Five Mid-sized Bank Stocks to Purchase for Dividend Income and Share-Price Appreciation 10/29/2021 | | | Inflation Set to Turn Global Debt Crisis Into US Death Spiral... The Fed's spending has shot "transitory" inflation up to 5.4% (14% if we use real metrics). It's created a debt crisis that could signal the death of the US Dollar... But 2x national bestselling financial author Adam Baratta predicted the fallout, and what investors can do to cash in on it. For a limited time, get his proprietary analysis for free and protect your portfolio from this inflation bomb.

Protect your portfolio before it's too late Click Here... | | | | Five mid-sized bank stocks to purchase offer dividend income and inflation protection while serving market niches that bigger and broader-based financial institutions may not be able to address as well.

The five mid-sized bank stocks to purchase for dividend income and share-price appreciation also are part of an industry that typically copes well with inflation. Plus, the five mid-sized bank stocks to purchase should benefit from growing customer interest in mortgages that may be stronger vs. pre-pandemic years due to increased demand for home purchases, according to a recent report from BofA Global Research.

BofA has observed improved momentum for banks in recent quarters. Current conditions include banks paying next to nothing for deposits while raising the rates they charge to borrowers.

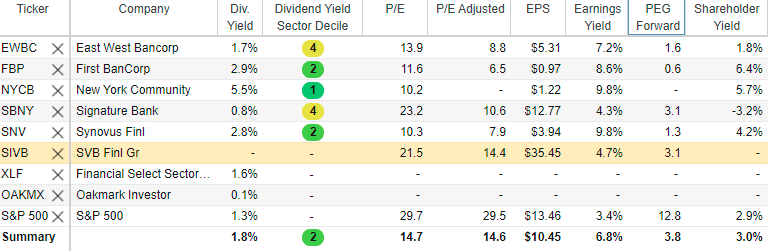

Source: Stock Rover. Click here to sign up for a free two-week trial.

Seasoned Stock Picker Sees Strength in Banking

"This is an ideal environment for banks," said Mark Skousen, chief of the Forecasts & Strategies newsletter and the Home Run Trader, Five Star Trader, Fast Money Alert and TNT Trader advisory services. The economy is strong. Unemployment is falling. Interest rates are rising. The demand for loans is strong. And asset quality is improving. Even used car prices are up 34% over the past year."

Mark Skousen, PhD, leader of Forecasts & Strategies, meets with Paul Dykewicz.

Five Mid-sized Bank Stocks to Purchase Affected by Asset Mix and Fee Income

BofA is assuming that cash as a percentage of average earnings assets (AEA) reverts to pre-pandemic levels, either deployed into investment securities or toward funding loan growth. Cash balances for its coverage universe stood at 13% of AEA as of second-quarter 2021 vs. 4%/6% in 4Q19/1Q20.

Of course, loan growth will be affected by multiple external factors, such as an expected rebound in inventories amid supply chain normalization, drawdown of the $2 trillion in excess liquidity sitting on consumer balance sheets and growing confidence among businesses to drive capital expenditure spending. Woods told me his favorite way to invest in banks right now is through the Financial Select Sector SPDR Fund (NYSE: XLF). That fund has blitzed the SPDR S&P 500 ETF (SPY) so far in 2021. While SPY is up 23.8% year to date, XLF has leapt 38.9%. That move is likely to be sustained not only due to fundamental reasons, but also for technical ones, said Woods, who forecast that the upside in XLF during the months ahead could be "substantial."

Chart courtesy of www.stockcharts.com

Upbeat earnings results for financial stocks, along with rising interest rates and strong growth in what is nearly a post-pandemic economy, has triggered a jump in banking stocks.

Paul Dykewicz meets with Wall Street veteran Jim Woods, editor of Intelligence Report.

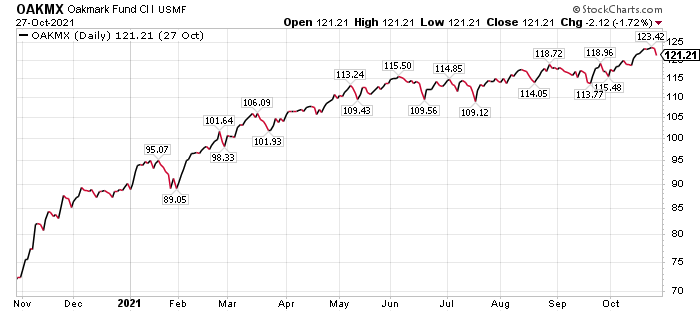

Oakmark is a Banking-Heavy Fund But Its Tiny Dividend Yield Pales Compared to Five Mid-Sized Bank Stocks to Purchase

Bank stocks account for a significant portion of what pension fund chairman Bob Carlson called his "favorite value stock" investment. Carlson, who writes the Retirement Watch investment newsletter and serves as chairman of the Board of Trustees of Virginia's Fairfax County Employees' Retirement System with more than $4 billion in assets, said the Oakmark (MUTF: OAKMX) fund uses valuation measures to assess companies in an array of industries that include financial services providers.

Retirement Watch chief Bob Carlson answers questions from Paul Dykewicz.

Financial services account for 33.9% of Oakmark's portfolio, with New York-based Citigroup Inc. (NYSE: C) as its fourth-largest position. McLean, Virginia-based Capital One Financial Corp. (NYSE: COF) is the fund's second-largest holding. Capital One Financial, known mainly for its credit cards and the television commercials, also is a significant mid-Atlantic banking presence after buying a regional bank 10-plus years ago, Carlson continued.

Chart courtesy of www.stockcharts.com

Investors Can Choose from Among Five Mid-sized Bank Stocks to Purchase

When interest rates climb, large-cap banks usually increase the spreads they earn between what they pay for deposits and what they collect by charging higher interest rates to borrowers. However, a problem can arise if banks keep too many fixed-rate loans that can lose their appeal if interest rates rocket upward.

BofA's recent research report predicted that the deposits that banks have collected from borrowers since the start of the pandemic should be retained. Even though the deposit mix-shift is likely to move toward interest-bearing deposits, banks clearly have more leeway to lag deposit pricing compared to 2015-18, the report noted. Deposit balances for the industry grew in the middle part of the last decade after the Fed began tapering its post-financial crisis quantitative easing.

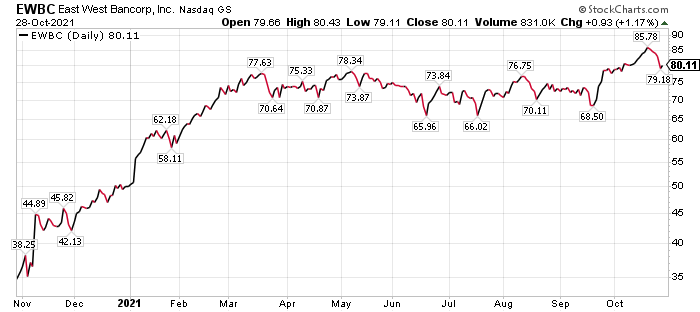

East West Bancorp Is One Of the Five Mid-sized Bank Stocks to Purchase for Dividend Income

East West Bancorp, Incorporated (NASDAQ: EWBC), of Pasadena, California, has more than 120 locations in the United States and China. The company's American branches operate in California, Georgia, Massachusetts, Nevada, New York, Texas and Washington. East West Bancorp's presence includes full-service branches in Hong Kong, Shanghai, Shantou and Shenzhen, as well as offices in Beijing, Chongqing, Guangzhou and Xiamen.

The bank holding company offers the "most attractive risk/reward" among the mid-sized banks at 13.4x price-to-earnings (P/E), in-line with its peers, according to BofA. East West Bancorp has been growing its core deposit base in recent quarters and its management has raised its loan growth outlook.

Any "thawing" of current U.S.-China tensions from a possible meeting before year-end between leaders of the two countries may help improve market perception, BofA wrote. Aside from deteriorating U.S.-China relations amid the latter country's threats of military action, additional risks to the bank's prospects include a potential worsening in the macroeconomic outlook and a possible decline in interest rates.

East West Bancorp received a $100 price objective from BofA, with a P/E multiple of 17.5, ranking above its peers due to a higher return profile. The bank could benefit from a faster-than-expected economic recovery, along with higher interest rates, BofA added.

Chart courtesy of www.stockcharts.com

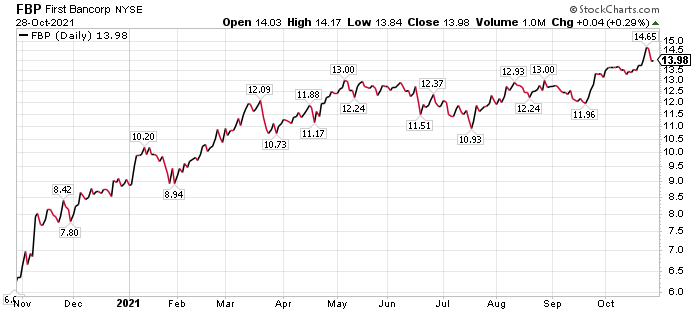

First Bancorp Puerto Rico Earns Spot in Five Mid-sized Bank Stocks to Purchase for Dividend Seekers

First Bancorp Puerto Rico (NYSE: FBP) shares outperformed peers after the company reported 3Q21 core earnings per share of 37 cents, excluding 1-cent in merger charges, beating BofA's more conservative estimates. The 3 cents a share "beat" of BofA's estimate partly due to lower credit costs and reduced expenses, offset somewhat by lower net interest income.

Merger integration remains on track, with FBP's management having completed all remaining systems conversions and pivoting focus toward growing the franchise. BofA wrote. Management provided an upbeat growth outlook, highlighting increasing economic activity in Southern Florida and an improved business environment in Puerto Rico. Plus, Puerto Rico has an 81% rate of fully vaccinated people aged 12 years and up vs. almost 58% for United State.

With FBP showing strong 3Q results and its management reaffirming that its shares should continue to outperform, BofA reaffirmed its "Buy" rating and $16 price objective on the stock.

Chart courtesy of www.stockcharts.com | | | The EV market is caught in a humiliating position...

One that's led to a critical shortage industry-wide.

And you can cash in right now while GM, Volkswagen, and other big car makers rush to cover their embarrassing lack of foresight.

Find out how in this still-developing story. Click Here... | | | | Five Mid-sized Bank Stocks to Purchase for Dividend Lovers Include New York Community Bancorp

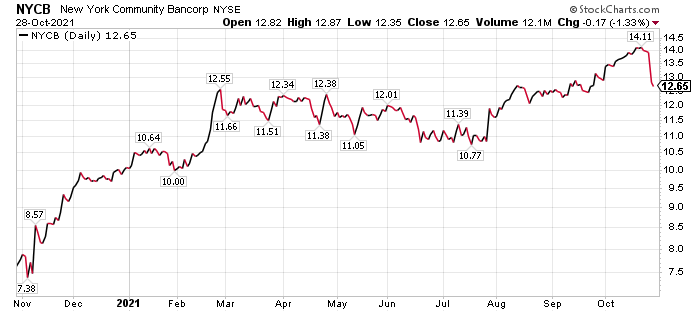

New York Community Bancorp (NYSE: NYCB), of Hicksville, New York, is the parent company of New York Community Bank, a New York State-chartered bank. BofA's price objective on NYCB of $17 is accompanied with a "Buy" rating. NYCB received a valuation above its peers due to a strong dividend yield and a healthy credit profile, according to BofA.

Upside to BofA's price objective include better-than-expected balance sheet growth and steepening of the yield curve. Risks to the price target are worse-than-expected loan growth and flattening in the U.S. Treasury yield curve.

Chart courtesy of www.stockcharts.com

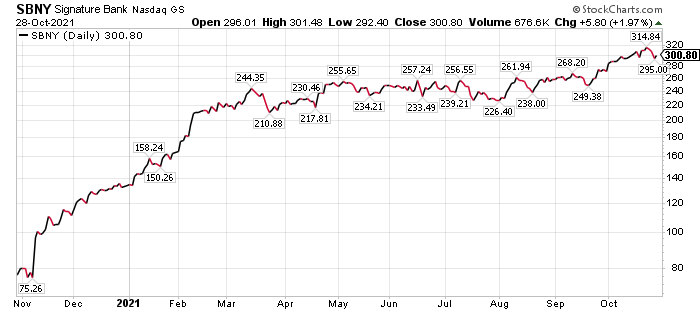

Signature Bank Seizes Spot Among Five Mid-sized Bank Stocks to Purchase for Dividend Payouts

Unlike most quarters, there was no intra-quarter update provided by the bank's management. This created added uncertainty for what already is a hard-to-predict business model for Signature Bank (NASDAQ: SBNY), a New York-based full-service commercial bank with 37 private client offices throughout the New York, Connecticut, California and North Carolina.

BofA wrote that the bank's loan and deposit growth could once again surpass expectations. Moreover, the backdrop of a steepening yield curve should allow its management to provide a relatively constructive message on spread revenue and margin prospects.

In addition to SBNY's crypto business, which includes lending against Bitcoin, BofA wrote that the market will be monitoring Signature Bank's recent endeavors, including mortgage warehouse and small business administration (SBA) lending.

BofA gave a price target of $405 to SBNY, and assigned a valuation multiple above its peers due to stronger balance sheet growth and a healthy credit profile. The stock could outperform that forecast with a better-than-expected macro environment and increasing long-term rates, according to the investment bank.

Of course, downside risks to reaching that price objective are required loan loss provisioning at higher-than-forecast levels, further deterioration in rental income for commercial properties and a longer-than-anticipated low-rate environment, BofA wrote.

Chart courtesy of www.stockcharts.com

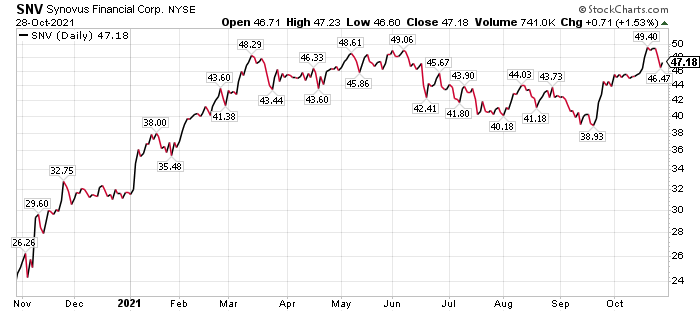

Synovus Financial Corp. Earns Spot in Five Mid-sized Bank Stocks to Purchase

Synovus Financial Corp. (NYSE: SNV), of Columbus, Georgia, is a financial services company with approximately $45 billion in assets that formerly operated as Columbus Bank and Trust Company. SNV outperformed BofA's expectations with its strong third-quarter results. Plus, the bank holding company's management disclosed plans to add investment banking to its existing business.

BofA gives SNV a "Buy" rating and a $60 price objective. If the bank holding company can deliver "superior growth" on a sustained basis, the stock has a chance to merit a "re-rating opportunity," according to BofA.

Chart courtesy of www.stockcharts.com

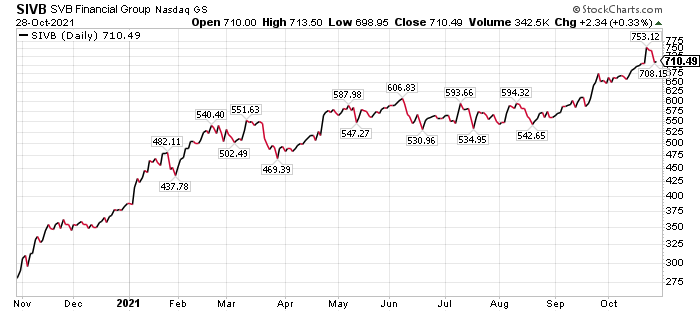

Lack of Dividend Leaves SVB Financial Group Outside the Five Mid-sized Bank Stocks to Purchase for Income Investors

SVB Financial Group (NASDAQ: SIVB), of Santa Clara, California, is the holding company of Silicon Valley Bank but its lack of a dividend leaves it out of the five mid-sized bank stocks to purchase. Nonetheless, BofA expects another solid quarter on the back of SVB Financial raising equity in August. Investors will want to pay attention to the bank management's preliminary 2022 guidance, which should provide a first look into the growth outlook for the recently acquired wealth management business and for the expansion of its investment bank into the technology sector.

BofA's price target on SIVB of $750 is accompanied with a "Buy" rating on the stock. Plus, BofA values the bank above the average multiple for the mid-sized to small- cap universe it follows due to a significantly higher return profile and stronger balance sheet growth outlook.

Potential risks are a longer than expected low-rate environment and a slowdown in the technology sector, as well as related IPO activity. Pluses could come from a sooner-than-expected pickup in the technology sector and the overall economy.

Chart courtesy of www.stockcharts.com | | | Traders who followed our lead reaped explosive profits because they had the tools at their fingertips to find profitable stocks. Click here now, and I'll send you my "5 Tips for Overcoming Market Volatility" eBook and reserve a seat for you at my LIVE online training, so you can learn how to skyrocket your profits. Click Here... | | | | Promising COVID-19 Case Numbers May Aid Five Mid-sized Bank Stocks to Purchase for Dividend Income

The threat of the highly transmissible Delta variant of COVID-19 seems to be fading in the United States with cases and deaths on the decline. In addition, the adult population in the United States increasingly is becoming vaccinated. Plus, the U.S. Food and Drug Administration (FDA) recently issued emergency use authorization (EUA) for a single booster shot of the Pfizer-BioNTech COVID-19 vaccine for high-risk groups.

A booster shot of the Pfizer-BioNTech vaccine or the Moderna COVID-19 vaccine can be given to people aged 65 years and older at least six months after they receive a second dose to guard against COVID-19. The booster shot also is approved for people aged 18 years and older who have underlying medical conditions and those aged 18 and older who live or work in high-risk settings.

The Centers for Disease Control and Prevention (CDC) reported on Oct. 29 that 221,348,530 people, or 66.7% of the U.S. population, have received at least one dose of a COVID-19 vaccine. The fully vaccinated total 191,242,432 people, or 57.6%, of the U.S. population, according to the CDC.

Globally, COVID-19 cases reached 245,526,421 and led to 4,981,428 deaths, as of Oct. 29, according to Johns Hopkins University. U.S. COVID-19 cases totaled 45,826,141 and caused 743,359 deaths. America has the dreaded distinction as the country with the most COVID-19 cases and deaths.

The five mid-sized bank stocks to purchase give investors an opportunity to profit from dividend payouts and stock-price appreciation as financial institutions continue to outperform the S&P 500. | | | Sincerely,

Paul Dykewicz, Editor

DividendInvestor.com

| | About Paul Dykewicz: Paul Dykewicz is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, Seeking Alpha, GuruFocus and other publications and websites. Paul is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is the editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul also is the author of an inspirational book, "Holy Smokes! Golden Guidance from Notre Dame's Championship Chaplain", with a foreword by former national championship-winning football coach Lou Holtz. Follow Paul on Twitter @PaulDykewicz. | | | | | |

Tidak ada komentar:

Posting Komentar