Three Strategic Defense Stocks to Buy as China and Russia Try to Expand Their Turf 11/30/2021 | | | Morgan Stanley's Chief Investment Officer recently said a plunge of more than 20% in US stocks is looking more like a real possibility. He's pointing toward weaker growth and falling consumer confidence as the likely culprits. But he's got the "real villain" all wrong. The true cause of the next crash? The Federal Reserve. And if you don't know what this "Fed dilemma" is - or what's causing it...the next crash is going to hurt (a lot). Don't be blindsided by the Fed. Click here to find out how you can avoid the surprise the Fed has in store. Click Here... | | | | Three strategic defense stocks to buy as China and Russia seek to expand their territorial claims at the expense of other nations should continue to find their products and services in demand by the U.S. government and its allies.

The three strategic defense stocks to buy feature consulting firms, contractors and cutting-edge capabilities such as artificial intelligence and cybersecurity. Those three strategic defense stocks to buy are fortified by having the U.S. government as a key customer that offers the companies dependable revenues and growth, as well as a 246-year track record of paying its bills.

Despite the emergence of a new COVID-19 variant, Omicron, the three strategic defense stocks to buy should show resiliency as the U.S. government and its allies seek to maintain military preparedness as threats mount from China, Russia, North Korea and Iran, among other countries. In recent weeks and months, China, Russia, North Korea and Iran have gained international notoriety for aggressive military actions and statements from government leaders who are raising concerns in nearby nations.

Threatening Actions Underscore Value of Three Strategic Defense Stocks to Buy

With bipartisan support, the U.S. House of Representatives passed the National Defense Authorization Act (NDAA) to boost spending to roughly $740 billion. China's defense spending is murky due to its leaders' secrecy, but the Stockholm International Peace Research Institute (SIPRI) estimates the country in 2020 accounted for 13%, or about $252 billion, of the world's $1.981 trillion in global military spending. The United States totaled 39%.

When adjusted for military purchasing power parity (PPP), China's defense spending is 55-75% of what the United States funds, wrote Ronald Epstein, a defense and aerospace analyst with BofAmerica Global Research. However, defense spending does not directly equal military power, since intangibles such as alliances, modernization of equipment, unmanned vehicles and original technologies rather than acquired intellectual property are part of it.

China's military expenditure ranks second in the world, rising 1.9% from 2019 and 76% over the decade 2011–20, according to the SIPRI. China's military spending has risen for 26 consecutive years, the longest series of uninterrupted increases by any country in the SIPRI Military Expenditure Database.

A recent dip in defense stock valuations overlooks a fundamental shift as the market has been focused on short-term budgetary concerns and COVID-19, Epstein wrote. He predicts defense stocks will do well in the next few years.

Ronald Epstein, BofA defense analyst. Image courtesy of Bank of America.

Russian Troops at Ukraine's Border May Fuel Three Strategic Defense Stocks to Buy

Ukraine's military intelligence recently reported that Russia had more than 92,000 troops massed around its borders, Ukrainian forces were preparing for an attack by the end of January or beginning of February, even though Russia's foreign intelligence chief said such reports were "malicious U.S. propaganda." However, he did not explain why nearly 100,000 Russian troops were placed along Ukraine's border.

Wall Street veteran Bryan Perry, who leads the high-yield-focused Cash Machine investment newsletter and the Premium Income, Quick Income Trader, Breakout Profits Alert and Hi-Tech Trader services, said investors have received a "double dose" of bad news in the past week. The potentially dangerous Omicron variant of COVID-19 accounted for one big risk, while Nov. 30 remarks by Fed Chairman Jerome Powell to a Senate subcommittee caused the other.

Powell told members of the subcommittee that the U.S. central bank may speed up its tapering of stimulus and raise short-term rates thereafter. All 11 sectors traded lower after his Nov. 30 remarks, with the major averages taking out Friday's lows by midday, Perry pointed out.

"Even as Powell is taking a more aggressive tone, bond yields are moving lower in a flight to safety with the dollar holding up near its 14-month high," Perry said.

Paul Dykewicz interviews Bryan Perry about investing opportunities.

Governments seem to be overreacting to the newly discovered Omicron variant of the COVID-19 as they typically do by shutting down air travel and imposing more vaccination and mask-wearing mandates, said Mark Skousen, PhD, a descendant of Benjamin Franklin and the leader of the Forecasts & Strategies investment newsletter. Skousen, who also heads the Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert advisory services, added that those actions have "spooked the bull market" on Wall Street and caused a selloff.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz in Philadelphia. Skousen's premium investment services consist of Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert.

Three Strategic Defense Stocks to Buy Include Booz Allen Hamilton

McLean, Virginia-based Booz Allen Hamilton Holding Corporation (NYSE: BAH), the parent company of management and technology consulting and engineering services firm Booz Allen Hamilton Inc., has spent more than 100 years helping military, government and business leaders solve complex problems. As a consulting firm, the company has experts in defense, analytics, digital solutions, engineering and cyber to serve as a key partner on some of the most innovative programs for governments and their most sensitive agencies.

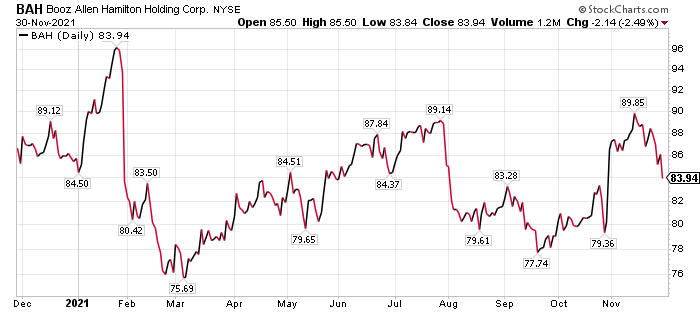

BofA's buy rating and $105 price objective on Booz Allen Hamilton is based on a 1.2x relative enterprise value (EV) / earnings before interest, taxes, depreciation and amortization (EBITDA) multiple to the investment firm's multiple for the defense prime contractors based on 2023 estimates.

"This equals a 16x EV/EBITDA multiple," according to BofA's Epstein. "We believe a premium to the defense primes factors in strong U.S. National Security demand for innovative technologies and solutions, and shareholder friendly capital deployment."

Risks to achieving the price target include cuts to the U.S. Department of Defense (DoD) budget versus what is anticipated, Epstein wrote in a recent research note. If the company hits any unexpected problems with integrating its mergers and acquisitions (M&A), containing its costs, COVID-19 or a heightened competitive environment, the performance could fall short, he added.

Chart courtesy of www.stockcharts.com

Three Strategic Defense Stocks to Buy Could Outperform Expectations

Upside beyond the price target would be possible with better-than-anticipated upturn in the federal budget, inexpensive and well-integrated M&A activity and unexpected capital returned to shareholders in the form of buybacks or special dividends, BofA continued.

The company reported second-quarter fiscal 2022 results, for the period ended Sept. 30, showing revenue growth of 4.3% and a 3.6% quarterly increase in revenue, excluding billable expenses. Its net income jumped by 13.8% to $154.8 million, while adjusted net income climbed by 18.6% to $170.2 million.

On September 13, 2021, the company announced it had completed its acquisition of Tracepoint, a digital forensics and incident response company, after making an initial strategic investment in December 2020. The transaction aligns with Booz, Allen Hamilton's broader capital deployment strategy to accelerate advancement in critical technology areas such as cybersecurity.

"Our strong second-quarter performance creates momentum that will allow us to accelerate through the rest of this fiscal year and beyond," said Horacio Rozanski, president and chief executive officer of Booz, Allen Hamilton. "The team delivered solid revenue growth, excellent bottom-line results and strong progress on hiring that positions us for continued success."

Income investors will appreciate that the company pays a quarterly dividend of $0.37 per share. | | | One of the top investment minds of the last 40 years sat down with us for a lively Q&A talk, at one point even sharing his #1 stock:

A "Made in America" investment that grows and thrives off capitalism, and, he says, is likely the highest-performing monthly dividend stock in the markets today.

Get the whole story here! Click Here... | | | | CACI International Snags Spot Among Three Strategic Defense Stocks to Buy

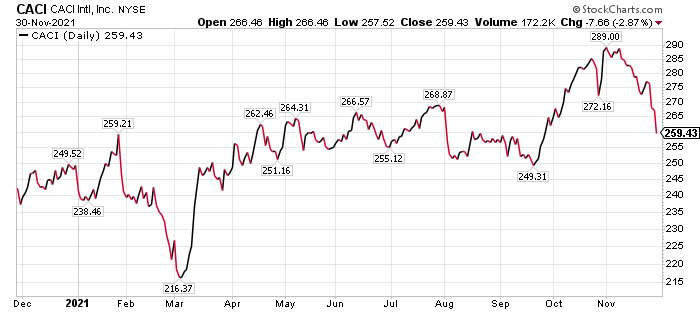

Reston, Virginia-based CACI International Inc. (NYSE: CAIC) is a defense contractor that received a $340 price objective and a buy recommendation from BofA. CACI's capital deployment strategy, including opportunistic share repurchases, offsets the discount related to its lack of dividend versus its peer group.

CACI's software-based technology strategy is showing traction, BofA wrote. However, risks include potential cuts to the DoD budget versus anticipated spending, problems finding targets to buy, integrating M&A, hiring the right personnel, containing its costs, estimating costs and executing on fixed price contracts, as well as sustaining reputational risk and future awards.

Potential to outperform stems from better-than-anticipated federal spending for innovative technologies and modernization, inexpensive and well-integrated M&A activity, unexpected capital return to shareholders in the form of dividends, market share gains in the mission technology arena and better-than-expected margin expansion, BofA wrote.

Chart courtesy of www.stockcharts.com

Contract Wins Aid CACI as One of Three Strategic Defense Stocks to Buy

CACI International announced on Nov. 9 that it won a new five-year single-award task order worth potentially $785 million for Special Operations Forces Emerging Threats, Operations, and Planning Support (SOFETOPS). The company will provide expertise in integrated information warfare (IW) and electronic warfare (EW) solutions, training, readiness, and modernization to advance U.S. Army Special Operations Command (USASOC) missions.

John Mengucci, CACI president and CEO, said, "CACI's mission expertise in operational support, intelligence analysis, technology integration, and training will help Special Operations Forces adapt to the current and future threat environment. Our experts will leverage advanced solutions for our mission partners and deliver training models based on first-hand experiences to prepare trainees with realistic scenarios."

CACI reported on Oct. 26 that it received a prime position in a technical services support (TSS) contract to serve the U.S. Deputy Chief of Naval Operations. The contract is a six-year, multiple-award, indefinite delivery and indefinite quantity pact.

Terms call for CACI to provide enterprise expertise to ensure sailor readiness and help implement a broad transformation of the MyNavy HR information system. CACI will also support MyNavy HR's enterprise technology architecture, portfolio management, data management, business process reengineering, government operations, and operational performance to meet evolving needs.

Acquisitions Help Three Strategic Defense Stocks to Buy

On the acquisition front, CACI announced it entered into an agreement on Nov. 3 to acquire Los Gatos, California-based SA Photonics, Inc., a developer and implementer of innovative multi-domain photonics technologies for free space optical (FSO) communications. The $275 million acquisition of SA Photonics will broaden CACI's capabilities as the leading U.S.-based FSO laser communications provider supporting space, airborne, and terrestrial missions to U.S. government and commercial customers.

SA Photonics' IP technology offers low size, weight, power and cost (SWAP-C) solutions that transmit data 25 times faster than current radio frequency systems, while using payloads that are half the size. Plus, SA Photonics' high-volume low-earth-orbit (LEO) optical inter satellite links (OISL) technology complements CACI's FSO technology optimized for medium-earth-orbit (MEO) and geosynchronous-equatorial-orbit (GEO) orbits. CACI's photonics-based capabilities enable terrestrial communications at higher-bandwidths and with a lower probability of detection.

CACI expects to close the transaction by the end of 2021, pending customary regulatory reviews.

With expertise in joint and coalition interoperability, as well as advanced technologies for command and control, signals intelligence, cyberspace and space-based communications, CACI also is helping to develop and deploy Joint All-Domain Command and Control (JADC2). Across the Department of Defense, CACI is seeking to usher in JADC2 as a vital component of 21st century national security.

List of Three Strategic Defense Stocks to Buy Adds Leidos Holdings

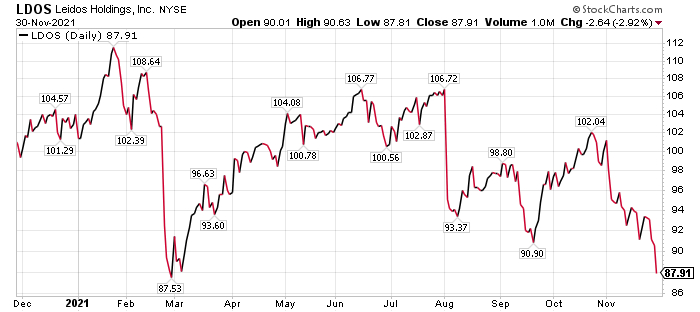

Leidos Holdings Inc. (NYSE: LDOS), of Reston, Virginia, is a spin-off of Bethesda, Maryland-based Lockheed Martin (NYSE: LMT). The global defense company previously separated out its Information Systems and Global Solutions (IS&GS) segment and folded it into the Leidos security solutions business.

The move, touted as a tax-efficient strategy, led to a one-time cash payment of $1.8 billion to Lockheed Martin to share with its stockholders. Lockheed Martin stockholders acquire 50.5% equity in Leidos, with 77 million shares valued at $3.2 billion.

BofA's price objective of $125 and buy recommendation of Leidos is based on the prospect that the company should trade in line with the defense prime contractors amid strong U.S. National Security demand for innovative technologies and solutions, along with solid free cash flow that is offset by a sluggish award environment and near-term supply chain pressures. There also is inflationary pricing from competitive dynamics and concerns about labor cost increases.

Risks to BofA's price target include cuts to the U.S. government budget versus expectations, increased competition from non-traditional rivals, problems integrating M&A, hiring the right personnel, containing costs, executing on fixed price contracts and sustaining future awards.

Upside to the price target feature a better-than-anticipated federal budget allocated to innovative technologies and modernization, inexpensive and well-integrated M&A activity, unexpected capital return to shareholders in the form of dividends or share buybacks, market share gains and improved margin expansion.

Chart courtesy of www.stockcharts.com | | | Do you know how to tell before the bottom drops out of the market? In this brand new, FREE, e-book, you'll learn five tips, tools, and strategies that can keep you from costly losses during dips and corrections... and save your account before a meltdown.

Get the full story by downloading Five Tips for Overcoming Market Volatility. Because not only will these strategies let you sleep soundly at night... they will keep your money growing while they're protecting it! Click Here... | | | | Pension Chairman Chooses Favorite Defense Fund for Income Investors to Purchase

"The U.S. defense budget will increase despite the withdrawal from Afghanistan as policy shifts toward containing China and Russia," said Bob Carlson, who leads the Retirement Watch newsletter. "Defense stocks sell at solid valuation discounts to the S&P 500, despite having higher estimated earnings growth than the S&P 500."

Retirement Watch chief Bob Carlson talks to Paul Dykewicz.

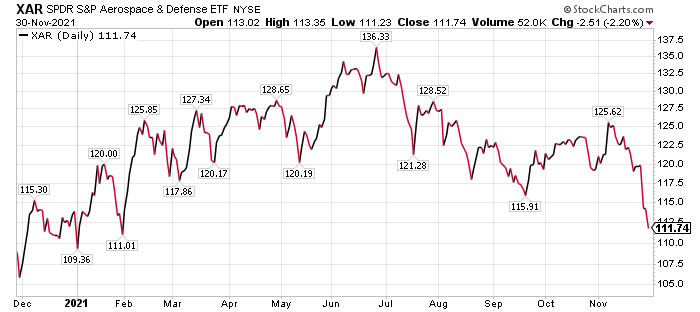

Carlson, who also serves as chairman of the Board of Trustees of Virginia's Fairfax County Employees' Retirement System with more than $4 billion in assets, said that his favorite defense fund right now is SPDR S&P Aerospace and Defense (XAR). The fund focuses on small- to mid-size companies. Top holdings recently were Heico (4.88% of the fund), Spirit AeroSystems (4.57%), Textron (4.55%), Hexcel (4.43%), and TransDigm (4.40%).

The ETF recently held 32 positions and had 44% of the fund in the 10 largest positions. It is up 4.98% so far this year and 15.78% over 12 months.

Chart courtesy of www.stockcharts.com

COVID-19 Risk Rises as Cases and Deaths Jump in Certain States

The highly transmissible Delta variant of COVID-19 has been joined by the Omicron variant to increase the risk for the United States and other regions of the world. Public health experts and government leaders still are urging increased vaccinations and booster shots, as well as stepped-up mask wearing.

The Centers for Disease Control and Prevention (CDC) has documented that the variants are leading to a rise in the number of people vaccinated from COVID-19. However, roughly 62 million people in the United States remain eligible to be vaccinated but have not seized the opportunity, said Dr. Anthony Fauci, a White House medical adviser.

As of Nov. 30, 233,207,582 people, or 70.2% of the U.S. population, have received at least a single dose of a COVID-19 vaccine, the CDC reported. The fully vaccinated total 197,058,988 people, or 59.4%, of the U.S. population, according to the CDC.

COVID-19 deaths worldwide, as of Nov. 30, topped the 5 million mark, soaring to 5,214,928, according to Johns Hopkins University. Worldwide COVID-19 cases have jumped past 260 million, reaching 262,753,012 on that date.

U.S. COVID-19 cases, as of Nov. 30, soared to 48,554,890 and caused 780,140 deaths. America has the dubious distinction as the country with the most COVID-19 cases and deaths.

The three strategic defense stocks to buy as China and Russia act aggressively could rise more than expected if the leaders of these countries continue their threats in the coming weeks and months. | | | Sincerely,

Paul Dykewicz, Editor

StockInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar