Five Precious Metals Investments for Income Seekers to Buy for Profiting from Putin's Preposterous 'Peacekeeping' Ploy 02/25/2022 | | | A former telecom insider has gone live with a shocking recommendation.

This trade involves 5G, the U.S. Army, billions of dollars...

And a bizarre device that could soon be found in EVERY home across America.

If you buy just one stock in 2022, you should make it this one.

Details on this recommendation here... Click Here... | | | | Five precious metals investments for income seekers to buy feature both stock and funds that should benefit from Russia's unpredictable President Vladimir Putin's preposterous ploy of ordering the attack and invasion of its peaceful neighbor Ukraine, while insisting the aggression came from the other side despite not providing a shred of evidence.

Putin's preposterous ploy propelled the price of oil upward when he deployed 150,000-plus 0f troops along the border of Ukraine to start an unprovoked war with Ukraine on Feb. 22. Putin, who unilaterally recognized the Donetsk and Luhansk regions of Ukraine as independent countries -- in violation of international law -- blatantly lied about pulling back his forces only to launch an attack days later to challenge the United States, other Western nations and key Asian partners to follow through on their pre-invasion warnings that invading Ukraine would lead to stiff economic sanctions on Russia.

The United States, its allies and partners from the European Union, the United Kingdom, Canada, Japan, South Korea and Australia announced their first tranche of sanctions on Feb. 22 within a day of Russia's invasion that White House officials said goes well beyond measures imposed in 2014 when Russia and its surrogates seized Ukraine's Crimea region. The latest invasion of Ukraine by Putin, who seems interested in trying to recreate the former Soviet Union in one form or another, led U.S. Secretary of State Antony Blinken to call the incursion "the greatest threat to security in Europe since World War II."

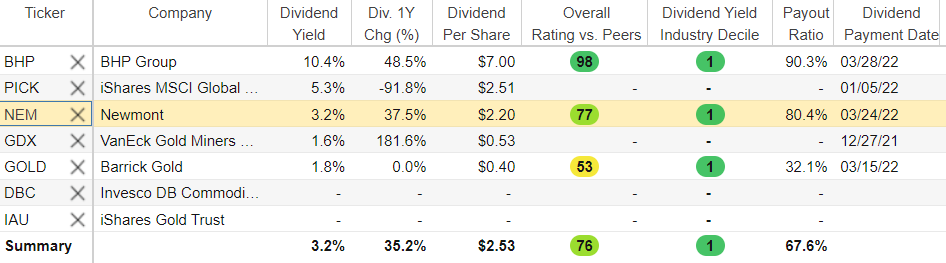

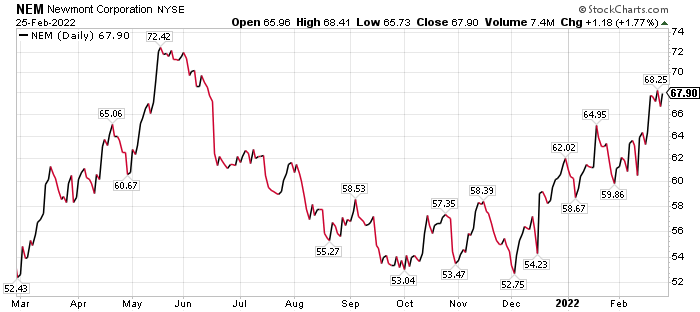

Chart generated using Stock Rover. Activate your 2-week free trial now. Chart generated using Stock Rover. Activate your 2-week free trial now.

Five Precious Metals Investments for Income Seekers to Buy for Profiting from Putin's Preposterous 'Peacekeeping' Ploy

As one of the first Western sanctions, Germany agreed that Russia's $11 billion Nord Stream 2 natural gas pipeline will not become operational. Russia's prized gas pipeline now will go to waste, squandering what would have been a cash cow for the country's financial coffers, according to the White House.

The decision will relieve Russia's "geostrategic chokehold" on Europe through its supply of natural gas, with the intent of spurring the world's energy independence from Russia. The United States and its allies also will fully block the fifth-largest Russian financial firm, V.E.B., a "glorified piggy bank for the Kremlin," from the U.S. and European financial systems, the White House announced. V.E.B. holds more than $50 billion in assets.

The United States and its allies also will fully block a $35 billion bank, Promsvyazbank, that finances the activities of the Russian military. The sanctions on V.E.B. and Promsvyazbank mean the financial institutions can no longer make any transactions with the United States or Europe, and the banks' assets in both financial systems will be frozen.

Paul Dykewicz interviews Bryan Perry, head of Cash Machine, Quick Income Trader and Premium Income.

Income lovers will appreciate the recommendation of BHP Group Limited (NYSE: BHP), of Melbourne, Australia, a miner of copper, iron ore, coal, nickel and other commodities. The company has consistently delivered high cash returns, with more than $22 billion of total announced returns to shareholders during the last 18 months, as of year-end December 2021. Income investors also might be enticed by the company's 10.4% dividend yield.

BHP Group's profit from operations of $14.8 billion during the half year ended 2021 showed a 50% jump from the same period the year before. Underlying earnings before interest, taxes, depreciation and amortization (EBITDA) of $18.5 billion featured a margin of 64% for continuing operations. Management credited disciplined cost performance, with the exception of Queensland Coal, which incurred increased expenses to reflect lower expected volumes for the full year due to significant wet weather and labor constraints.

The outlook appears bright in light of net operating cash flow of $11.5 billion and free cash flow of $8.5 billion for continuing operations, reflecting higher realized prices across major commodities and reliable operational performance. Investors also have been showing a willingness to bid up the company's share price since hitting a 52-week low in November 2021.

Chart courtesy of www.stockcharts.com

Gold Shines Among Five Precious Metals Investments for Income Seekers to Buy

The five precious metals investments for income seekers to purchase for profiting from Putin's power play provide potent protection from the market's recent pullback. For example, gold is a traditional hedge against inflation and geopolitical conflict.

Russia's attack of Ukraine conflict is the latest reason to take positions in investments that pension fund chairman Bob Carlson has been recommending for other reasons. He likes gold, commodities in general, and energy commodities. An invasion by Russia would add to tailwinds for the prices of all these investments, he told me.

"Gold normally rises in times of international uncertainty and turmoil," said Carlson, who leads the Retirement Watch investment newsletter. "It also usually rises when inflation is rising globally. Gold's been on a strong run since late January, and I expect that to continue."

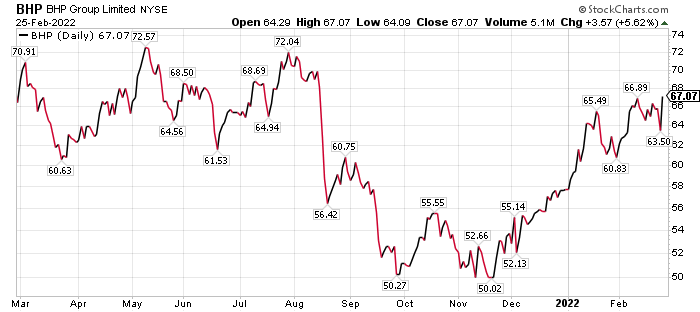

PICK is One of Five Precious Metals Investments for Income Seekers to Buy

A good choice is iShares MSCI Global Metals and Mining Producers (PICK), Carlson said. The fund tracks an index of the leading global mining companies that benefit as prices of commodities rise. The fund is up 5.53% in the last four weeks and 8.80% for the year to date.

Chart courtesy of www.stockcharts.com

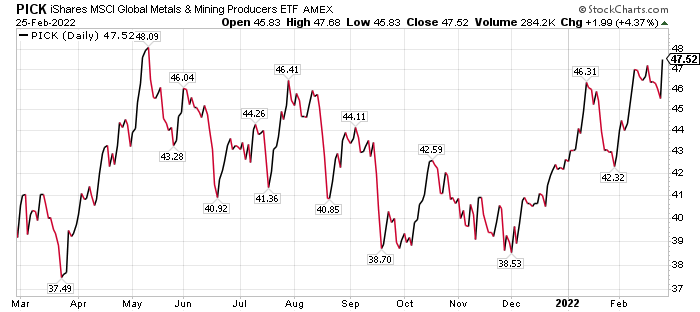

Newmont Is Among Five Precious Metals Investments for Income Seekers to Buy

Jon Johnson, an options expert who heads the Investment House, Success Trading Group and Technical Traders Alert advisory services, sees now as a time to take some profits in oil investments and buy gold.

Johnson said his indicators point to gold and his preferred pick at this time is Newmont Corporation (NYSE: NEM), of Greenwood Village, Colorado. The gold mining company is breaking upward and could "easily run" to $75 per share, up from its $67.17 close on Feb. 22. Its growth drivers include inflation and geopolitical unrest, he added.

Chart courtesy of www.stockcharts.com

"One thing I always tell people, and they just don't listen is… take some of the profits made from trades and buy hard assets such as gold and silver," Johnson advised.

"Maybe Putin wants to reconstitute, to some degree, the former Soviet Union, but what is gained by lighting up the nuclear candles over Ukraine?" Johnson asked rhetorically.

"Putin says he will do it, and after reading about him and his beliefs about what is Russian homeland, etc., I think he would not discount it if things did not go Russia's way in any conflict," Johnson said.

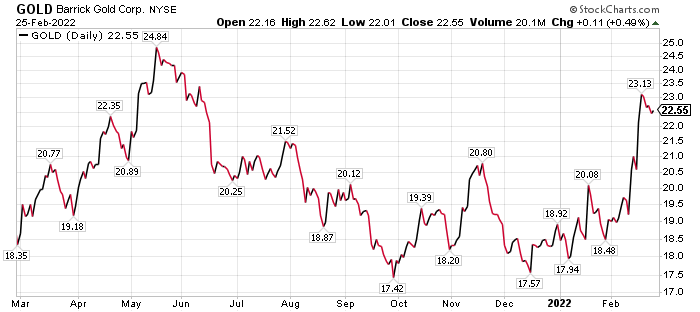

Barrick Gold Shines as One of Five Precious Metals Investments for Income Seekers to Buy

Mark Skousen, PhD, recommended Toronto-based Barrick Gold (NYSE: GOLD) in his Home Run Trader advisory services, and the stock has rallied 24% this month. The company has gold mines in Argentina, Canada, Cote d'Ivoire, the Democratic Republic of Congo, the Dominican Republic, Mali, Tanzania and the United States, while it operates copper mines in Zambia, Chile and Saudi Arabia.

Not only do geopolitical tensions and rising inflation account for the surge, but so does Barrick Gold topping Wall Street estimates when it recently reported fourth-quarter earnings, Skousen wrote to his subscribers. The company managed to do that even though its costs were at the higher end of its guidance and capital spending increased.

In fact, Barrick Gold ended 2021 net cash positive, despite paying a record $1.4 billion in dividends to its shareholders. The company also buoyed the value of its stock price by announcing a share buyback program.

Mark Skousen, a descendent of Ben Franklin, leads the Home Run Trader, Five Star Trader, TNT Trader and the Fast Money Alert advisory services, meets Paul Dykewicz. | | | Imagine being able to outperform the market by 6X every single year.

Now imagine accomplishing that, without spending a lick of time studying charts, or doing any kind of stock market analysis.

Sounds like a pipe dream, right?

Yet, hundreds of investors have been using a little-known strategy to collect annual stock market gains of 63% over the last 3 years – without doing any real work…

And you can, too.

Click here to discover how. Click Here... | | | | Stock Buyback Program Lifts Value of Barrick Gold Shares

Stock buyback programs can be good for shareholders. When earnings are divided by fewer shares of stock through repurchase arrangements of companies like Barrick Gold, the earnings per share (EPS) climb. EPS is the "primary driver" of stock prices, said Skousen, who also heads the Forecasts & Strategies investment newsletter.

"Of course, higher inflation and escalating tensions between Russia and Ukraine have also boosted gold prices to their highest levels since June," Skousen said. "Gold is up in 12 of the last 15 sessions, and it appears poised for a further breakout."

Chart courtesy of www.stockcharts.com

Woods Offers Pick to Wow With Fund That Boosted Dividend Payment by 181.6% in Past Year

Jim Woods, who has a track record for picking profitable stocks, funds and options, wrote to his Intelligence Report newsletter readers that Russia's aggression against Ukraine is a key reason why stocks have been under pressure lately. Investors must navigate how to protect their money when Putin seems intent wage war, despite both Russia and Ukraine incurred hundreds of deaths just days since Putin ordered the invasion of the neighboring nation.

Woods, who also heads the Successful Investing newsletter, as well as the Bullseye Stock Trader and High Velocity Options advisory services, wrote about Putin backing separatists in the Ukrainian territory of Donbas, specifically in the Donetsk and Luhansk regions. Those areas of Ukraine are coveted by Putin-led Russia, which is invading its neighbor to seize control of land militarily.

It is reminiscent of 2014, when Russia invaded Ukraine to annex Crimea, a region that, similar to Donbas, was populated by many Russians. In a return to the old Soviet playbook, Russia is making new unsubstantiated claims to wage a propaganda campaign against Ukraine.

With Russian leaders reportedly lying about Ukrainians shelling Russian separatists without provocation, certain analysts predicted that Russian leaders were seeking to dupe the rest of the world to rationalize Putin invading Donbas and annexing the territory, similar to what happened in Crimea in 2014. As occurred in the 2014 invasion and takeover of Crimea, an attack against the Donbas region by Putin-empowered forces would result in significant international sanctions against Russia.

Any near-term gain may be followed by other nations in the region solidifying their budding relationships with the North American Treaty Organization (NATO) to defend their territory against future potential invasions by Russian or surrogate forces that Putin may direct. While the Russia-Ukraine conflict pulled down the S&P 500 Index during the first week of fighting before the market rose on Friday, Feb. 25, as Ukrainian men showed spirited resolve to keep fighting despite overwhelming numbers of troops and firepower on the Russian side. Russian forces found resistance while trying to control Ukraine's capital of Kyiv through the the land and air, while Ukrainian soldiers and civilians fought to retain their country's freedom. Ukraine's President Volodymyr Zelenskyy vowed in televised remarks not to surrender.

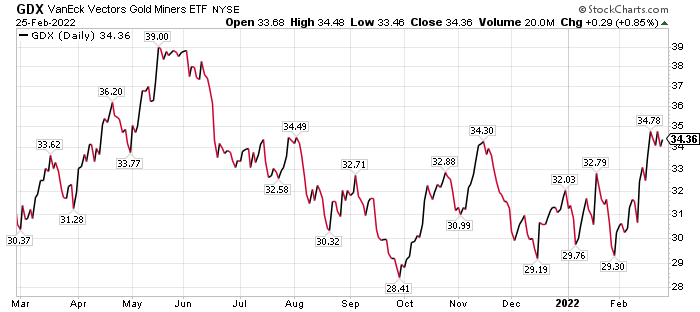

Gold has been glittering in the last week as investors move into the safety of what traditionally is the greatest store of value in the market, Woods said. Given the trend higher in gold so far this year, Woods is recommending VanEck Gold Miners ETF (GDX) in the Tactical Trends Portfolio (TTP) of his Intelligence Report newsletter.

GDX holds the biggest and arguably best gold and precious metals mining stocks. The fund has been breaking out to new highs.

Chart courtesy of www.stockcharts.com

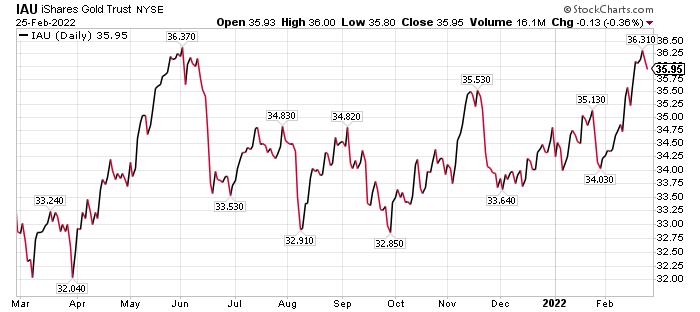

Non-Dividend IAU Offers an Alternative to Income-paying Precious Metals Investments

For investors who are willing to consider non-dividend-paying precious metals investments, Carlson recommends a gold exchange-traded fund (ETF), iShares Gold Trust (IAU). It is up 3.50% in the last four weeks and 3.59% for the year to date.

Chart courtesy of www.stockcharts.com

Demand for most commodities has exceeded supply since at least early 2021, Carlson counseled. That's going to continue, he added.

"Many producers reduced production during the early days of the pandemic, and it takes a while to turn that around and ramp up production," Carlson said. "At the same time, demand increased. So, for demand and supply to balance, the producers have to increase production above pre-COVID levels."

Pension fund and Retirement Watch chief Bob Carlson answers questions from columnist Paul Dykewicz. | | | In a few hours, we will reveal how Vantagepoint AI successfully predicts stock trends utilizing Artificial Intelligence, and how you can accurately forecast the market and protect your capital.

Click here to register now! Seats are first come, first serve. Click Here... | | | | BDC Is Another Alternative to Five Precious Metals Investments for Income Seekers to Buy

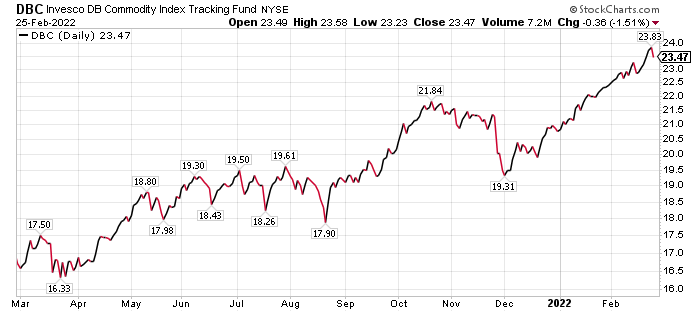

For investors willing to forgo a dividend, Carlson also recommends an ETF that invests broadly in commodities, such as Invesco DB Commodity Tracking (DBC).

"The fund is up 5.32% in the last month and 11.55% for the year to date. It issues K-1 forms, so it could complicate your tax reporting if you're holding it at the end of the year," Carlson said.

Chart courtesy of www.stockcharts.com

Omicron Variant of COVID-19 Drives U.S. Cases and Spur Concerns of MIS-C

The Omicron COVID-19 variant sickened a record number of U.S. children in January, causing children's hospitals in the United States to monitor for a rare but dangerous condition called multisystem inflammatory syndrome, also known as MIS-C. An average of more than 750,000 new coronavirus infections were reported every day over the past week, according to data from Johns Hopkins University.

The Centers for Disease Control and Prevention (CDC) reported that the variants still are spurring people to obtain COVID-19 boosters. But more than 60 million people in the United States remain eligible to be vaccinated but have not done so, said Dr. Anthony Fauci, the chief White House medical adviser on COVID-19.

As of Feb. 25, 253,232,298 people, or 76.3% of the U.S. population, have received at least one dose of a COVID-19 vaccine, the CDC reported. Those who are fully vaccinated total 215,318,037, or 64.9% of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Feb 25, topped the 5.9 million mark to hit 5,907,714, according to Johns Hopkins University. Worldwide COVID-19 cases have zoomed past 427 million, reaching 427,927,602 on that date.

U.S. COVID-19 cases, as of Feb. 25, soared beyond 78.6 million, totaling 78,649,528 and causing 939,201 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five precious metals investments for income seekers to buy offer investors a chance to produce positive returns even when the market overall is trading down or sideways. With inflation and the Russia-Ukraine conflict escalating, the trend should help precious metals investors, even if the key reason behind the strategy is a war that is worsening fast as Russian forces intensify their attacks against the Ukrainians trying to defend their homeland and freedom. | | | Sincerely,

Paul Dykewicz, Editor

DividendInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar