I'll be live at 8:45 AM EST. After yesterday's Fed meeting, I'll lay out the breakout stocks, what you need to trade today, and how to take advantage of this recent rebound

March 20, 2025 | Read Online | | Where The Money's Going Right Now I'll be live at 8:45 AM EST. After yesterday's Fed meeting, I'll lay out the breakout stocks, what you need to trade today, and how to take advantage of this recent rebound |

| | | | | Dear Fellow Trader: | Greetings from the Catskill Mountains. | A few months ago, I was supposed to be having surgery. | So, we scheduled this vacation. I was going to recover in the mountains. Turns out… | Misdiagnosis. | But we still came… and it turned out to be the same week I launched this free show… | TheoLive: Market Masters. | Each morning, hundreds of active traders joined me to talk about the markets, what to do with their money, and the top trades to take advantage of. | Now, it's your turn. Just click the link and join me at 8:45 EST. | What's been in store this week? | Filming from a bizarre chalet in New York? Check? | Nailing our calls on breakouts in Freeport (FCX) and Devon (DVN)? Check. | Teaching viewers pro-style ideas to enhance their returns? Check. | Ready to show you where money is moving RIGHT NOW… and how to take advantage. | That's what we have on tap this morning. | Click the link and join me at 8:45 AM EST. |  | Dall-E |

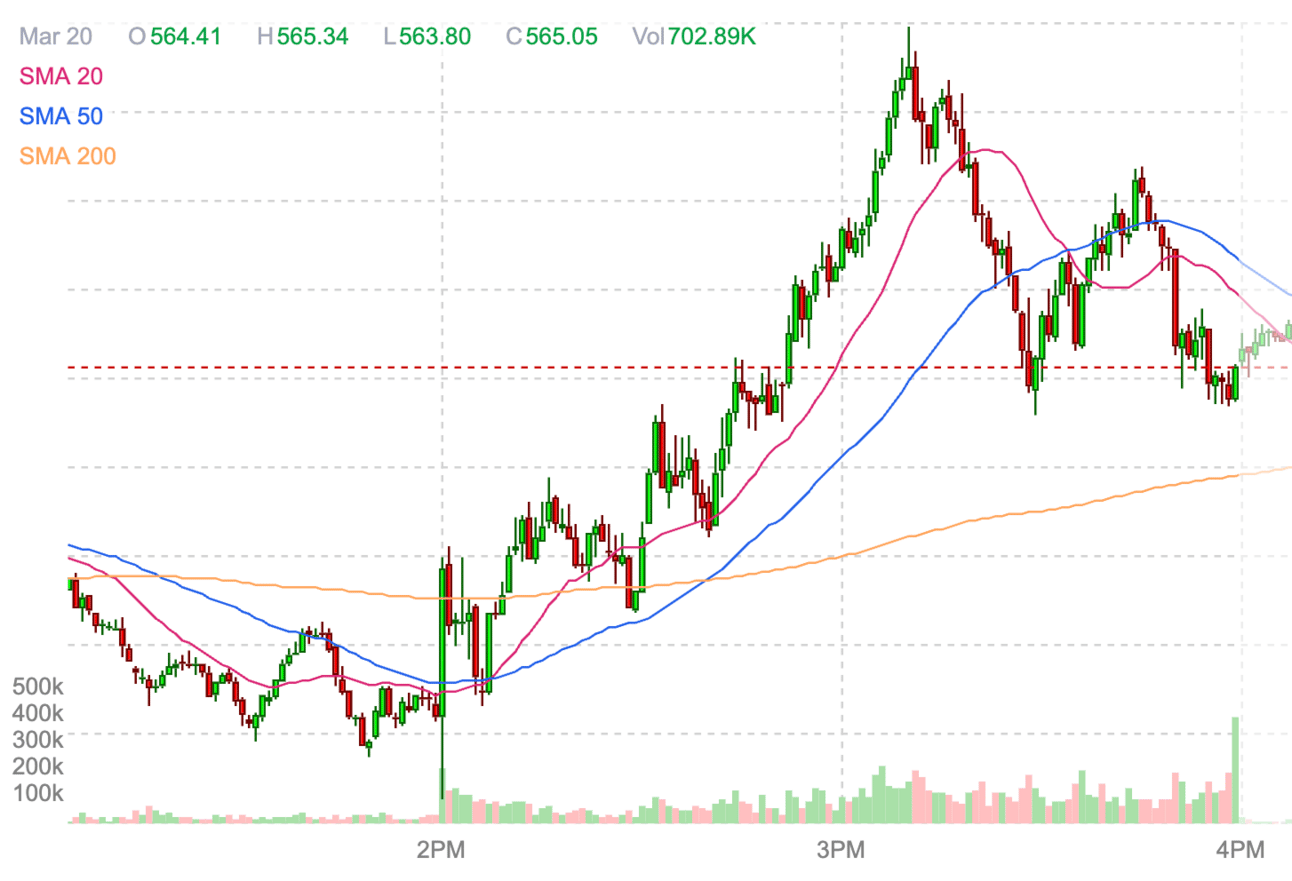

| What's On Tap | Yesterday, we predicted a pop and drop during the Fed announcement. | But the gains came earlier than expected. | At 2 pm, the SPDR S&P 500 ETF (SPY) ripped off its second deviation band of price (to the downside) and surged for the entire hour. | Same-day SPY options rallied on a lackluster decision by the Fed to reduce its balance sheet drawdowns. And Powell's speech was so boring, I didn't even notice what color tie he wore. | Then, as expected, the institutions used the final hour to take profits - and the drop was complete. |  | Finviz |

| Institutions have used premarket trading as a way to keep taking gains. | This morning, the S&P 500 is down slightly after yesterday's rally. | In the last week, we've seen breakouts in the Basic Materials sector… as we projected last week. Now, Energy has pushed back into positive momentum territory… | Since our readings hit no buying pressure last Thursday, the S&P 500 has gained 3.1%. | The question is how long will this rally last. | Yesterday, in our live 2:00 Fed Session, Don showed traders a possible range where the S&P 500 could head next. That figure was around 5,850. | I want to show you why that level is so critical based on the technicals we use to forecast selloffs… and why history rhymes. | Then, I'll show you the exact trades you need to prepare for that selloff. We're talking about high-conviction, high-probability trades. | And if this is what I'm giving away in the FREE morning show, imagine what you can get as a member of our all-day Trading Room. | Listen, you've gotta tune in today. So, get in the room. | Get some coffee… and dig deeper into what's on the horizon. | Stay positive, | Garrett Baldwin |

| | | | Update your email preferences or unsubscribe here © 2025 TheoTrade Live Show PO Box 24790

Christiansted, Virgin Islands 00824, United States of America | | Terms of Service |

|

|

|

|

|

Tidak ada komentar:

Posting Komentar