Run to This Overlooked Tech Stock? |

Remember "The Tank?"

My seemingly indestructible Garmin Forerunner 35 wristwatch that had accompanied me over the last decade?

I had been diligently researching a replacement. I mentioned offhand to my wife some models I was looking at. (Planting the seeds, so they say…)

I somehow hadn’t pulled the trigger yet, though.

So my wife pulled it for me.

Last month, she surprised me with a shiny new Forerunner 265 for my birthday.

Look at that shiny AMOLED display!

The Tank served me well, but I ripped that thing off my wrist so fast…

I'm not here to review a watch, but I totally understand the hype around newer fitness accessories now.

I've always struggled with how I should be training and sticking to a plan.

I don't have to worry about that anymore.

With training plans that adjust to my fitness level, along with all the data that shows my progress, I can't wait to get out the door and sweat my butt off.

And I know I'm not alone…

| He’s made as much as 3,250,000% in just three years on companies like Facebook, Airbnb, and PayPal…

But our research shows his latest investment could be his most successful venture yet.

See how you can invest alongside him (with a starting stake of just $35).

But you’ll want to do it between now and October 31. |

Fitness Trackers Are Big Business

According to Statista, the fitness tracker market is expected to reach $41.2 billion in 2024. Just seven years ago, that number totaled just $10.8 billion.

With the rise of smart devices and artificial intelligence, I don't see this market shrinking any time soon. Just think about how many people you know that wear an Apple Watch.

Statista expects the fitness tracker market to grow at a compound annual growth rate of 6.6% from now until 2029, increasing its value to $56.8 billion by the end of the decade.

With that as a framework, I wanted zo revisit Garmin's stock and see how it stacks up now in Adam O'Dell's Green Zone Power Ratings system.

Still Strong Bullish…

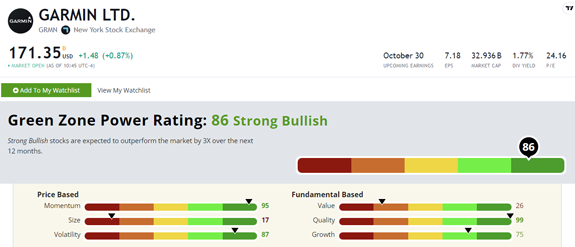

Back in July, Garmin Ltd. (NYSE: GRMN) rated a "Strong Bullish" 82 out of 100 in our system.

And its rating has improved since then to 86 out of 100.

That's a better score than Apple or Microsoft, Big Tech darlings that rate in the "Neutral" zone of Green Zone Power Ratings.

This is why I love our system. Garmin isn't making headlines on all the popular financial news sites. It's a relatively boring company that's focused on developing pinpoint accurate GPS technology for everyone from the U.S. military to you and me training for 5K.

And yet, GRMN stock is up 61% over the last year, more than doubling AAPL and the broader S&P 500. That's why it boasts a 95 rating on Adam's Momentum factor.

In its latest quarterly earnings call, Garmin reported $342 million in operating income, a 20% increase year over year.

Additionally, Garmin’s returns on assets (16%), equity (21%) and investment (21%) far outpace the communication equipment industry (of which their returns average negative numbers).

These strong Quality metrics earn GRMN a 99 on that factor.

It also increased revenue by 14% to $1.5 billion year over year, leading to a solid 75 Growth rating.

We've been talking about size a lot in Money & Markets Daily this week. With the Fed's 50 basis point interest rate cut this week, smaller companies are set to benefit greatly as financing becomes more affordable, juicing growth rates for small- and mid-cap stocks.

Alas, GRMN doesn't fall into those categories. Its $33 billion market cap puts it firmly in large-cap territory.

But still, a "Strong Bullish" overall rating means Garmin's stock is set to outperform as this bull market continues.

Back to obsessing over my VO2 Max and sleep scores…

Until next time,

Chad Stone

Managing Editor, Money & Markets Daily

P.S. I haven’t landed on a nickname for my new watch. If you have any ideas, shoot me an email at Feedback@MoneyandMarkets.com.

Check Out More From Money & Markets Daily:

Tidak ada komentar:

Posting Komentar