| In partnership with | | The week ahead of us 🔍 | Here's a look at earnings coming up this week, I'd argue lululemon (the biggest underperformer of the S&P 500 this year, down -38% YTD) is the biggest one. | Monday: GitLab Tuesday: CrowdStrike, HP, Core & Main, Bath & Body Works, Wednesday: lululemon, Dollar Tree, Campbell Soup, Five Below Thursday: Autodesk, J.M. Smucker, DocuSign, Vail Resorts

| A Message from our Sponsor | Where Sophisticated Investors Access Private Markets | | 10 East is a co-investment platform where sophisticated investors access private market investments alongside a veteran team with a decade+ track record of strong performance. | The firm is led by Michael Leffell, former Deputy Executive Managing Member of Davidson Kempner. | Members have the flexibility to participate on a deal-by-deal basis across private equity, credit, real estate, and venture capital. | Benefits of 10 East membership include: | Flexibility – members have full discretion over whether to invest on an offering-by-offering basis. Alignment – principals commit material personal capital to every offering. Institutional resources – a dedicated investment team that sources and diligences each offering.

| Plus, there are no upfront costs or commitments associated with joining 10 East. | Wall Street Rollup readers can join 10 East with complimentary access here. | The Main Story🤯 | Problems in Private Credit? There's a fight squaring off between Vista backed Pluralsight and existing lenders. Pluralsight dropped down assets into a new subsidiary to raise new financing, moving it outside of the collateral of the existing lender base. This is an example of a liability management exercise (LME), where the borrower uses loose credit documentation to move assets away from borrowers, and then use those assets to gain financing from a new capital source. This has been happening a lot lately in the public credit, but this supposedly wasn't supposed to happen in private credit | We've been hearing for a few years now that credit documentation and collateral protection in private credit is stronger than the public credit market, but this move shows that lenders aren't as safe as they thought they were and could kick off some more LMEs going into a distress cycle. Additionally, I would note that generally upper middle market credit agreements aren't as tight as people generally believe, and that middle market/lower middle market private credit has tighter documentation The Pluralsight deal has not been going well for Vista and was a classic example of a bad 2021 underwrite. They've written down the equity value of the $3.5B deal, per Axios There's also some big lenders involved in Pluralsight. In Private Credit, relationships are very important - in the traditional leveraged finance market you work with 100+ different leveraged loan or high yield groups, but for larger private credit deals, there's more so like a dozen guys you'd really lean on. Therefore, hurting some big lenders who you'll need later on down the road if you want to do more private credit deals isn't a good look. The lender group has engaged Centerview and Davis Polk

|  | Downside Case @DownsideCase |  |

| |

Owl Rock, Ares, GS, BlackRock, Oaktree, Golub all in Pluralsight. Vista torching some big lenders | | | May 31, 2024 | | | | | | 136 Likes 2 Retweets 5 Replies |

|

| | Headlines 🔍 | Disney & Comcast are haggling over how much Hulu's worth. Five years after Disney won control of the streaming service, the entertainment giants are debating how much Disney owes Comcast for its remaining 1/3 stake. Disney pegged Hulu's valuation at the $27.5B floor set by the two sides in a 2019 agreement, but Comcast's fighting for $40B. Zooming out … Bob Iger has dialed in on making streaming profitable for Disney (now expected in Q3). Iger hopes that Hulu, one of the few cash flow positive streamers, will help him get there. Meanwhile, Comcast's been ramping up Peacock. NBC Universal has prioritized live sports, successfully partnering with the NFL, Big Ten, and Premier League (though still managing to lose ~$650mm last quarter).

Bill Ackman Wants Liquidity: The Pershing Square Founder is raising $1.05B to sell a 10% stake in the Hedge Fund at a $10.5B valuation, and is gearing towards an IPO at some point. The valuation seems aggressive cause technically this values a handful of valuable hedge fund analysts, plus a founder that acts somewhat erratically on X at a pretty steep valuation There's certainly succession issues in Hedge Funds, so it makes sense for Bill to try to figure out exit liquidity, but it's certainly a weird business to take public

Carl Icahn found a new toy: He's built a stake in Caesars Entertainment, which jumped up 11% on Friday, though the corporate raider declared that he planned "absolutely no activism" in the largest casino owner in the US Amazon is increasing their stake in Grubhub to 18%. The news comes a month after Amazon announced the launch of a new in-house grocery delivery service and a plan to give Prime customers free Grubhub+ subscriptions Edwin Dorsey and RCI Hospitality Square Off: Edwin Dorsey, Founder of The Bear Cave, a Substack that focuses on corporate misconduct and potential short ideas, wrote a piece on RCI Hospitality ($RICK). The $RICK Team is very active on X so this caused quite the stir, with a lot of insults thrown at Edwin Dell's earnings disappointed. Dell was initially up 133% YTD prior to earnings, but are now down -22%+ post earnings after disappointment around the margin profile of their AI offerings. Credit Suisse is no more: The entity has been officially deleted - it's just UBS now. R.I.P. to Debit Suisse Nelson Peltz is out on Disney after losing his proxy battle against the company. He sold his stake in early April, but did make a cool $1B…. Nvidia could soon overtake Apple as the World's Second-Most Valuable Company The US 10-Year Yield Falls Below 4.5% After PCE Data (YahooFinance) Paramount Directors are backing a Skydance Merger Retailers like Gap and Foot Locker had a strong week. That doesn't spell a consumer comeback (CNBC) How to Allocate Capital Like a Boss - from The Secret CFO

| M&A Transactions💭 | Adevinta, an online classifieds company, was acquired for $12.89B by Permira, TCV, General Atlantic, and Blackstone (NYS: BX). ABG Sundal Collier and Citigroup advised on the sale. | Neoen (PAR: NEOEN), a French renewables developer, has entered a definitive agreement to be acquired for $3.51B by Temasek and Brookfield Asset Management (TSE: BAM). | A portfolio of 7 retail warehouses of Partners Group was acquired for $125.01M by LSTH Svenska Handelsfastigheter. | Kraus Jeans, manufacturer of women-focused casual fashion clothing, was acquired for $2.0B by Kewal Kiran Clothing (BOM: 532732). | Inhibrx, a clinical-stage biotechnology company, was acquired for $1.98B by Sanofi (PAR: SAN). Eight Advisory and Lazard advised on the sale. | The Ground Transportation System Business Unit of Thales Group (PAR: HO) was acquired for $1.79B by Hitachi Rail. Lazard advised on the sale. | ShockWave Medical (NA: SWAV), a medical device company, was acquired for $13.1B by Johnson & Johnson (NYS: JNJ). Perella Weinberg Partners advised on the sale. | Enerplus, producer and developer of crude oil and natural gas assets, was acquired for $3.9B by Chord Energy (NAS: CHRD). Evercore, RBC Capital Markets, CIBC Capital Markets, and BMO Capital Markets advised on the sale. | Private Placement Transactions💭 | Figma, developer of a design tool designed to help companies brainstorm, design, and build better products, raised $415.75M of venture funding led by Franklin Venture Partners, Sequoia Capital, and Andreessen Horowitz at a pre-money valuation of $12.08B. | Sedemac, manufacturer of mechatronic products intended to accelerate high volume deployment of novel technology, raised $100.0M of venture funding led by Xponentia Capital Partners, A91 Partners, and 360 ONE at a pre-money valuation of $150.0M. | Noteworthy Chart 🧭 |  | Source: PitchBook |

| Best of YouTube ⌚️ | America's shrinking population: The economic impact of a falling U.S. birth rate |  | America's shrinking population: Economic impact of falling U.S. birth rate |

|

| Meme Cleanser 😆 |  | #REF! @im_REFarted |  |

| |

VP asking me why I hardcoded the check figure |  | | | May 30, 2024 | | | | | | 1.2K Likes 42 Retweets 3 Replies |

|

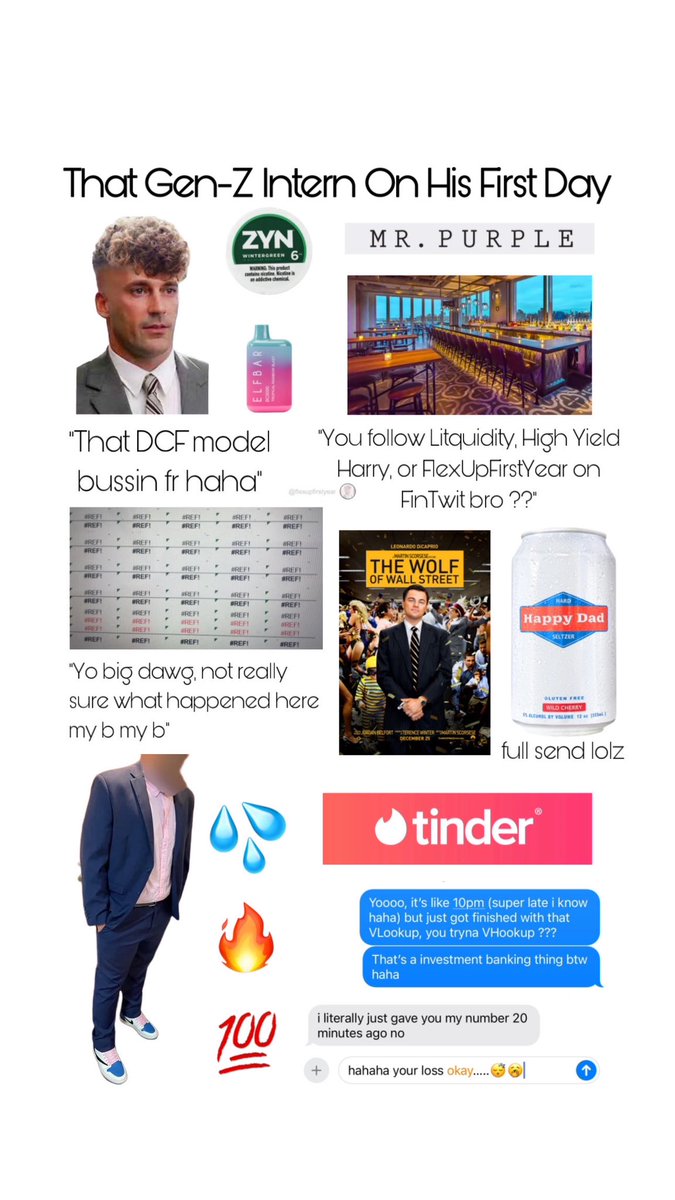

|  | FlexUpFirstYear @flexupfirstyear |  |

| |

'twas the friday before intern season, when all through New York |  | | | May 31, 2024 | | | | | | 86 Likes 1 Retweet 4 Replies |

|

|  | JL @spooky_JL |  |

| |

If you get ask a question you don't know the answer to at IC just ask "am I being detained" and if they say "no" you are free to go | | | May 29, 2024 | | | | | | 158 Likes 2 Retweets 2 Replies |

|

| Reader Survey: | Now that we've added our full team, and we've been up and running for 2+ months, we'd like to gather reader feedback of what you love and what areas you'd like to see additions to. | How are we doing so far?Tell us what you like and what you want added in our newsletter | |

|

Tidak ada komentar:

Posting Komentar