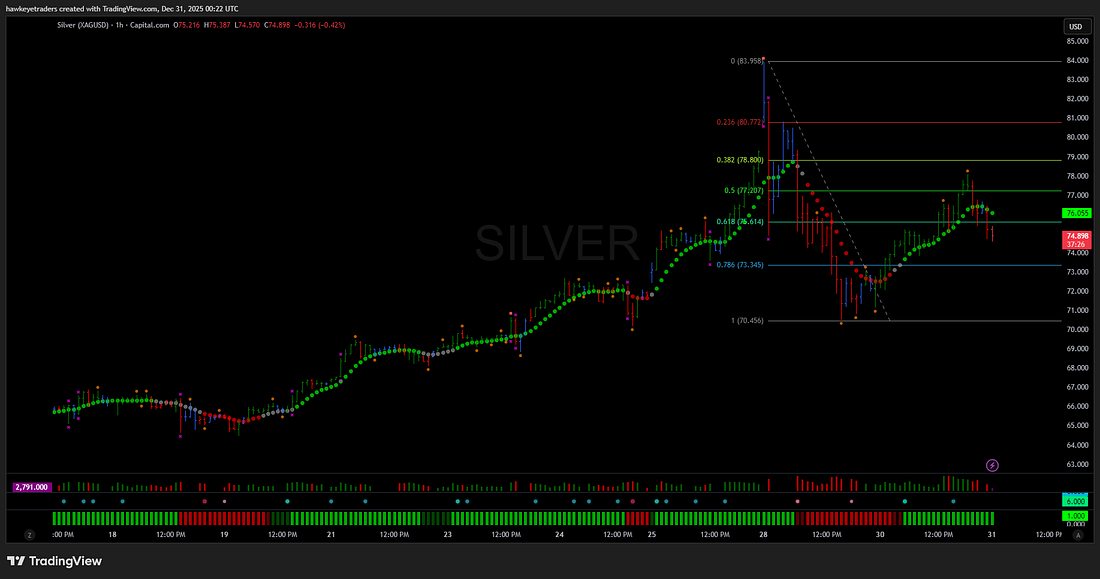

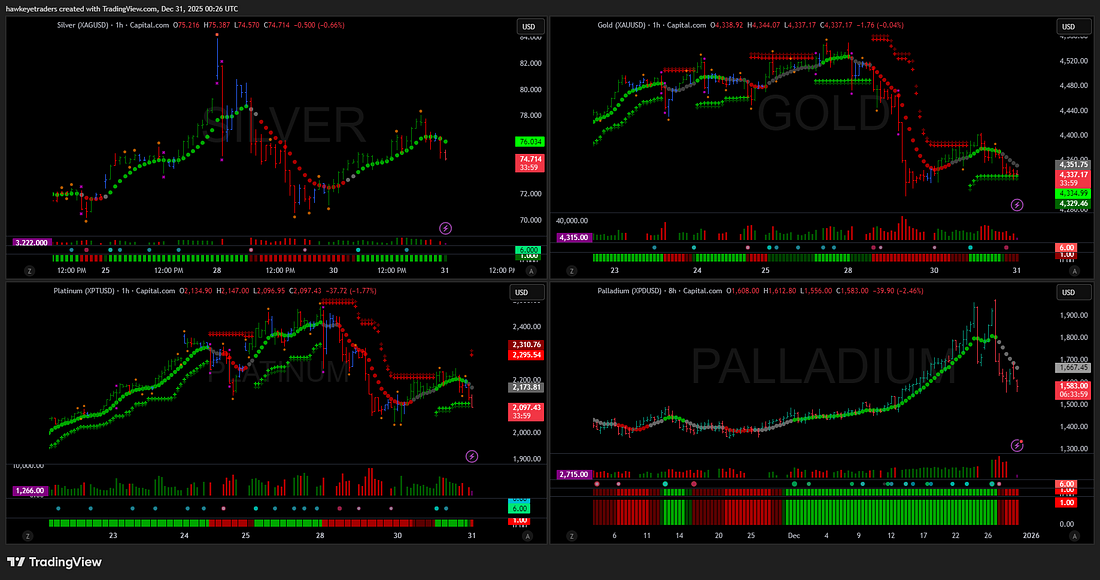

Silver Crashed 14% Then Bounced 7% in a Day: What the Hell Just Happened (And What’s Next)As paper silver imploded, real metal disappeared and capital quietly revealed its next preference.In the span of 48 hours, the precious metals market did something it only does near major inflection points. Gold and silver erased months of gains in a violent, thin-liquidity selloff. Late-cycle buyers panicked. Leveraged players were forced out. Seven-figure paper gains vanished overnight. Then, just as quickly, prices snapped back. Silver fell roughly 14% from its highs and then ripped more than 7% in a single session. Gold followed the same script, just with less drama. Physical dealers across Asia reported shortages and exploding premiums even as futures markets imploded. Depending on where you were positioned, this week either felt like a long-overdue reckoning or the buying opportunity of a lifetime. So what actually happened here? And more importantly, what does this move tell us about where capital is headed next? The 48-Hour Shock That Reset the BoardStart with the raw facts. Over two trading days, more than two trillion dollars in paper value was wiped out across gold, silver, and related derivatives. The move was amplified by year-end liquidity, crowded positioning, and margin mechanics that few retail participants fully understand. This was not a slow unwind. It was a trapdoor. Silver, which had become the poster child for the 2025 metals run, led on the way down. Gold followed. Platinum and palladium did not escape either. The speed mattered. Moves like this are rarely about fundamentals in the moment. They are about positioning, leverage, and forced behavior. When prices fall this fast, traders are not making decisions. They are reacting. The Physical Market DisconnectHere is where things get interesting. While futures prices were collapsing, reports from physical markets told a very different story. Dealers in China, Dubai, and parts of Europe reported shortages. Premiums jumped. Inventory disappeared. That disconnect is now being used as Exhibit A by metals bulls. Their argument is simple and emotionally compelling. Paper selling does not change the underlying reality. Structural supply deficits remain. Central banks are still buyers. The long-term debasement thesis has not changed. From this perspective, the crash was a gift. A violent shakeout designed to remove weak hands before the real move higher in 2026. The Exhaustion NarrativeBears see something else entirely. They see a speculative trade that finally met gravity. Silver had gone vertical. Leverage had built up. Margin requirements rose. Year-end profit taking hit a crowded trade at exactly the wrong moment. They also point to something harder to dismiss. During one of the biggest precious metals selloffs in years, Bitcoin did not break. While gold and silver were bleeding, Bitcoin held firm. In some cases, it outperformed. That has reignited a quiet but growing argument that the market is already voting on the next store-of-value regime. Not with words, but with flows. This Was a Stress Test, Not a VerdictMy take is this. This move was not a random crash and it was not just noise. It was a stress test. Stress tests reveal behavior. And behavior reveals where marginal capital is likely to go next. Gold and silver failed the test in the short term because they were crowded and levered. That does not invalidate the long-term thesis, but it does change the timing and the path. Bitcoin passing that same test does not mean it has won the war. But it does mean capital is more comfortable sitting there during volatility than many expected. That matters. The most important question is not whether silver goes higher eventually. It is whether metals can regain leadership once the leverage has been reset. If they cannot, capital will not wait patiently. It will rotate. What This Means Heading Into 2026The big picture question for next year is not about one asset. It is about regimes. Will rate cuts and fiscal pressure reignite the debasement trade in a clean, orderly way. Or has the market found a new release valve in digital scarcity and growth-adjacent narratives like AI and infrastructure. This week did not answer that question definitively. But it gave us a very clear signal about where pain exists, where resilience exists, and how fast sentiment can flip when positioning gets crowded. That is information worth paying attention to. Your TurnMarkets are conversations. This one just got loud. Did you buy the dip, sell the rip, or stay on the sidelines. And heading into 2026, which asset do you trust most during real stress. Gold, silver, Bitcoin, or cash. Let me know in the comments. You’re currently a free subscriber to Market Traders Daily. For the full experience, upgrade your subscription. DISCLAIMER: FOR INFORMATION PURPOSES ONLY. The materials presented from Global Profit Systems International are for your informational purposes only. Neither Global Profit Systems International nor its employees offer investment, legal or tax advice of any kind, and the analysis displayed with various tools does not constitute investment, legal or tax advice and should not be interpreted as such. Using the data and analysis contained in the materials for reasons other than the informational purposes intended is at the user’s own risk.

|

Rabu, 31 Desember 2025

Silver Crashed 14% Then Bounced 7% in a Day: What the Hell Just Happened (And What’s Next)

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar