Profit Off the HUGE Battery Gold Rush With This $5 Stock During periods of elevated market volatility – such as the one we’re seeing right now – I like to do one thing: Focus on the big picture.

The simple reality, folks, is that it is nearly impossible to predict with any great certainty what’s going to happen over the short-term. Inflation could keep rising. Or it may start decelerating. The Fed may hike rates 10 times. Or they may make a U-turn in the summer. Russia may try to invade mainland Europe. Or they may stop the fighting altogether.

There’s a lot of uncertainty out there right now. So, let’s do ourselves a favor and stop trying to do the impossible in predicting how all of those risk factors will play out.

Instead, let’s do something much easier. Let’s take a deep breath. Let’s zoom out. Let’s look at the big picture. And let’s realize that while today’s macroeconomic and geopolitical risks may seem like world-enders, they are not.

Just like no macroeconomic risk or geopolitical risk before them was a world-ender.

COVID-19? World kept turning. Great Financial Crisis? World kept turning. Dot-Com Crash? World kept turning.

Lather. Rinse. Repeat. In the big picture, the world, the U.S. economy, the stock market, and humankind in general have a multi-century track record of trumping crisis, after crisis, after crisis, after crisis.

That’s the big picture.

Keep that in mind while stocks throw a little temper tantrum here. Because, in doing so, you’ll realize that what you should be doing amid this market meltdown is simply focusing on the long-term technological trends reshaping our world.

I’m talking artificial intelligence, electric vehicles, digital advertising and shopping, robotics, and more. Those trends are not going to be derailed, or stopped, or even slowed all that much by what’s going on in the market today.

Just like computers weren’t stopped by Black Monday. Just like the internet wasn’t stopped by the dot-com crash. Just like cloud computing wasn’t stopped by the financial crisis.

Ultimately, world-changing trends always end up changing the world – regardless of what happens in the near term.

Makes sense, right?

All that is really a long-winded way of saying that the best investment strategy at the current moment is to ignore the noise and focus on the long-term megatrends reshaping our lives.

The best such megatrend? The "Battery Gold Rush." Batteries Are Everything These Days When you sit back and really think about it, pretty much every technological megatrend out there requires batteries to power it.

Electric vehicles? They run on lithium-ion batteries.

Energy storage systems? They, too, run on batteries.

Artificial intelligence? Built on software, which is run on computers, which are powered by… you guessed it… batteries.

What about smartphones? VR headsets? Charging stations? All those end-markets need batteries, too.

Morgan Stanley aptly summed it up in a research note just a few weeks back by saying:

“We need batteries. Literally everywhere.”

The purpose of the research note was to illustrate that the world is about to embark upon a battery infrastructure spending boom over the next decade, so that countries and companies can produce enough batteries to power these tech megatrends.

We couldn’t agree more with that thesis.

Batteries will be the epicenter of our tech-dominated future. Demand for them is going to increase at exponential rates in the 2020s. But there is not an infinite supply of batteries. If anything, we have a supply shortage today. Therefore, there is going to be a battery spending boom over the next decade, wherein companies all along the battery manufacturing supply chain will make a lot of money.

It will be a Battery Gold Rush.

And we have a $5 stock to play this decade-long megatrend. The Forever Battery Is the Holy Grail of This Gold Rush The “holy grail” of the coming “Battery Gold Rush” will be a special type of battery that I like to call a forever battery. And it’s going to change the world as we know it.

To understand why, we need to take a quick trip back to chemistry class…

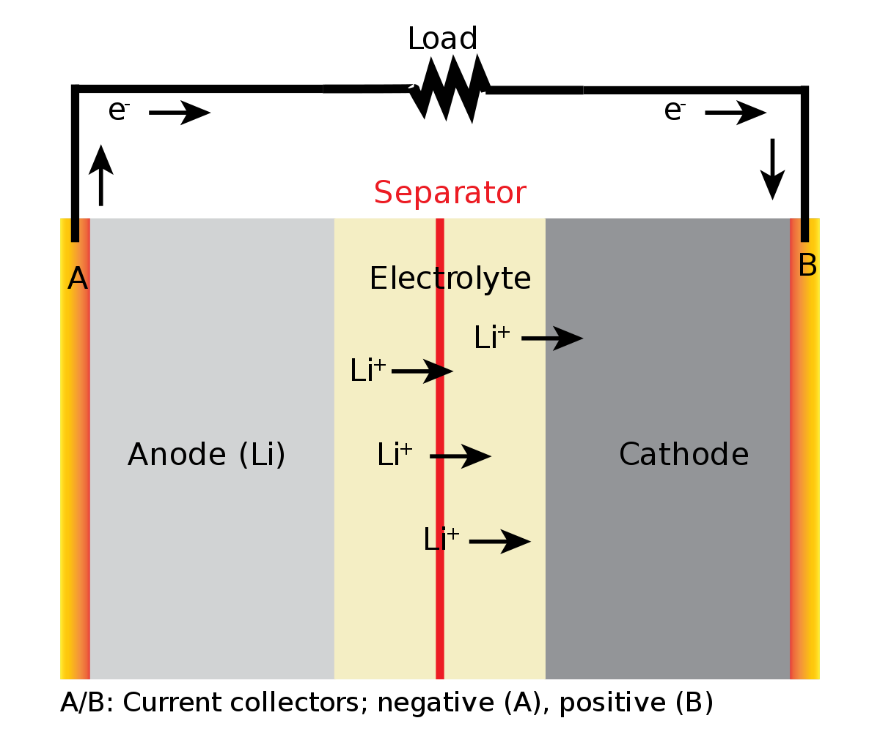

OK, so, batteries comprise three things: a cathode, an anode, and an electrolyte. Batteries work by promoting the flow of ions between the cathode and anode through the electrolyte:

Conventional lithium-ion batteries are built on liquid battery chemistry. That is, they comprise a solid cathode and anode, with a liquid electrolyte solution connecting the two.

These batteries have worked wonders for years. But, due to the physical constraints of dealing with a liquid electrolyte, they are now reaching their limit in terms of energy cell density. Which basically means that if we want our phones, watches, and electric cars to last longer and charge faster, we need a fundamentally different battery.

Insert the solid-state battery.

With solid-state batteries, the name pretty much says it all. Take the liquid electrolyte solution in conventional batteries. Compress it into a solid. Create a small, hyper-compact solid battery that – because it has zero wasted space – lasts far longer and charges far faster.

Of course, the implications of solid-state battery chemistry are huge.

Solid-state batteries could be the key to making our phones sustain power for days… enabling our smartwatches to fully charge in seconds… and, yes, allowing electric cars to drive for thousands of miles without needing to recharge.

That’s why solid-state batteries are dubbed by insiders as “forever batteries ” -- and it is why these forever batteries are the holy grail of the Battery Gold Rush.

Competitive advantages in the 2020s will be gained by companies using the best batteries. The better the battery, the better the performance of an electric vehicle, phone, energy storage system, and more.

Therefore, there won’t be any rush for old-school batteries built on old tech. But there will be an unprecedented mad dash for these solid-state batteries.

Said differently, the Battery Gold Rush of the 2020s will be focused on solid-state batteries. |

Tidak ada komentar:

Posting Komentar