September 13, 2024

What's Going on With Ether?

Dear Subscriber,

|

| By Juan Villaverde |

It’s no secret Ethereum (ETH, “A-”) has had a rough start in this bull market.

Since bottoming out in November 2022, it has consistently underperformed Bitcoin (BTC, “A”), the reigning benchmark in the crypto world.

Not only is Ethereum trailing Bitcoin, but it’s also feeling the heat from faster, newer blockchains like Solana (SOL, “B”).

Competition isn’t new for Ethereum. But the degree of its current underperformance is raising eyebrows.

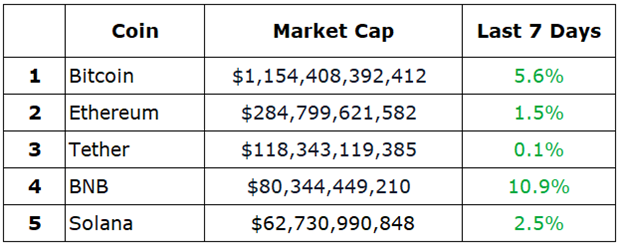

Top five (by market cap) coins’ seven-day gains. Source: CoinGecko

Click here to see full-sized image.

So, how did Ethereum — once the golden child of decentralized finance — end up being viewed as an "outdated" blockchain?

Analysts point to a couple of major factors. But today, we’ll focus on the elephant in the room …

That is, centralization.

This week marks two years since Ethereum made the bold transition from Proof-of-Work (PoW), where miners secured the network, to Proof-of-Stake (PoS), where staking replaced mining.

At the time, the move — dubbed "The Merge" — was celebrated as a milestone.

Ethereum’s price doubled in anticipation, outperforming both the broader crypto market and Bitcoin.

It led many, including our crypto team, to ask, “Could ETH Overtake BTC and Become No. 1?”

It was a fair question at the time. But looking back, that was the last time Ethereum outshone Bitcoin.

Although the technical transition went smoothly, I don’t see the move to PoS as the right choice.

Since the switch, control over Ethereum has become concentrated in the hands of a few big players, especially Lido, Ethereum’s largest staking service.

In theory, Lido allows users to stake their ETH without the hassle of managing it themselves.

In practice, though, staking with Lido is akin to handing your ETH to a centralized entity and receiving an IOU in return.

Staking on Ethereum works in two ways. Either:

- You hold at least 32 ETH (roughly $70,000 at current prices) and run your own validator — a costly and complex task.

- Or, you loan your ETH to a service like Lido, which handles the validation for you in exchange for a small cut of your rewards.

The problem?

A few large staking providers now control the majority of the network.

Lido alone holds over 30% of the total staked ETH.

Add Coinbase to the mix, and these two dominate the network.

This makes Ethereum more centralized than ever before.

Did Ethereum really need to switch to Proof-of-Stake? In my opinion, no.

Ethereum was functioning well under Proof-of-Work. While PoW has its inefficiencies, Ethereum had already started scaling via Layer-2 solutions.

Instead of overhauling its consensus mechanism, Ethereum could have kept improving Layer-2 as it was already doing successfully.

What did Ethereum gain from the switch? Not much.

The network is still slow and expensive, but now it’s less secure, with control concentrated in the hands of a few.

Since "The Merge" in September 2022, Ethereum has been losing value relative to Bitcoin.

And here’s the kicker …

While Ethereum compromised its security, Bitcoin has been rolling out its own Layer-2 networks, potentially offering the same functionality with the security of a tried-and-tested PoW system.

No wonder capital is flowing out of Ethereum and back into Bitcoin.

The move to PoS was a step Ethereum didn’t need to take. It sacrificed security for minimal gain.

That said, Ethereum isn’t going away anytime soon.

It’s still the No. 2 crypto by market cap.

But it could have been less of a distant second if it hadn’t made the switch.

Best,

Juan Villaverde

P.S. You have a decision of your own to make. And I trust you’ll pick the best outcome for you.

That is, to join me, Dr. Martin Weiss and all your other favorite Weiss Ratings editors at the 2025 Weiss Investment Summit.

We are returning to the beautiful Boca Raton resort in Boca Raton, Florida, this coming May 4-6.

We’ll have two solid days of investment presentations, workshops and opportunities to mingle with other like-minded investors. You can also purchase tickets to bring along family and friends.

Acting on just one of the exclusive recommendations for attendees could more than pay for your registration.

Reserve your seat(s) at the 2025 Weiss Investment Summit here.

One of the things that makes this event so special is that, despite the grand resort in the backdrop, we keep this gathering intimate.

Just 234 spots remain out of 300 total … and only opened the doors to the public this week!

Our team has secured a heavily discounted room rate at this Forbes Five-Star Resort. So be sure to take advantage of all this luxurious property has to offer.

You’ll find all the details here.

Tidak ada komentar:

Posting Komentar