November 4, 2024

Where the Crypto Cash Is Flowing Ahead of the Election

Dear Subscriber,

|

| By Marija Matic |

Crypto has seen an uptick in election-related volatility.

That isn’t surprising. But the direction where crypto cash is flowing might be.

A sharp sell-off recently impacted smaller alternative coins. According to Coinglass data, this weekend's dip led to some $230 million in liquidations ahead of tomorrow’s U.S. presidential election.

On top of that, we saw a $4 billion reduction in leveraged positions on centralized exchanges.

This behavior signals a clear risk-off sentiment in the crypto market.

Despite the electoral uncertainty, institutional investors appear unfazed.

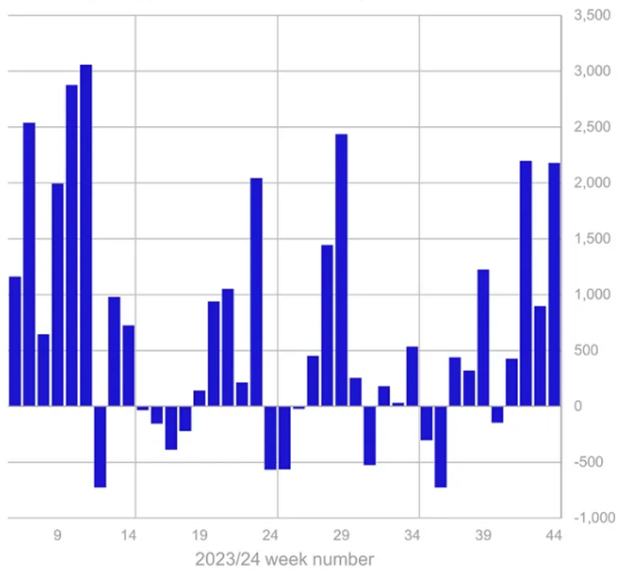

Global crypto funds managed by firms such as BlackRock and Fidelity saw net inflows of $2.2 billion last week, according to CoinShares.

Weekly crypto asset flows (in millions).

Source: The Block.

Click here to see full-sized image.

This brings the year-to-date total to a record $29.2 billion.

So, the money is still staying in crypto. Its flow toward older, more established cryptos and crypto funds signals continued confidence in the crypto market.

This is likely due to Bitcoin’s (BTC, “A”) ability to remain bullish despite the risk-off sentiment plaguing the altcoins.

What’s really newsworthy, though, is that Bitcoin's price seems to be closely following all the latest Polymarket polling data.

Specifically, the $3.12 billion bet that has been heavily favoring a Donald Trump victory:

In the chart below, you can see Bitcoin started to correct on Oct. 30.

This coincided with a decline in Trump's odds on Polymarket:

As a reminder, Polymarket is not an official poll and doesn’t necessarily reflect the views of U.S. voters.

After all, just about anyone can bet on Polymarket — even if they can’t vote in the upcoming election.

And thanks to the platform’s transparency, a report from Chaos Labs found that “wash trading constituted around one-third of trading volume on Polymarket’s presidential market.”

(Wash trading is a form of market manipulation where shares are bought and sold, often simultaneously and repeatedly, to create a false impression of volume and activity.)

So, while Polymarket activity is fascinating, the election is still anyone’s game.

But there are still plenty of reasons to watch these political bets.

The correlation between sentiment and market dynamics on Polymarket cannot be denied when it comes to high-stakes political developments.

That’s why Trump's improved odds provided some relief to the crypto market today.

Hence, based on pre-election market behavior, it seems likely that a Trump victory would lead to a more bullish market response, while a win for Kamala Harris might result in a less bullish reaction, at least in the immediate aftermath.

Regardless of tomorrow’s election outcome, the volatility might not stop there.

The Federal Open Market Committee meeting is on the horizon, potentially taking place under a new administration. Hence, investors will be closely monitoring any implications for monetary policy of FOMC on Thursday, with a 25 basis-point rate cut currently anticipated.

Whether you’re eligible to vote in this U.S. election or whether you’re watching from outside the country, we’re all eager to move past this uncertainty!

So, brace yourself for a tense and eventful week ahead. And for the best way to play it, no matter the outcome, consider watching my colleague Juan Villaverde’s latest briefing.

He released it in response to what he calls “Crypto’s Golden Window.” In previous Golden Windows, select cryptos saw windfall gains of 19x ... 23x ... and even 93x!

This time around, Juan doesn’t want you to miss out. That’s why he reveals how he combines his market analysis to find the best performing assets and his proprietary Crypto Timing Model to find the most opportune moments to enter and exit the market.

And he reveals just how much this strategy — which he models for his Weiss Crypto Portfolio members — has outperformed a simple “buy and hold” approach over the past several crypto cycles for the top performing assets.

The briefing is free to watch. Just click here.

Best,

Marija Matić

Tidak ada komentar:

Posting Komentar