September 20, 2024

Wall Street's Dirty AI Secret

Dear Subscriber,

|

| By Michael A. Robinson |

It’s easy to make money by investing in AI — or so Wall Street would have you believe.

Simply place your hard-earned dollars into an AI-focused ETF and let the returns roll in.

On paper, this strategy makes sense. When you invest in a pool of AI-related stocks, you target the waterfront of AI and let fund managers do all the heavy lifting.

Piece of cake, right? Not so fast …

It turns out that an overlooked design flaw of several AI ETFs has led their performance to come up short. And their investors lost money rather than profited from this powerful tech revolution.

Make no mistake: ETFs like these have their place. They can be powerful tools in your wealth-building toolbox.

But picking the right ETF is crucial.

And today, I’ll reveal a specific fund that consistently outperforms the market. It’s one that may surprise you.

Something’s Not Right Here

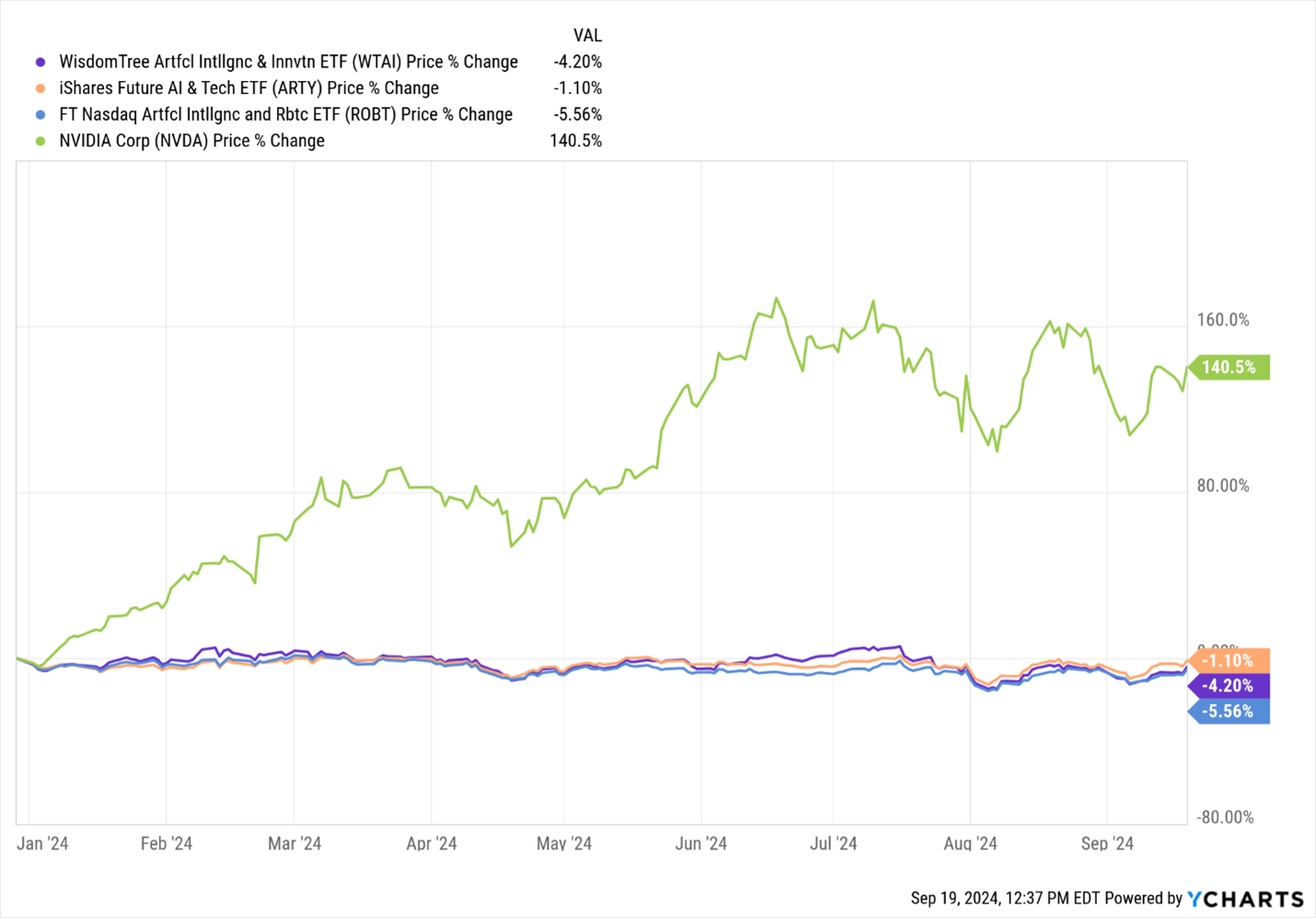

As reported in The Wall Street Journal earlier this month, a trio of AI ETFs have trailed the S&P 500 and MSCI World indexes this year.

In other words, you’d have been better off investing in the S&P than trying to capture the momentum through these AI funds.

This underperformance can be hard to understand. AI is an unstoppable trend. So, naturally a fund with a focus on this technology should be delivering market-beating returns, right?

Ironically, part of the struggles of these ETFs is thanks to perhaps the biggest AI company in the world. I’m referring to Nvidia (NVDA).

Even after a recent selloff, shares of Nvidia have more than doubled so far this year. They’ve been a godsend for many AI investors.

The thing is many ETFs haven’t been able to take full advantage of Nvidia’s banner 2024. Here’s why …

The Problem with AI ETFs

You see, many ETFs aim to diversify, meaning they weight their holdings equally across a number of companies or put a cap on the maximum size of any one stock.

Nvidia makes up more than 6% of the S&P 500. But it’s a much smaller part of many AI-focused ETFs. For example:

- WisdomTree’s $213 million AI and Innovation Fund (WTAI) is equally weighted, giving it only 3% exposure to Nvidia. It’s down 4.2% this year.

- BlackRock’s $610 million iShares Future AI & Tech (ARTY) fund is similarly weighted. It’s off 1% year-to-date.

- And First Trust’s $457 million AI and Robotics ETF (ROBT) has only 0.8% of its allocation in Nvidia. So far this year, it’s down more than 5.5%.

This design flaw is why these ETFs have disappointed, despite a focus on one of the top technology trends in the past decade.

NVDA (top

green line) vs. WTAI, ARTY & ROBT year to date.

Source: YCharts.

Click here to see full-sized image.

So, does this mean we should stay away from all ETFs? Absolutely not.

Not this one, anyway …

Introducing: IGV

Today I’m introducing you to the iShares Expanded Tech-Software Sector ETF (IGV). Weiss Ratings gives it a “C+.”

This fund holds dozens of top-tier technology stocks, including a blend of stable large-cap companies and some lesser-known firms among retail investors.

With this fund, we don’t have to worry about a disadvantageous allocation strategy, or that we’re missing out on returns being captured by a single stock that’s exploding.

Inside this fund, you’ll gain exposure to several high-performing companies. Take a look:

-

C3.ai (AI) provides turnkey solutions for integrating AI into existing systems.

This includes anything from plugging in a specialized AI into a company’s customer database to scan for potential untapped revenue … to having an AI connect to a client’s production database to create optimized manufacturing scheduling, lowering costs and errors.

C3.ai boasts the U.S. Air Force as a major client.

-

Cadence Design Systems (CDNS) is the clear leader in a field of known as electronic design automation (EDA).

This aggressive firm can handle the core development work for its clients’ chips, printed circuit boards and all related hardware systems.

Cadence is a leader in providing software for the booming semiconductor industry and is now using generative AI to help its clients build more robust chips.

-

Palantir Technologies (PLTR) ranks as a pioneer in AI-driven software and solutions with a strong hook in government contracts.

Offerings from this savvy growth firm cover quite a range of applications and sectors. We’re talking about everything from defense to anti-money laundering to intelligence, retail and telecommunications.

Palantir also is offering its tech through the giant Azure cloud platform hosted by Microsoft (MSFT).

IGV is a relatively low-risk way to play the broad waterfront of the reliable software sector.

And unlike those AI ETFs, your profit potential isn’t limited by missing out on any single outlier.

That’s why I’m not surprised that this ETF consistently beats the broader market by 15% over the long haul.

By definition, that means it is just crushing these new AI-centric funds from Wall Street.

Now you know why I say to make sure that if you’re looking to capture the benefits of investing in a portfolio of stocks, you identify the right fund.

As you can see, IGV certainly fulfills this wealth-building mandate.

Best,

Michael A. Robinson

P.S. Of course, the best way to make even more money from the unstoppable AI trend is to own the right individual AI stocks. Here’s a hint: It’s not Nvidia any longer. Instead, I urge you to check out this presentation on the companies about to take advantage of the AI giant’s $1 trillion pivot.

Tidak ada komentar:

Posting Komentar