| I love investing in smaller companies.

As I wrote last week, smaller stocks tend to outperform larger stocks over time. And the effects are even more powerful when combined with the other five primary factors that drive my Stock Power Ratings system: momentum, volatility, growth, value and quality.

But I also know that markets often follow cycles. Certain sectors of the market do better or worse depending on how the economy is doing and what’s happening at the macro level.

This year has not been kind to small-cap stocks thus far. Over the past 12 months, the S&P 500 is down about 16%. But over the same period, the small-cap Russell 2000 is down more than 23%.

Click here to see why. Suggested Stories: Why Smaller Stocks Will Thrive Out of This Bear Market

Life Hacks From an Undiagnosed ADHD Sufferer

| This is the government’s fourth and final assault on the dollar. And as you’ll see here ... there’s a small window open to protect yourself and your family. | |

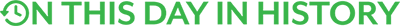

Chart of the Day Some economists have a sense of humor.

One seems to be Herb Stein. President Richard Nixon's economic adviser is also the father of funnyman Ben Stein.

Many remember him for Stein's Law, which states: "If something cannot go on forever, it will stop."

This seems silly yet profound at the same time.

At first glance, we may wonder if it even needs to be said.

Economists often extrapolate current conditions into the future.

Stein's Law is a caution against that.

It reminds economists to consider additional data to understand if a trend is supportable.

Stein's Law certainly applies to consumer spending.  (Click here to view larger image.) Suggested Stories: Pandemic Darling Stocks Face a Brutal Reckoning

REITs Are a Screaming Bargain Again — Add One to Your Shortlist

| Consumer goods prices are soaring … and you’re paying the price. But you can fight back with a class of stocks that beats back inflation, stagflation and … yes, even recessions … by giving investors exactly what they need: recurring income. I’ve uncovered five of the very best inflation-busting stocks … including a stock with a massive 14% yield that’s so consistent with its payouts, I call it my “sure thing.” | |

|

1926: And for his next trick… Harry Houdini, a notable magician and escape artist, said he could withstand a punch to the stomach at any time — anywhere. When Houdini died of an abdominal infection from a stomach injury on this day, many believed it was from a punch he did not suspect. To this day, many still debate his cause of death. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Tidak ada komentar:

Posting Komentar