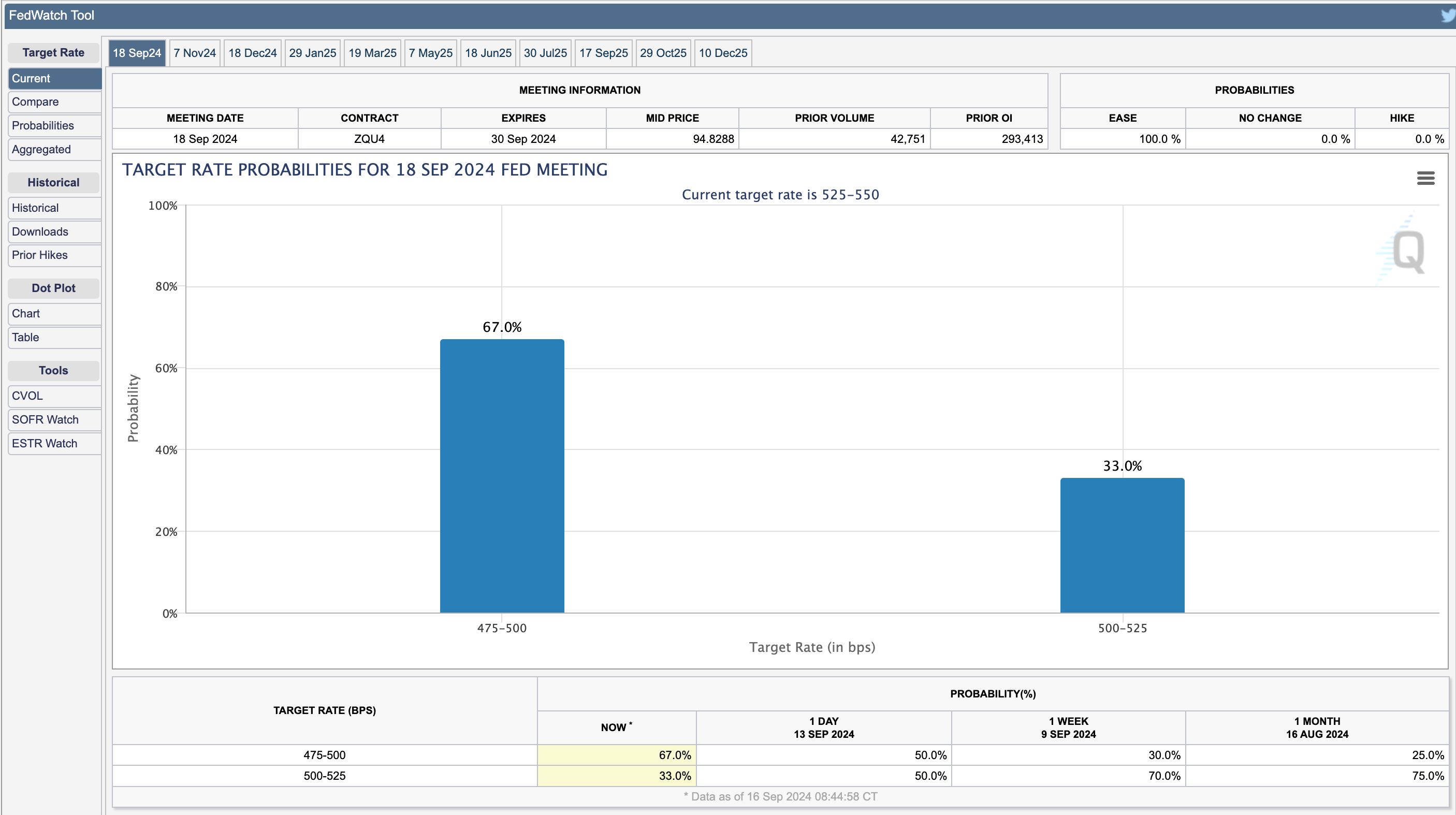

After two wild weeks of the market nosediving, then ripping higher like it was shot out of a cannon, things have calmed down. But it’s the calm before the storm. This week is the most anticipated Fed meeting in years, and the big question is, "What will Powell do?" Wall Street’s been playing the guessing game for months. First, the pros thought March was the time for rate cuts. Then they shifted to June. Then July. But a few weeks ago, Powell gave the bat signal: September is the time. Now, here we are, just days away from the Fed’s big move. The debate? Will it be 25 basis points or 50? And that’s the trillion-dollar question, isn’t it? The media’s been harping on about how we’re in a "Goldilocks" economy. Inflation’s cooling, growth is steady. But here’s the weird part — just six weeks ago, everyone was screaming bloody murder about the Fed being “behind the curve.” Now they’re quietly expecting the Fed to pull off a miracle. Let’s not forget the Nikkei crash a few weeks back, all thanks to the yen strengthening when the Bank of Japan finally moved rates out of the negative. To calm the market, they said they wouldn't raise rates further. Wall Street’s not all in agreement on what’s next. This divide could send markets soaring to new highs… or crashing down. And it’s not just me saying that. Look at the volatility—up big time. The S&P 500 is flirting with all-time highs. So what’s the split? Right now, it’s all about whether the Fed cuts rates by 25 or 50 basis points. According to the FedWatch Tool from the CME Group, there’s a 67% chance of a 50-point cut — up from 30% just a week ago. A bigger cut could signal that the Fed’s lost control of this so-called “soft landing” they’ve been selling. But if they only give us 25 points, when 50 is expected... we’re in for some serious fireworks. I’ve been watching the market flows, and guess what? Money is piling into safe havens—consumer goods, staples, gold, and bonds. Meanwhile, the S&P is a stone’s throw from all-time highs. Keep in mind, the market’s been dead wrong on rate cuts since the beginning of the year. The AI boom is the only thing that’s kept this market afloat. I can’t remember the last time there were so many distortions in the market. Going into the week, the S&P’s options are pricing in a 100-point swing, higher or lower. And that’s after the last two weeks blew past expectations. Wednesday could be the blow-off top we’ve been waiting for. The yen’s about to take out its August highs, which tanked U.S. stocks the last time around. And there’s still a lot of money tangled up in that carry trade. Bottom line? Be ready. Trade smart, Josh Belanger You’re currently a free subscriber. Upgrade for the full experience and receive exclusive special reports like "How to Get Rich in The Stock Market" and "Congress' Secret Stock Playbook: The Top 5 Power Picks Revealed”. |

Senin, 16 September 2024

The Calm Before the Fed… But Brace for Fireworks

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar