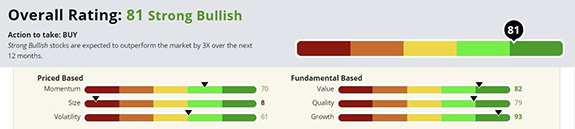

| If you’ve followed my ongoing homeowner saga, you know we’re selling our home in Dallas. We love the neighborhood, but the house is too small for a family of five. Selling will be easy. Buying is the real challenge. Even building something new is a lot more expensive than it used to be. Some materials prices are up several hundred percent over the past year. And good luck finding labor if you need something built. Welcome to the world of inflation. I think price spikes in at least some corners of the market will be short-lived. But I’m not so sure about houses or labor. The inventory of homes for sale is at record lows across many markets in the aftermath of the 2008 mortgage meltdown. This isn’t something that can be fixed overnight. You can’t snap your fingers and “fix” a decade of underinvestment in housing. But you can find ways to invest as construction ramps up again. That’s where my dividend stock of the week comes in. Click here to see why this “Strong Bullish” materials stock is a buy before the real boom.

Suggested Stories: The Latest Read on Inflation (and a 5.3% Dividend to Buy) 112% to 236%! Don't Miss Our Next Green Zone Ratings Winner

| If you own stocks, you may want to cash out immediately. And if you hold dollars, you need to see this chart. Because, according to one of America's most respected economists, the data in this chart signals a possible COLLAPSE ahead for the dollar. What he revealed is not pretty. | |

Chart of the Day

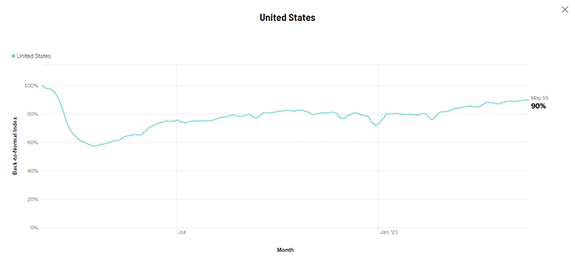

In 2020, policymakers around the world made the unprecedented decision to shut down the economy. These orders crashed economies and pushed economic activity down by 40% or more, levels of contraction seen during the Great Depression of the 1930s. The unprecedented nature of the contraction makes it difficult to predict the path of the recovery. To overcome this challenge, Moody’s Analytics and CNN Business partnered to create a Back-to-Normal Index. The index ranges from zero, representing no economic activity, to 100%, representing the economy returning to its pre-pandemic level in March. You can see below that the index rose to 90% recently. But that last 10% is going to be a struggle to gain back. Here’s why.

Suggested Stories: Money Velocity Shows the Govt Can't Prop the Economy up Forever A Permanent Portfolio for the Post-COVID World

| America's $51 trillion green boom will be of unheard magnitude. Only it's not from anything Biden is doing. Or from any big corporation. Instead, one pioneering company is at the forefront. You won't believe what it's battery tech can do. It's 25X more powerful than a Tesla EV. | |

|

1896: The Dow Jones Industrial Average premiered for the first time, initially valued at 40.94. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar