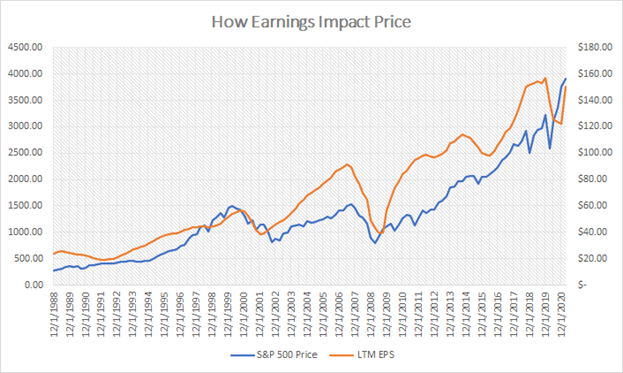

The Best Stock to Buy Amid the Market's Taper Tantrum  | | Luke Lango | When Treasury yields surge – as they're doing right now – innovation stocks fall. It's a simple relationship that has remained true throughout 2021. But guess what? Treasury yields don't paint the full picture here. They are a driver of long-term stock prices – but not the biggest driver. Instead, that title is reserved for earnings. Take a look at this chart. The correlation between the orange line (earnings) and blue line (stock prices) is unmistakably strong. Indeed, from a numbers perspective, that correlation clocks in at a whopping 0.95 – that's about as strong of a correlation as you'll find in the financial markets.

The point? Earnings are the biggest driver of long-term stock prices, not yields. So… what is the current earnings outlook for innovation stocks? Well, it's improving, thanks to increasing momentum in the clean energy, automation, blockchain, artificial intelligence, gene editing, space, and metaverse megatrends. So, in our flagship investment research product Innovation Investor – where we invest in the world's most innovative companies for huge multi-year returns – we're utilizing the current sell-off in innovation stocks as an opportunity to buy tomorrow's biggest winners at today's biggest discounts. Specifically, we've identified one freshly public, hypergrowth company that we think could be a huge winner. And we're going to add that stock into our portfolio after the markets close today. This is a company that is headed by a bunch of former executives from Amazon, Twitter, and Microsoft. Its engineering team includes dozens of Stanford, Caltech, MIT, and Harvard grads. Its revenues grew by nearly 200% last quarter. Its solutions solve a huge point in a multi-trillion-dollar market, are being quickly adopted by customers in that market, and have been very positively reviewed by those customers. Its biggest shareholder just upped its stake by more than $50 million. Its CEO recently bought more than $5 million worth of stock, too. The business model is hyperscalable. The balance sheet is loaded with cash. And the average price target on the stock, per Wall Street analysts, is nearly double the current price. Folks… we're big believers in this stock… it's a winner. And we couldn't be more excited to add this stock to our portfolio today, after the markets close, along with our October issue of Innovation Investor. The countdown is on. Click here to sign up for Innovation Investor today to find out the name, ticker symbol, and key business details of this hypergrowth disruptor this afternoon. Sincerely,

Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. |

Tidak ada komentar:

Posting Komentar