Dear Fellow Trader: |

If you see this for the first time… |

Make sure that this email isn't going to spam. |

That it's not ending up in a promotions folder. |

White list it. |

I will send you this letter - a Trader's Almanac - on the weekends… it will be the most important thing you read during those 48 hours as a trader and investor. |

Let me start your week with the most important charts to start your week… |

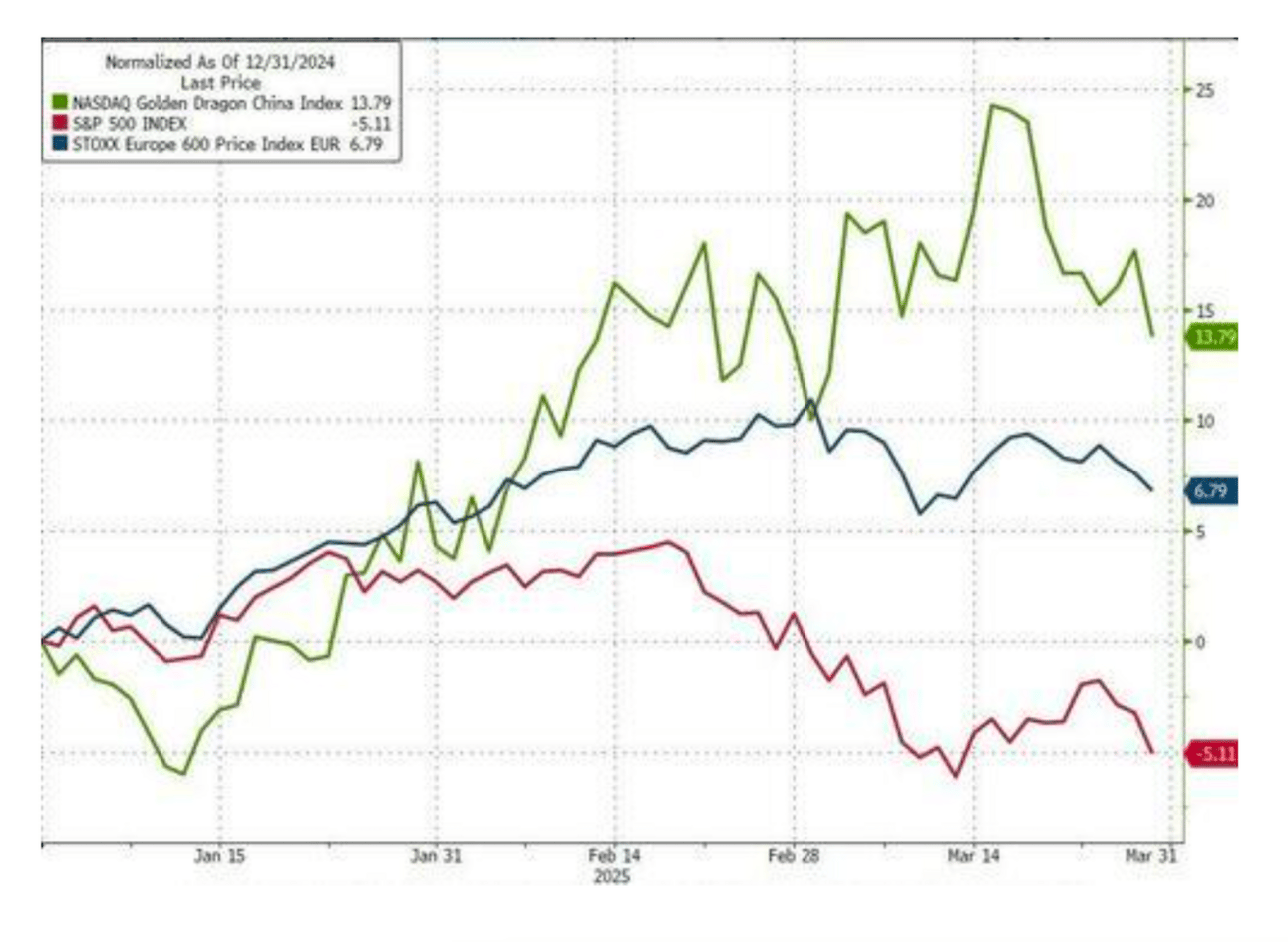

Chart of The Week: There Goes the Money |

Since January, money has been gushing toward Europe and China. |

And the results are clear in this chart. |

| Source: Zerohedge, Bloomberg, and Syz Group |

|

The Green line is the Nasdaq Golden Eagle Index (China), which gained 13.8% at the start of the year. The Blue line is Europe, which is up 6.8%. |

And the red line? |

That's America, baby!!! Down 5.1%. |

The question that people should be asking is… Why? |

The headline from the media will say that it's due to tariffs. |

That could not be further from the truth. |

This chart comes from a financial management firm in Geneva, Switzerland, called Syz Group. They agree with me in their presentation of this chart, stating: |

"Q1 saw a big Global Asset 'Regional Rebalancing', with money into "Fiscal Expansionists" and stimulators/easers i.e. Europe & China, and money out of "Fiscal Contractionists" i.e. United States as "source of funds"..." |

|

|

What does that mean? |

This means that China is pumping stimulus into its economy. |

This means that Europe is expanding its monetary supply base and looking for ways to stimulate and boost defense spending. They are the"Fiscal Expansionists." |

Meanwhile, the U.S. is reducing its stimulus. We're not pumping trillions of dollars in short-term debt into the system, and we're keeping rates elevated. We are a "Fiscal Contractionist" right now… |

Money flows downhill… and chases places where it can compound, and leverage can be used. Where every dollar can be squeezed. Last week, Bank of America noted the third-largest selling of U.S. stocks on record by foreign investors. The figure totaled $6 billion from U.S. equity funds. That money appears to be going home for now… |

|

It's a GREAT BIG game… |

If you follow the cross-border flows and where there's expansion, you can make money… BIG MONEY. You just need to know where to look and the signs of when these central banks and massive governments turn on or off the financial taps. |

Don't Get Ghosted… |

Holy cow. I've been in this financial research business for a decade. |

It's rare that my heart will race over an opportunity the way it did when Don and Brandon talked about Ghost Prints yesterday. |

It's real math, real probability… and taps into the real plumbing of the trading markets. |

The results explain so much of what I've been studying for years. |

Why are stocks breaking out or breaking down the way they are? |

Why are they crossing key technicals that I use to trade? |

I'm seeing the results in Ghost Prints… it's right there… in Brandon's data. |

I love what he's doing. Check it out here. |

Beware the Rug Pull |

Two Thursdays ago, we predicted a short-term bottom for the market at 5,500. With no buying pressure in the market (elevated beta stocks up 5% weekly and up for the month), that tends to precede a short-term pop. When that pop comes, retail investors tend to get sucked back into the market (thinking that the worst of the selloff is over.) |

As I've noted, there isn't much stimulus in the U.S. financial system. |

Credit is tightening, risk is tightening, and leverage is tightening. We can have these short-term, low-volume pops (something Don warned about last week). What happens is that funds will then turn right back around when prices move higher… and sell into that short-term strength. |

That's what we call "A Rug Pull." Retail investors had been piling back into the market after the S&P 500 gained about 5% off that low of 5,500. |

Friday was a good example of that. After the bearish PCE Inflation figure, the S&P 500 fell nearly 2%. The Nasdaq dropped 2.7%. Of course, we have been showing investors how we measure underlying momentum in the market. Our signal has largely been negative since February 21. And while we had a collapse of selling pressure in the last week, it has resumed and taken us back under 5,600 on the S&P 500. |

A retest of 5,500 appears to be in the cards for this week. This was a brutal week on the cyclical side of the markets, and we're looking at breakdown mode for names like DoorDash (DASH), Paypal (PYPL), the cruise lines, the casinos, and the hyperscalers. |

What Did Barron's Do? |

Don't get sucked into what Barron's is selling this week. We're watching AI stocks face a significant amount of pressure. With momentum weak, the AI trade could get a one or two-day Barron's bump… but that might not last long. |

|

Earlier this week, we saw the Coreweave IPO deliver disastrous results. On the morning of the IPO, CNBC was busy saying that this hyperscaler's stock could create a wave of new IPOs in the space. By the end of the day, they had a completely different opinion. |

Stocks breaking down right now in this space include Marathon Digital (MARA) and CleanSpark (CLSK). Both stocks dumped more than 8.5% on Friday after the inflation news. These companies have very cool stories, and I expect continued consolidation in this space in 2025-2026. But the narrative isn't enough to make me want to invest or trade them. We need to see price action. |

People ask: When should I trade a name like this? |

I'm a bit more conservative - and I like to set tight stops and trade around specific moving averages. If we look at CLSK, for example, the 20-day moving average is a great place to trade. If it breaks above the 20-day, buy it. If it drops under, sell it. |

For example, in February last year, the stock broke out… It went from $8.00 to $23.00 in less than a month. Look at the pink line—the 20-day moving average. |

|

Now, will that happen every time? |

Of course not. But if you're diligent and disciplined, you may find a trade starts to run. |

If you keep the stop tight… you keep your losses at a few percentage points. |

If it breaks out, though? You're the smartest trader on the block. |

What's Ahead? |

On Monday and Tuesday, I'll be in Utah. |

We'll still be live at TheoLive: Market Masters at 8:45 am ET. So, get in the room right here. Just be aware that I'm not in the studio. |

|

Monday's trading session will be critical for a few reasons. It's the last day of the quarter, so we'll definitely be looking at money rotating from sector to sector. If you're not a member, grab the one-month $7 offer. |

Decide what you want to do later. I want you to listen to Dr. Jeffrey Bierman on Monday. Because he has a terrific understanding of what portfolio managers (PMs) are doing - and what stocks they're dumping. |

When PMs all collectively sell at the same time, it creates incredible value trades that allow traders to make fast gains. |

The managers' losses can quickly become your gains. |

And if you have a broker who has you in any of these stocks that are getting dumped on Monday - you might want to consider firing them. |

They likely bought very high with your money and sold very low. |

Tuesday is the first day of the second quarter, so it will be a good day to trade upstream oil stocks. Bloomberg will publish its OPEC production survey on crude oil, and we could see the markets readjust expectations, especially the day before tariffs go into effect. I'll be listening to what Blake and Brandon say on the matter. |

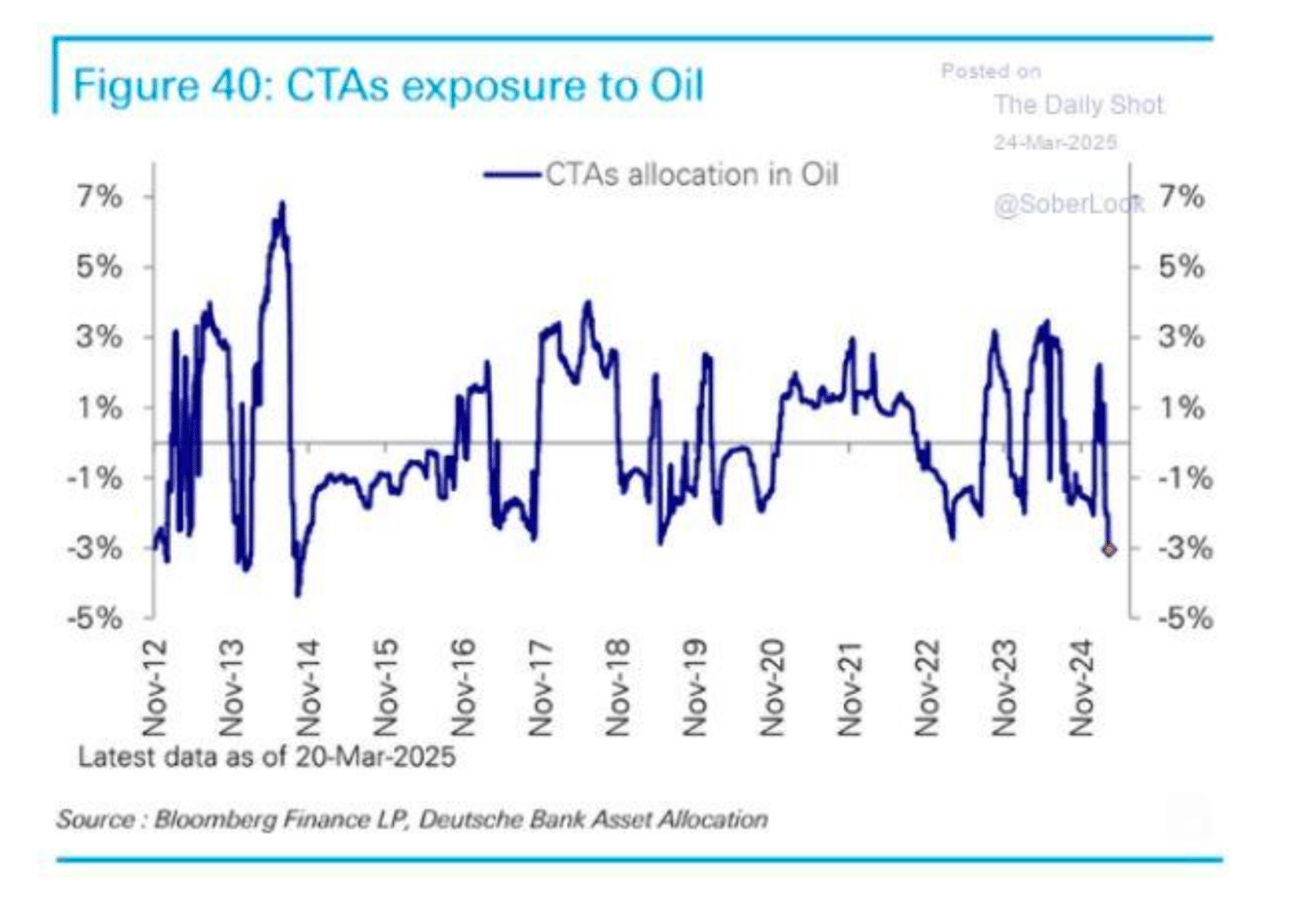

The MicroSectors Oil and Gas Exploration and Production 3X ETN (OILU) is coming out of overbought territory and just dropped under its 200-day moving average. Names like Devon Energy (DVN) are running out of steam. This comes at a time when Commodity Trading Advisors are massively short on oil futures. |

| Bloomberg, DB, Syz Group |

|

This is the strongest bet against oil prices since 2014 when they collapsed from over $100 per barrel to under $40 per barrel.

Wednesday is "Liberation Day" - or something. |

It's the day Americans start paying more for products due to tariffs. While some concessions have been made on the European front, Canada appears ready to dig in. Your eyes should be elsewhere. |

Earlier this week, I named Fluor (FLR) to our watchlist. |

The company will hold a "town hall"-style event to outline its new strategic plan for the year. I think this is a tradeable moment. Keep an eye on that 20-day moving average. If it breaks above the 20-day moving average, buy the stock or target a cheap, in-the-money call. Use that 20-day moving average as an exit. This company has a high F score, a low price-to-Graham number, and ample evidence that most of its gains cover when the stock is over its 20-day moving average. |

Two important names in the consumer goods industry report earnings on Thursday. This is a good opportunity to trade after the results come in using deviation bands and short-term options. |

Conagra Brands (CAG) and Lamb Weston (LW) are on tap. CAG is critical to the health of the U.S. consumer. LW, meanwhile, will give us a preview of what to expect from McDonald's (MCD), provided that they are a major supplier of french fries. On Thursday morning, I'll show you how to use Volume Weighted Average Price after earnings reports and the optimal options strategies as we wrap up the week. |

You don't want to miss this. |

Finally, we will wrap up the week on Friday with the March jobs report. Keep a close eye on wage growth - because that's been a thorn in the Federal Reserve's fight against inflation. After that report, the markets could reverse direction quickly when Fed Chair Jerome Powell speaks at 11:25 am ET. One last thing: Microsoft (MSFT) celebrates its 50th anniversary on Friday. It could make some very important announcements during a celebratory event. |

It will be a busy week… but we'll make it profitable together. |

Join me at 8:45 ET on Monday. And take advantage of the $7 offer. |

Stay positive, |

Garrett Baldwin |

Tidak ada komentar:

Posting Komentar