July 2, 2024

It's Raining Cats, Doges and Frogs!

Dear Subscriber,

|

| By Bruce Ng |

Since March, Bitcoin (BTC, “A”) has been chopping sideways between $60,000 and $73,000.

Meanwhile, altcoins have dropped off a cliff since the end of April. While some have rebounded strongly, others are still slugging sideways.

As Juan Villaverde said previously, this is normal behavior for crypto market at this time of year. Still, expecting it doesn’t make this volatility easier to navigate.

Sure, some investors may just HODL. That is, hold onto their positions tightly and wait out the storm.

But if you can tolerate the tumultuous price action, there are profits you can extract from this market.

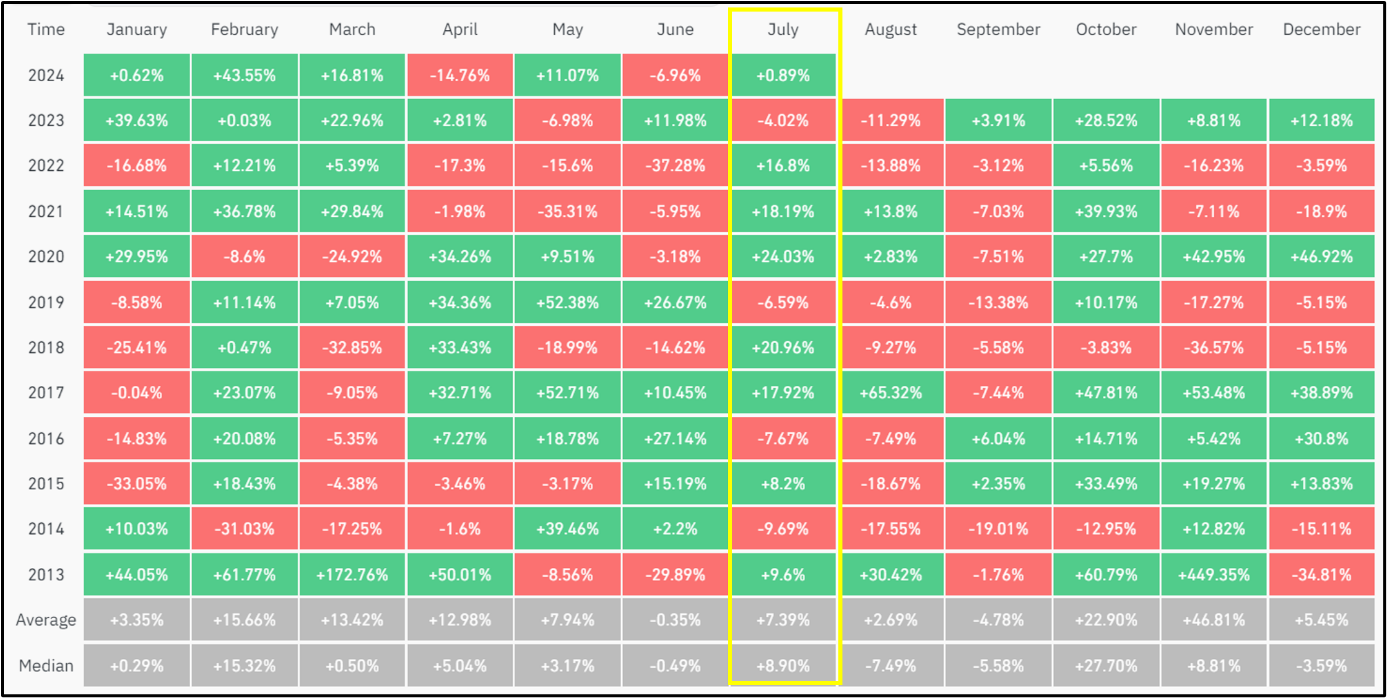

To start, it pays to look at the monthly seasonality of BTC, as shown below:

Figure 1: Bitcoin monthly returns for the years 2013-2024.

Source: Coinglass.

Click here to see full-sized image.

Look at the returns for each month. For each year, each month seems to deliver similar returns.

For example, February, October and November are very bullish months. On the other hand, May and June are typically bearish months.

Now, I want to focus on the month that’s just beginning: July. Overall, summer is a sleepy season for crypto, with an average -0.35% loss in June and a mere 2.69% gain in August for the past 11 years.

But notice July’s average gains in that same time? It comes in at an average 7.39%.

That tells me that Bitcoin has a strong possibility of ending this month with a net gain. Indeed, I believe that we may even see BTC pump above $65,000.

And if it does, altcoins are likely to follow and pump as well.

Memecoins (Again)

When July is over, we’ll still be in the middle of a quiet crypto summer season. That means stronger coins are most likely to benefit from a Bitcoin pump.

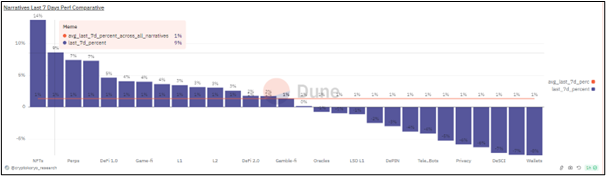

And to find those, you’ll need to identify the strongest sectors. For that, let’s take a look at this chart:

Figure 2: Top performing narratives past 7 days.

Source: cryptokoryo.

Click here to see full-sized image.

This shows the performance of crypto sectors — also called narratives — over the past seven days. And it looks a little different than the last time I showed it.

Right now, memecoins have taken a back seat to a surprising challenger: NFTs.

- NFTs: 14%

- Memes: 9%

- Perps: 7%

- Money markets: 7%

- DeFi 1.0: 5%

I’ll be a bit blunt: I think NFTs are a fad, and this recent outperformance is a one-off thing.

That isn’t to say there isn’t value in NFTs. But they’ll be good at the end of the cycle, when retail money piles in.

Memecoins, however, continue to be the best rebounders and outperformers in the space. You can read my last Weiss Crypto Daily for the historical evidence behind my analysis. And this is why I have been focusing mainly on memecoins this whole cycle.

Not only have they demonstrated the biggest strength on the rebound, I think they will be the best performers into the end of this cycle.

So what are the top memecoins you should look at?

Below are five top-performing memecoins I think have the best potential to explode up in the parabolic bull market, if it occurs at the end of this year. This is based on each coin’s previous performance in Q1 and the strength of its rebound in Q3.

- Pepe (PEPE, Not Yet Rated): Based on our memecoin boom and bust theory, PEPE has undergone a first rally and a 90% dip. It has since consolidated and is ready for its next leg up. Which may come soon, as PEPE is widely regarded as a leveraged play on ETH. And the entire market is eagerly anticipating the official listing of a spot ETH ETF soon.

-

Bonk (BONK, “C+”): BONK led the Q4 rally in 2023. It was airdropped to Solana holders back in 2022, when the Solana community was down on its knees due to various factors.

But while recent price performance has been great, there are two downsides: First, a large chunk of supply is held by venture capitalists. This means we could see price fluctuations from large holders selling. Second, utility has recently been added, which means BONK is no longer a pure memecoin. Pure memecoins perform the best.

- Dogwifhat (WIF, “E+”): WIF has had a stellar performance over the past week. It started from a low near $1.55 last Monday and climbed back to about $2.34 yesterday. It has since corrected slightly to $2.21 at the time of writing. This shows that it still has a big fight left in it.

-

Dogecoin (DOGE, “C+”): DOGE is THE original memecoin. It has survived three crypto cycles, which means it has lasted longer than most coins — including ones considered “more legitimate,” like DeFi protocols and Layler-1 platforms.

Due to its already high market cap, its potential upside is capped. But it is still a good bellwether for how the memecoin sector as a whole will behave. It may head back to $1 at peak market later this year. It usually pumps at the end of a cycle.

- Popcat (POPCAT, Not Yet Rated): POPCAT is currently the best performer on this list. DOGE, BONK and WIF are all dog-themed coins. As a cat-themed memecoin, POPCAT piggybacks off their popularity to emulate their performance. However, cat memecoins represent only a sixth of dog memecoins in terms of total market cap. Which means while they are riskier to trade, they can grow by a lot more.

Remember, however, that memecoins are volatile assets. Sure, the upside can be incredible, especially during big bull market rallies. But they also correct harder than the broad market, making their dips particularly painful.

Be sure if you decide to invest or trade memecoins, you are comfortable with that additional risk, and only invest what you’re able to lose.

Best,

Dr. Bruce Ng

Tidak ada komentar:

Posting Komentar