REITs Deliver Inflation Friendly Income and Growth | | Sponsored Content Free Report: 5 Stocks to Protect Your Portfolio During Tumultuous Times Markets are an absolute disaster.

With Russia's invasion of Ukraine, inflationary threats, a potential recession, and likely interest rate hikes on the way, investors are terrified. Plus, with oil prices now above $110 a barrel, there are concerns pump prices could substantially curb consumer spending.

And unfortunately, no one is quite sure what comes next. Here are five ways to protect your portfolio right now.

Click Here to Download the FREE Report | | | REITs deliver inflation-friendly income and growth as price increases are reaching levels not witnessed since the 1980s.

Inflation is reflected by rising wages, commodity prices, cost of services and monetary policy tightening. The bond market is already pricing in several rate hikes by the Federal Reserve in upcoming Federal Open Market Committee (FOMC) meetings, and the war in Ukraine is pushing out expectations of easing for supply chain constraints that have kept prices of everything elevated.

The main problem with high inflation is that it is very sticky and can last for months and even years, first transitioning the economy into a period of stagflation and then running risk of falling into a recession. The Fed can raise rates, but that does little to change the supply/demand equation for the prices of oil, natural gas, wheat, corn, soybeans, beef, chicken and most other commodities beset by supply chain disruptions and strong organic demand from end markets.

Because of inflation, there has been tremendous upheaval in the stock market in the form of a rolling correction that has taken a big toll on what formerly were the hottest growth stocks in the market. There has also been heavy downside pressure on retailers, several industrials and a number of rate-sensitive stocks.

Aside from the volatile energy and commodity sectors, one area of the economy that has remained extremely consistent and reliable for investors has been real estate. Most operators of income-producing real estate have enjoyed strong year-over-year gains, as well as increasing dividend payouts. | | Program Launch: $5K to Seven Figures in Nine Months Chances are, you've never seen a system make a million dollars this fast. In fact, had you followed this system in 2021, you could've collected $1.04 million, from just a $5,000 stake. And you would've made that easy 7 figures, in only 9 months. This same system produced $1.07 million in trading gains in 2020. Once again, inside just 9 months, and starting with a mere $5,000. So if you want to see this system for yourself before it makes its 2022 run... You'd better act quickly. The 2022 program launch is nearly underway. Get all the details here (there's no charge for access). | | | REITs Deliver Inflation-Friendly Income and Growth: XLRE

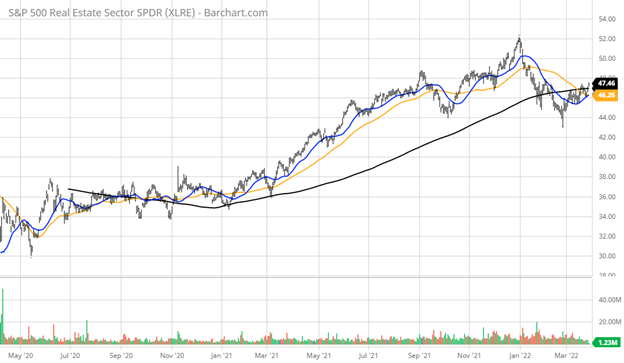

The chart of the S&P 500 Real Estate Sector SPDR ETF (XLRE) shows a steady rise in price over the past two years, interrupted briefly by the recent market correction, only to reclaim its 200-day moving average and resume its upside bias. It is a bullish technical indication for a sector that can quickly overcome market adversity and regain its relative strength, making the recent pullback an attractive entry point.

Because real estate investment trusts (REITs) come in various classes of underlying assets, it is crucial for investors to commit capital to those sub-sectors within the larger REIT space that have strong secular trends in place. Areas under stress include office properties, nursing/long-term care, shopping mall and mortgages. Those that are seeing strength are ecommerce logistics, data center, self-storage, multi-family residential, lodging and experiential entertainment now that the pandemic has diminished.

Since income investors are rotating heavily out of intermediate and long-term bonds and fixed income assets; they are turning to the equity markets for assets with stable underlying businesses that pay substantial yields that do a good job of keeping up with the rate of inflation, while also delivering some long-term capital appreciation. | | The Volatility Edition: Free Live Training In a few hours, we will reveal how VantagePoint AI successfully predicts stock trends utilizing Artificial Intelligence, and how you can accurately forecast the market and protect your capital.

Click here to register now! Seats are first come, first serve. | | | REITs Deliver Inflation-Friendly Income and Growth: Cash Machine REITs Shine

To this point, REITs become a primary target of capital flows aimed at higher yields and growth. It is why I've structured a new REIT portfolio within my Cash Machine newsletter's income advisory service. This new portfolio has five REIT holdings with dividend yields ranging between 3.5% and 6.2%. Each REIT is a leader in its respective sector.

Below is a link to obtain more information about how interested investors can get involved in this special portfolio along with the other 22 Cash Machine holdings, some with yields well in excess of 10%. It is a portfolio that is tailor-made to benefit from inflationary tailwinds, with strong exposure to energy, commodities, floating-rate assets and covered-call exchange-traded funds (ETFs) where volatility favors such strategies.

The market gets a bad rap for once-darling stocks like Meta Platforms, Inc. (NASDAQ: FB), formerly Facebook, Netflix Inc. (NASDAQ: NFLX), PayPal Holdings (NASDAQ: PYPL), Block, Inc. (NYSE: SQ), formerly Square, Shopify (NYSE: SHOP), Starbucks (NASDAQ: SBUX) and Salesforce.com (NYSE: CRM) getting crushed by 50% or more. Meanwhile, the performance of well-situated REITs has been solid.

REITs Deliver Inflation-Friendly Income and Growth: Risk-Reward Advantages

Even as the market has enjoyed a nice oversold rally from the lows, there remains a very high level of uncertainty surrounding inflation and geopolitical risks. Investing is about risk versus reward, and the right REITs offer a very compelling risk/reward equation.

To learn more about my Cash Machine investment newsletter and its REIT portfolio, I invite you to click here now. | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income

Editor, Quick Income Trader

Editor, Breakout Options Alert

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. | | | | | |

Tidak ada komentar:

Posting Komentar