February 4, 2023

Market's Strong January a Prelude to 2023

Dear Subscriber,

|

| By Jordan Chussler |

In 2022, traders were beset by mass sell-offs, ongoing supply chain issues, decades-high inflation, aggressive interest rate hikes from the Federal Reserve and yearlong market volatility.

Treasury bonds, once considered some of the safest investments in the world, collapsed, posting their worst year ever.

Tech crashed. Crypto crashed. Even America’s largest blue-chip companies were unable to avoid the pain.

When all was said and done, the Dow lost almost 9%, the S&P 500 ended 2022 with a loss of 20% and the Nasdaq shed an astounding 33%. With the exception of energy and utilities, every sector of the S&P 500 finished in the red.

Then the calendar turned to 2023 and things started to change:

- By the end of January, the Dow posted a gain of 2.83%.

- S&P 500 finished the first month with a gain of 6.2% — it’s best January performance since 2019.

- And the Nasdaq Composite posted a gain of 11%.

Meanwhile, inflation has likely peaked, and despite this week’s interest rate hike from the Federal Reserve, the market interpreted that move as dovish in light of the Consumer Price Index reading having now subsided six months in a row.

The housing market is in correction territory, jobless claims remain near historical lows and wages have tapered off. Layoffs in Big Tech are being seen as a positive for shareholders.

That’s being evidenced in share prices. Meta Platforms (META) — which saw its stock drop over 64% last year — beat earnings in Q1, with shares rising over 51% in January. It’s a similarly strong story for Netflix (NFLX), with its shares losing over 51% in 2022 but gaining 25% in the past month.

Stocks aren’t alone in their outsized performances to begin the year, either.

ETF Focus

There are currently three “B+”-rated ETFs in the Weiss universe:

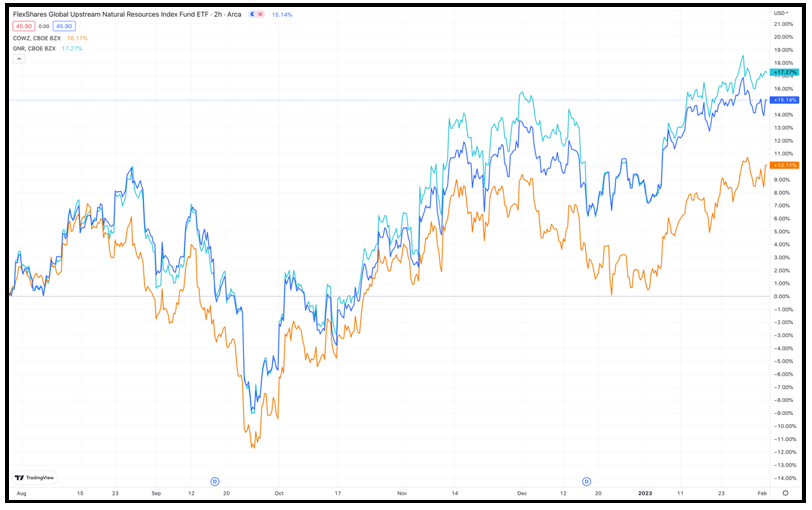

1. The FlexShares Morningstar Global Upstream Natural Resources Index Fund (GUNR), which gained over 7% in January.

2. The Pacer US Cash Cows 100 ETF (COWZ), which gained over 9% in January.

3. And the SPDR S&P Global Natural Resources ETF (GNR), which also gained more than 9% in January.

Six-month chart of the GUNR (dark blue line), COWZ (orange line) and GNR (light blue line).

Click here to view full-sized image.

Those three ETFs pay dividends yielding 3.97%, 3.88% and 4.12%, respectively. You can research them and other ETFs here.

There is plenty to like about this market environment right now and hopefully for the remainder of 2023. For a clearer picture of that, here are this week’s top stories from our team of analysts and editors.

Time to Get Bullish on Metals

Senior Analyst Sean Brodrick continues his three-part metals series with a focus on explaining why silver, platinum and copper are each poised for a strong run this year.

VIDEO: Market Minute with Kenny Polcari

In this week’s Market Minute, Financial News Anchor Kenny Polcari discusses the Fed’s 25-basis-point rate hike, Big Oil’s earnings and other macroeconomic news painting the big picture for Q1.

You Can Invest Like the World’s Richest Man

As China reopens from three years of COVID-19 lockdowns, luxury spending by Chinese millionaires should explode. According to Senior Editor Tony Sagami, investing in companies that cater to the wealthy is wise because they are hardly affected by economic slowdowns.

Look to Benefit from Increased Corporate Hacking

Pulitzer Prize winner Jon Markman details the increasingly high risk of data breaches and why investors should consider buying cybersecurity shares in this company.

How the Algos Can Help You Profit

Algorithms can trigger trades based on any factor a human directs it to — even news events. Analyst Kenny Polcari reports on how you can take advantage of the growing trend of algorithm-based trading by investing in one of the biggest technologies behind it.

Investors Should Continue Treading Lightly

For Income Analyst Nilus Mattive, historical measures and real-world experience are still flashing warning signs for stocks. Despite the market’s strong start to 2023, he stresses that it’s always prudent to proceed with caution … and safety-rated investments.

Until next time,

Jordan Chussler

Managing Editor

Weiss Ratings Daily

Tidak ada komentar:

Posting Komentar