The Fed's 2% Target Rate for Inflation is Not Realistic | | Sponsored Content Free Book Reveals 37 Income Secrets to Crush Inflation How you could claim $4,501 before March 31st — discover the simple way you could collect 1-day payouts from America's most profitable companies.

Grab your free copy now. | | | Based on the recent string of economic data that includes January employment, Consumer Price Index (CPI), Producer Price Index (PPI), Producer Consumption Expenditures (PCE), weekly initial jobless claims, personal spending and consumer confidence, it appears as if the domestic economy is functioning fairly well.

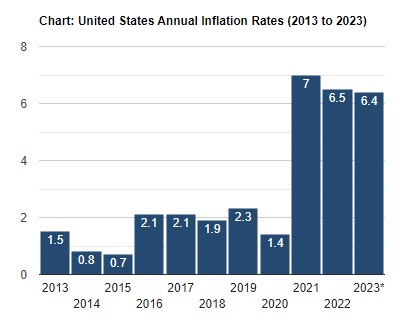

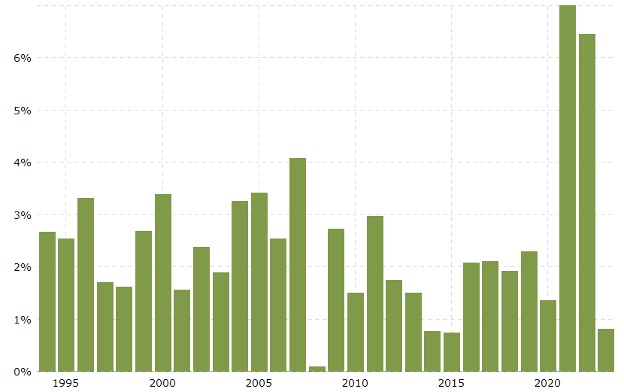

This performance is occurring amid a backdrop of some very stubborn inflationary forces. The annual inflation rate for the United States is 6.4% for the 12 months ended January 2023, after rising 6.5% previously, according to U.S. Labor Department data published Feb. 14. The next inflation update is scheduled for release on March 14.

Source: www.usinflationcalculator.com.

Inflation is coming down, but not nearly fast enough to satisfy the Fed leaders. Investors now seem to expect three more quarter-point interest rate hikes by the July meeting.

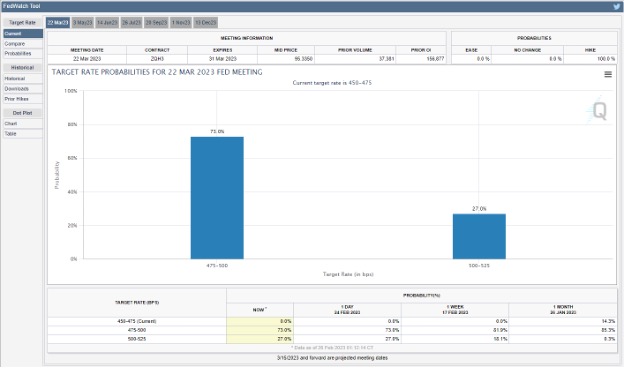

Depending on upcoming employment, inflation and other economic data to be released before the March 22 Federal Open Market Committee (FOMC) meeting, investors are starting to see a growing chance of a 50-basis point move at that meeting that would imply 100 basis points from now through July. This latter scenario would take Fed Funds up to 5.50-5.75%.

While the prospect of higher-for-longer interest rates has been on the minds of investors for some time, it has taken a while for the reality of such a scenario to sink in, and last week's price action for both the bond and stock markets started to reflect this reality. Even with all the attention a potential half-point hike at the March meeting is getting, the FedWatch Tool puts only a 27% chance of that happening and a nearly 73% probability of a quarter-point hike being the most likely outcome. But again, investors will receive a parade of fresh data that will steer the narrative more clearly in the next two weeks.

| | Bryan Perry's 4th & Final "Millionaire Beta Test" Over each of the last three years, Bryan Perry's Quick Income Trader Beta Tests have generated 7 figures in trading gains, each time in under 10 months.

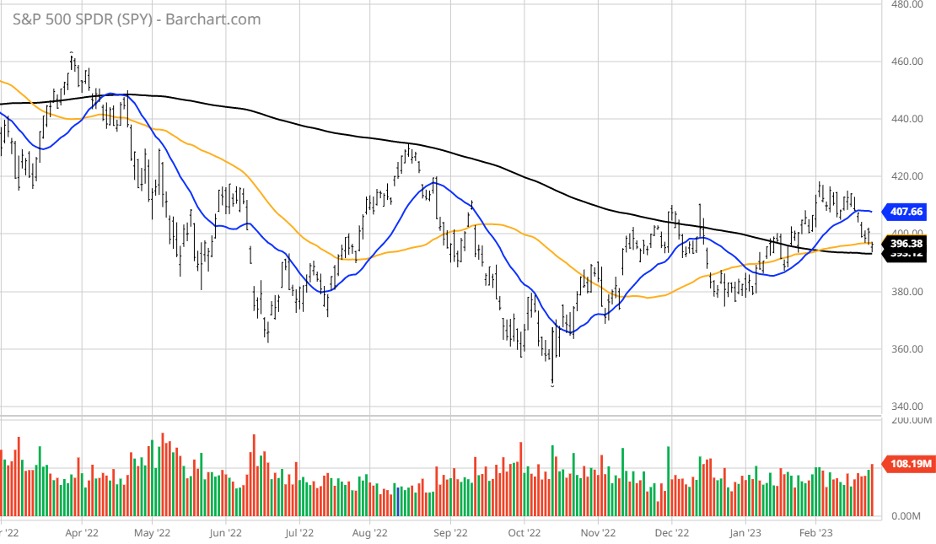

To learn about Bryan's next (and last) program, follow this link. | | | As it stands, the assumption of a rapid deceleration of inflation that unfolded in January to fuel the rally has faded. The market's value now is heavily influenced by the narrative of the Fed tightening for longer. How the market responds to this change has already been shown with the 5.2% retracement by the S&P 500 to its 200-day moving average.

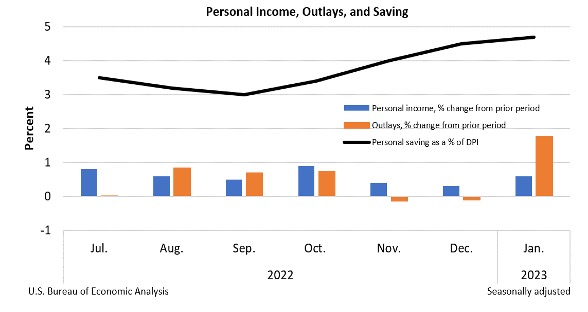

The angst over last Friday's PCE report was that it showed inflation and some robust spending will keep the economy moving ahead at a pace that will maintain inflation at elevated levels for some time. Even with an unexpected 1.8% jump in the personal spending rate for January, the personal savings rate, as a percentage of disposable income, increased to 4.7% from 4.5% in December.

It was broadly thought the consumer was somewhat tapped out. But within the data, spending was notable in purchases of cars and appliances, staying at hotels and going out to restaurants. The bump in the savings rates at the same time as the spike in spending runs counter to the narrative coming into February amidst rising bond yields and borrowing costs. But prior to the Great Recession of 2008-2009, before quantitative easing became embedded in Fed policy for the next 14 years, the rate of inflation was running at closer to 3% than the Fed's target of 2%, averaging 3.28% from 1914 until 2023, reaching an all-time high of 23.70% in June of 1920 and a record low of -15.80% in June of 1921.

Source: www.macrotrends.net.

Here is where it gets interesting for market participants. With salaries and hourly wages having risen, and the labor force participation rate still below pre-pandemic levels, one could argue that the labor component to inflation is going to remain high. As far as the shelter component of inflation is concerned, new home construction fell again in January, the fifth straight month of declines, adding to the longstanding inventory problem.

Tight inventory has kept prices from substantially dropping off, making homes still unaffordable for many, especially first-time homebuyers. Those that locked in super-low rates for purchases and refinancings are staying put.

| | Where's the Next Stock Market Gravy Train? Join our FREE live interactive masterclass for traders and we'll share with you which stocks may be about to explode.

Click here now to get access. | | | It seems more plausible that if the annual rate of inflation can get back down to the historical 3.3% level, the market should be elated. The timeline for which this scenario unfolds has been obviously pushed out by both the Fed and by market participants, having to do a reset on expectations this past week. With all the factors impacting inflation, it appears the Fed's target rate of 2% is wholly unrealistic -- especially with the risk of a more protracted war in Ukraine and the potential for new actions by the United States and China against each other, the notion of a sub-4% inflationary environment materializing anytime soon has been tabled.

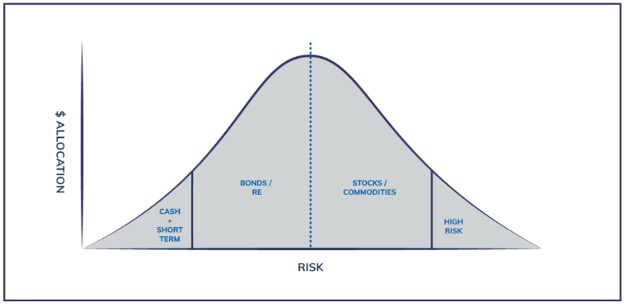

To this end, investors who demand yield can look at short-term Treasuries. As of last Friday, the 10-year Treasury Bill was paying 5.07%. For those willing to take on risk, hard asset lenders, bridge financing and business development companies are paying 6-12% depending on the portfolio composition of leverage and exposure to floating rate securities. In the energy patch, closed-end funds that own master limited partnerships (MLPs) are paying upward of 8-9% with no K-1s issued.

At some point, when the Fed is done raising rates, settling at a terminal rate, it will present an excellent opportunity to lock in long-term rates on bonds and own some zero-coupon Treasuries that will vault higher in value when rates recede. Right now, the bond futures market thinks that time will be in July. If so, the traditional barbell strategy might just come right back into fashion.

Source: https://www.goodfinancialcents.com/barbell-investing-strategy/. | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income PRO

Editor, Quick Income Trader

Editor, Breakout Options Alert

Editor, Micro-Cap Stock Trader

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan also serves as Editor of these services: Cash Machine, Premium Income PRO, Quick Income Trader, Breakout Profits Alert, Hi-Tech Trader, and Micro-Cap Stock Trader. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan also serves as Editor of these services: Cash Machine, Premium Income PRO, Quick Income Trader, Breakout Profits Alert, Hi-Tech Trader, and Micro-Cap Stock Trader. | | | | | |

Tidak ada komentar:

Posting Komentar