The Silver & Golden Lining

To Recent Events It’s easy to feel like the world has gone crazy. Wars, economic hardship, and an impending energy crisis are only a few of our everyday worries.

But with so much going on, what’s important is protecting yourself and those closest to you…and that starts by making sure your assets can not only survive, but THRIVE during this crisis.

Even with high gas prices, it’s still possible to beat the hardships at the pump with a few smart investments.

And there’s no better way to keep your wealth secure than by cashing in on a GOLDEN opportunity that’s only going up in value.

Finally, if world events have you craving a moment of quiet with a cold beer, then we’ve got some more good news: that drink in your hand might just be your next big investment!

Before we get into this discussion, I want to preface our conversation with this: what you’re about to hear may sound negative at first, and to a certain extent, it definitely is.

However, as bad as things may seem, the bottom line is this: there is always an opportunity for investors to protect their wealth from global hardship. We have options.

So while much of the world may hear what I’m about as “negative,” as investors, it’s always important to keep in mind that every dark cloud has a silver lining.

Now, here’s the bottom line, and I’m going to be blunt: don’t expect gas prices to come down anytime soon.

Now, I realize that’s a hard pill to swallow, but it’s an important one because the sooner we accept that truth, the sooner we can start moving on to the good stuff.

But it’s a fact.

The US doesn't have many options to bring down gas prices at the moment. No Real Relief At The Pumps While things were bad before, the war in Ukraine just threw a big ol’ monkey wrench into the machine–and where things were bad with gas before, they’re about to get worse.

Russian President Vladimir Putin chose this war, and President Joe Biden has been forced to take action. So far, the actions that he’s taken are in the form of economic sanctions.

The sanctions target Russian banks, individual oligarchs, and the country’s tech sector, but the US has yet to impose restrictions on oil supplies from the aggressor for one reason and one reason ONLY.

Russia is the world's third-largest oil producer, and the Biden administration is worried that stemming oil and gas flow now with inflation soaring and crude costs surging would only exacerbate the situation.

This is very telling about the state of the world’s oil supply.

According to one analyst, the lack of sanctions on Russian oil solidifies the theory that the US doesn't have "many good options" right now to combat rising gas prices.

Isaac Boltansky, BTIG Director of Policy Research, said in a recent interview, “I’m sure the White House will do everything it can… but I’m just not sold on any of the options that they have really helping consumers.”

And what options are the Biden administration looking at?

Well, right now, they’ve suggested tapping into the US oil reserves (Strategic Petroleum Reserve, or SPR for short), even though it was just a few months ago that the White House released 50 million barrels of oil from said reserves in a move that had little to no impact on prices.

Boltansky isn’t convinced that this a good move, “We’re already at the lowest level of reserves in the SPR since 2002, so we’re already bumping up against constraints there, and frankly, it hasn’t had that much of an impact.”

So, where are we right now?

Well, the national average gas price in the US is $3.54 a gallon (according to AAA), which is up from $2.65 just a year ago.

And there are experts saying that it’s just the beginning, predicting that gas prices could top $4 as early as next week.

For example, long-time energy strategist Dan Dicker recently shared on Yahoo! Finance Live that he believes that gas prices could go much higher if the war in Europe drags on, saying "My guess is that you are going to see $5 a gallon at any triple-digit [oil prices] ... as soon as you get to $100. And you might get to $6.50 or $7.”

That’s troubling…but as I said, knowing this and accepting it is half the battle. Finding That Silver Lining If we have an idea that this is what’s going to happen, we can start looking at options to hedge that money lost at the pump by making some in the markets.

Resource companies could be our ticket to both surviving and THRIVING over the coming months, and it may be smart to start perusing this sector now for any hot prospects.

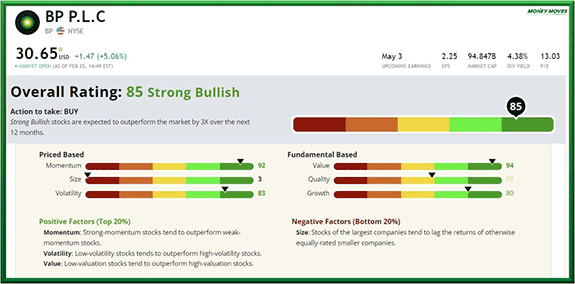

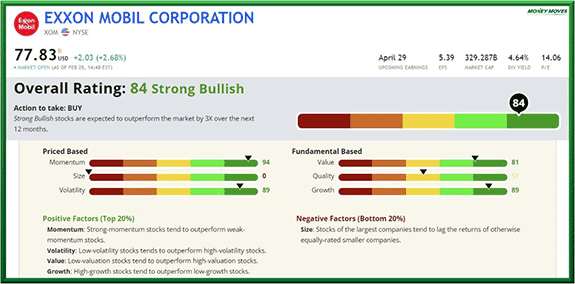

If you look across the board, oil companies surged this week. Both BP (BP) and Exxon Mobil (XOM) are trading up, and when you look at their PowerStock rating, you’ll see that things are looking good for these established oil titans.

Take a look at BP:  (Click here to view larger image.) Not bad right? I’ll take an 85 all day long.

Exxon is literally RIGHT behind them:  (Click here to view larger image.) Like I said, there may be dark clouds hanging over our heads, but there are always silver linings.

We just need to look for them.

Gas prices will be down before you know it–and hopefully, this war will be too. There’s a lot of suffering going on beyond the gas pump right now, and that’s perhaps a bigger concern.

Peace and prosperity is the goal–and I hope we get there soon.

| You make the trade on Monday… relax for 48 hours… and then close it on Wednesday. It couldn’t be any simpler. Yet the profits using Adam O’Dell’s new 2-day trading strategy are out of this world. With top-performing trades like 519% in 2 days… 440% in 2 days… 400% in 2 days…

To get the details, go here now. |

I’m not a “gold” guy.

When it comes to wearing jewelry–which I don’t wear often–I don’t like to wear gold.

In fact, I don’t own ONE piece of gold jewelry save for an earring my high-school girlfriend had engraved with the number 73, my football jersey number.

The jewelry I do own is 99.5% silver. I just like the way it looks with my skin tone better.

ALSO–and don’t judge me for this–while I don’t really believe in the existence of werewolves…you never really know! I’d rather have the ability to make some nice shiny silver ammo on the fly than be left without it.

However, while I don’t like to wear gold, I think I prefer it to the other precious metals when it comes to investing.

Why?

Because the world prefers gold, giving it a higher value than almost any other commodity out there.

Why Gold? As a commodity, the price of gold fluctuates with the economy.

In bull markets, asset-based investment commodities like oil and gold

Are rarely the best places to grow your money.

Sure, they’ll gain value here and there, and if you find the right company, you may even get paid some dividends–but for the most part, bull markets tend to shun commodities as a whole in favor of those high-growth prospective technology plays.

That being said, the opposite could be true during a bear market.

Now, it’s important to understand that we’re not in a bear market yet.

In fact, we’re only in a correction–perhaps just moving toward a correction–in the major indices. However, a bear market could be here before you know it, and after what happened with gold this week, something tells me that bear is getting ready to bite.

Yesterday, February 24th, gold prices moved higher as traders sought safe-haven plays after Russia invaded Ukraine.

Spot gold prices jumped up 2.1% to $1,970 an ounce, which is close to its one-year high, and comes alongside a major risk-averse selloff trading that seems to be going on throughout the global markets due to Russia’s aggression. By Comparison, Gold Is Killing It How badly did the markets do yesterday?

Well, the Dow Jones plunged 2% at open yesterday and Russia's main stock market tanked about 45% at the open.

Markets in Europe were also feeling the crunch, as people started worrying about the growing oil issue and what a war with Russia would do to global crude prices.

However, when it comes to gold, the precious metal has had a pretty good 2022 already, and the war in Ukraine has only added to its luster. Gold prices have grown by about 8.3% and the SPDR Gold Shares ETF is up 4.3% since early January.

This is important when you keep in mind that the S&P has recorded a LOSS of 11% over that same time frame.

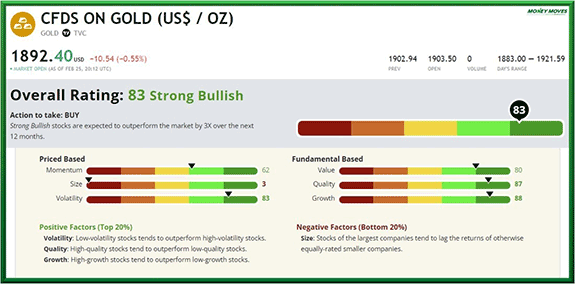

But, if you were looking for a play, you may want to start with Barrick Gold (GOLD), the shareholders of which witnessed a jump of 18% over the past month.

In fact, that’s a run that may continue, as the StockPower rating on Barrick is coming in at a healthy 83:  (Click here to view larger image.) Not too shabby, right?

However, if you look back over the history of the stock market during troubling times, you’ll learn that this is a trend that happens all the time.

Barrick Gold CEO Mark Bristow explained, "The last 50, 60 years gold has always been a stabilizer in a portfolio. You should have around 5% of your portfolio in some sort of gold package. That really helps you through difficult times.

We are entering into those difficult times.

How long we stay there is anybody’s guess, but what we know for sure is that it’s better to be prepared.

If you are stressed about this whole “Russia invading Ukraine” thing, you might want to grab a beer.

And if you’re in the mood to crack a cold one, you might consider a beer from Molson Coors. It’s been a bad week for international geopolitics, but it was a good week for Molson Coors.

The alcohol company reported their best numbers in a decade.

According to CNBC, “For the first time in more than a decade, the Miller Lite owner reported annual revenue growth. Net sales rose 6.5% to $10.28 billion in 2021, a dramatic turnaround from 2020 when net sales declined 8.7% as pandemic restrictions weighed on demand…

For the fourth quarter, Molson Coors’ net sales grew 14.2% to $2.62 billion, beating Refinitiv estimates of $2.55 billion. But its quarterly profits were under pressure as freight and commodity costs ticked higher. The company reported adjusted earnings per share of 81 cents, falling short of Wall Street’s estimates of 86 cents per share.”

Molson Coors’ results are especially impressive considering beer is losing popularity in the country. Spirits are the fastest-growing segment of the alcohol industry.

Since the 1600s, when the first brewery was built in America, beer has been the predominant alcoholic beverage of choice.

However, those days appear to be coming to an end.

Liquor is quickly catching up to beer and is within striking distance of overtaking it for largest market share in the alcohol-producing industry.

Or, as they say, “liquor gets you there quicker.” (See what I did there?)

According to the Wall Street Journal, spirits’ share of the American alcohol market increased from 28% in 1999 to 39% in 2020. Beer’s market share decreased to 44% in 2020, from 56% in 1999.

Adding insult to injury for beer, the Beer Institute estimates that drinkers choose beer just under half the time compared to 60.8% of the time in the 1990s.

American whiskey sales rose 8.2% last year, while cognac grew 21%, and tequila and mezcal combined increased 17%, according to DISCUS data.

Americans increased their alcohol consumption big time during the pandemic, and with many bars and other entertainment events closed, they had more disposable income to dedicate to higher-end spirits. Spirits costing above $40 accounted for 40% of U.S. spirits industry growth last year.

Pre-mixed cocktails and hard seltzers are becoming increasingly popular with the kiddos these days. Beer is no longer the cool drink of choice; now it’s the White Claws and Crown Royal beach teas that are in.

Younger generations are more worried about their figure these days and don’t want a Homer Simpson beer gut.

However, Molson Coors recognized these trends and has moved to produce hard seltzers and even non-alcoholic drinks. That seems to defeat the point of being a beer company…but hey, it worked for them this past quarter, so don’t fix what isn’t broken.

So, cheers to Molson Coors. Here’s to many more successful quarters to come.

For more quality content like this, and to learn more about the Money Moves team, visit us at https://moneyandmarkets.com/category/money-moves/ |

Tidak ada komentar:

Posting Komentar