Money & Markets Daily: The 5 |

It’s time to get on the fast track to stock profits — with the five things you need to make money this week … in just 5 minutes.

Let’s get started!

What Is a Decillion Anyway?

Here are a few numbers to get you started this week:

- $477 trillion – The estimated combined total net wealth.

- $105 trillion – The estimated worldwide gross domestic product in 2023.

- $2 trillion – The estimated value of Alphabet Inc. (Nasdaq: GOOGL).

- $2 decillion – The size of a fine imposed on Alphabet by a Russian court last week.

Wait? What?

Some context for that last number…

In 2020, Russian-based Tsargrad TV and RIA FAN sued Google – whose parent is Alphabet – because they were blocked on the search platform due to U.S. sanctions following Russia’s invasion of Ukraine.

Two years later, Google’s Russian arm declared bankruptcy after government authorities seized its bank assets.

Last week, a Russian court ordered the tech giant to pay $2 undecillion rubles or $20 decillion.

For the record, $20 decillion is $20,000,000,000,000,000,000,000,000,000,000,000.

In its recent quarterly report, Alphabet refers to “ongoing legal matters” related to its Russia business.

The fine will continue to increase the longer it isn’t paid. Ironically, it could reach a googol, which is a 1 followed by 100 zeros.

Less Than 24 Hours Away…

We’re now hours away from Election Day in the U.S.

Pollsters and market odds alike show a tight race between former President Donald Trump and Vice President Kamala Harris.

As investors, we're always looking for an edge as market conditions change. And if you're wondering what to expect for your portfolio after the polls close tomorrow, we've got you covered.

You can find an election investing guide I created a few months ago here. It discusses how the market has performed under different administrations.

Chief Investment Strategist Adam O'Dell has been tracking the election as well. He's run the numbers and found certain stocks that are set to crush the market — no matter who wins! Click here to find out more.

NVDA Joins the Dow Jones Industrial

This week, chipmaker Nvidia Corp. (Nasdaq: NVDA) has become one of 30 stocks on the Dow Jones Industrial Average index.

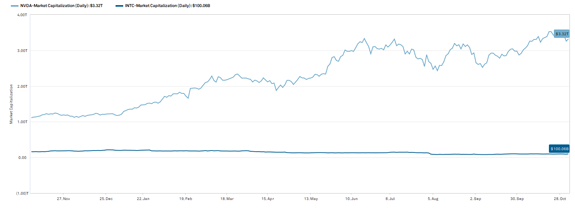

NVDA replaces fellow tech company Intel Corp. (Nasdaq: INTC) on the index after crossing the $3 billion market cap threshold:

Nvidia’s market cap has soared to more than $3.2 trillion in the last 12 months, while Intel’s market cap has remained relatively flat at $100 billion.

NVDA’s addition to the Dow shows a shift in the order of technology, which is now dominated by artificial intelligence.

NVDA’s inclusion on the Dow resulted in a 1% rise in the stock during premarket trading on Monday.

Charting Apple’s Income

Are you curious about how one of the largest technology companies makes and spends its money?

Look no further:

(Click here to view larger image.)

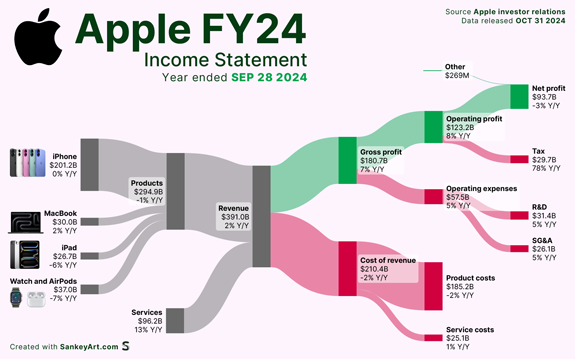

Here is a breakdown of how Apple Inc. (Nasdaq: AAPL) made its revenue in Q3 2024… and how it spent it.

The company made $201.2 billion in sales of its flagship iPhone product, with another $30 billion in MacBook sales.

In total, Apple recorded $294.9 billion in product sales and $96.2 billion from services.

What’s interesting is where that revenue goes.

More than $210 billion is categorized as the cost of revenue. This is the amount of expenses a company incurs to create, market and distribute its products and services.

All told, Apple clocked $93.7 billion in net profit, a 3% decline year over year.

| From our Partners at Banyan Hill Publishing. “Crypto Whisperer” Ian King is calling it: due to a change in Bitcoin’s “status,” he believes Bitcoin is about to go on one FINAL bull run.

But the best way to play it isn’t by buying Bitcoin.

Instead, Ian has identified 3 specific “alt” coins with the potential to blow past Bitcoin’s spectacular gains.

To get in before November 4th, see everything you need to do HERE now. |

Who’s Groggy?

It’s the Monday after rolling our clocks back. Did anyone else struggle to get out of bed this morning?

We’re having a little fun this week in “The 5.” Currently, only two states don’t observe daylight savings time (Arizona and Hawaii). Some other states are debating its future as well.

What’s your take? Does the time change throw you off and make you dread the sun setting at 5:15? Or maybe this is your favorite time of year…

Should we eliminate daylight savings time and never adjust our clocks again? Email us at Feedback@MoneyandMarkets.com with your thoughts. We’ll take funny stories about missing the bus due to the time change as well…

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets Daily

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar