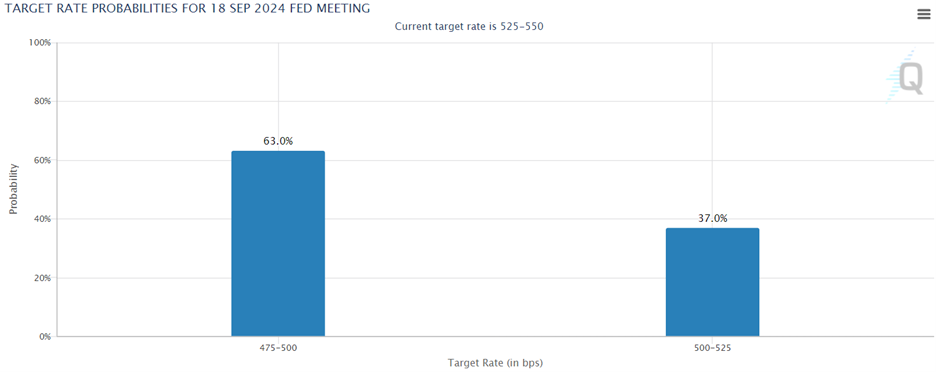

Quant Ratings Updated on 107 Stocks The big day is nearly here. The Federal Reserve’s September Federal Open Market Committee (FOMC) meeting is officially underway. And tomorrow, we should finally have an answer to the question on everyone’s mind… How much will the Federal Reserve cut key interest rates? Interestingly, there is now a growing consensus that the Fed should cut rates by 0.5% rather than 0.25%. So, in today’s Market 360, I will address what may happen with tomorrow’s Fed announcement. I should also note that we won’t see much action in the markets until after the Fed meeting. So, I’ll also share how you can best position yourself to profit following the Fed’s announcement. How Big Will the Fed Cut Tomorrow? On Friday, the probability of a 0.5% rate cut grew to 50% after falling to a 13% likelihood mid-week. Then yesterday, the probability of a 0.5% rate cut expanded to 57%, with the likelihood of only a 0.25% rate cut slipping to 43%. And following this morning’s retail sales report, the market has now priced in a 63% chance that the Fed will cut rates by 0.5%, according to CME’s FedWatch Tool.  Source: CME FedWatch Tool

To be frank with you, this morning’s retail sales report was mixed. Retail sales increased 0.1% in August, beating economists’ expectations for a 0.2% decline. July’s retail sales were also revised up to a 1.1% increase, compared to the previously reported 1% rise. August retail sales that exclude autos and gas increased 0.2%, which missed estimates for a 0.3% rise. So, when you consider the latest retail sales data, the fact that inflation continues to moderate and fall closer to the Fed’s 2% target and that the labor market is weakening, there is a strong likelihood that the Fed could cut rates by 0.5% tomorrow.

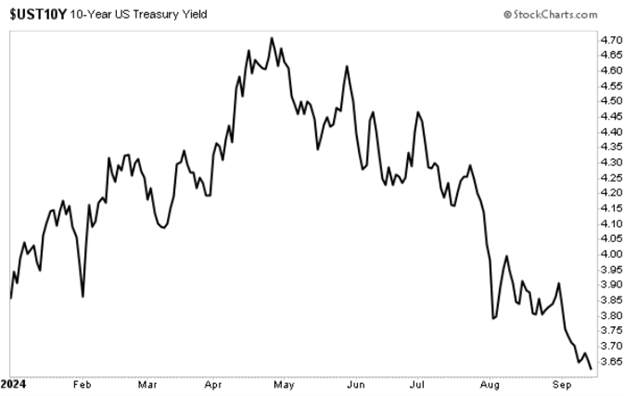

Now, if the Fed does cut key interest rates by 0.5%, then an explanation will be necessary. The fact is the FOMC does not want to give the impression that it panicked and needs to catch up with market rates. Remember, Treasury yields declined in the wake of recent economic data, including last week’s consumer and wholesale inflation reports. The 10-year Treasury sitting at about 3.65% today, while the two-year Treasury yield stands at about 3.59%. That compares to a 10-year Treasury yield of 4.7% and a two-year Treasury yield of 5.05% in late April.  While Treasury yields have declined steadily in recent months, the Fed stood pat in June, keeping key interest rates between 5.25% and 5.5%. Clearly, there is a big difference between the federal funds rate and market rates – and typically, the Fed does not fight market rates. So, that’s another reason why there have been calls by Fed officials and market pundits for a bigger rate cut on Wednesday. Whatever happens, I am looking forward to seeing a more dovish tone in the Fed’s official statement as well as in Fed Chair Jerome Powell’s press conference. I’ll also be interested to see the new “dot plot,” which surveys the Fed members on their outlook for rates in the future. I think it’s probably going to forecast two more rate cuts this year – in November and December – and another three rate cuts in 2025. This Week’s Ratings Changes But you don’t have to listen to me. We’ll have the report soon enough tomorrow, and we’ll know for sure. In anticipation of the Fed decision tomorrow, the stock market is trading relatively flat. But I expect a relief rally after the Fed’s announcement tomorrow, provided the news is dovish and suggests additional rate cuts are on the way.

In the meantime, to help you prepare for what could be a big move in the market after the Fed’s announcement, I took a fresh look at the latest institutional buying pressure and each company’s financial health. I decided to revise my Portfolio Grader recommendations for 107 big blue chips. Of these 107 stocks… - Eleven stocks were upgraded from a Buy (B-rating) to a Strong Buy (A-rating).

- Seventeen stocks were upgraded from a Hold (C-rating) to a Buy (B-rating).

- Eighteen stocks were upgraded from a Sell (D-rating) to a Hold.

- Nineteen stocks were downgraded from a Buy to a Hold.

- Thirteen stocks were downgraded from a Hold to a Sell.

- And four stocks were downgraded from a Sell to a Strong Sell (F-rating).

I’ve listed the first 10 stocks rated as Buys below, but you can find a more comprehensive list – including all 107 stocks’ Fundamental and Quantitative Grades – here. Chances are that you have at least one of these stocks in your portfolio, so you may want to give this list a skim and adjust accordingly. | ADP | Automatic Data Processing, Inc. | B | | ANET | Arista Networks, Inc. | B | | CARR | Carrier Global Corp. | B | | CLX | Clorox Company | B | | COO | Cooper Companies, Inc. | B | | DD | DuPont de Nemours, Inc. | B | | DOCU | DocuSign, Inc. | B | | MOH | Molina Healthcare, Inc. | B | | MPWR | Monolithic Power Systems, Inc. | B | | MSFT | Microsoft Corporation | B | Preparing for What’s Next The fact is we likely won’t see any big market moves until the Fed’s announcement. And this gives you an opportunity to prepare your portfolio for what comes next... The fact is, folks, I predict that when the Fed begins cutting rates, it will mark the end of the $8.8 trillion “cash bubble.” And all of this money just sitting on the sidelines will be unleashed on the market. One thing I know after 40 years in the markets is that money goes where it’s treated best… That means fundamentally superior stocks should benefit the most. With the stock market likely to start regaining momentum in a few weeks, right now is a great opportunity to snap up shares of fundamentally superior stocks at deep discounts. Specifically, I’ve identified five stocks in one of the market’s hottest sectors that remind me of the FAANG stocks from the internet boom. To get access to my full briefing on this cash bubble – and how you can profit – go here now. (Already a Breakthrough Stocks subscriber? Click here to log in to the members-only website.) Sincerely, |

Tidak ada komentar:

Posting Komentar