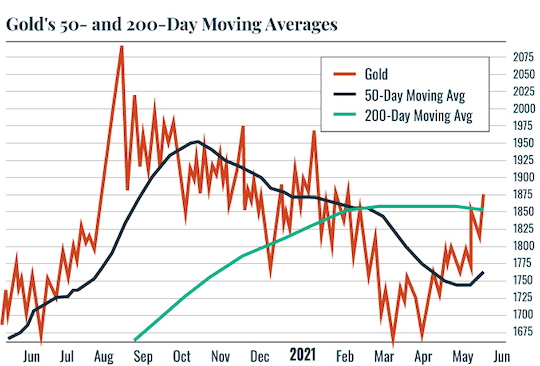

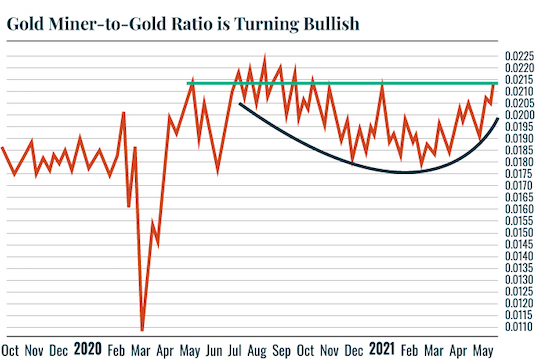

| NOPE Gold has just broken out of a nine-month consolidation with conviction.  This is an extremely bullish development, particularly when you consider that gold had to break through both its 50-day moving average (DMA) and its 200-DMA to do this.  So, this begs the question, has gold finally bottomed? Because if it has, the upside target for that bull flag is north of $2,400 per ounce. During major bull runs in gold, gold miners typically outperform the precious metal by a significant margin. The chart below shows the ratio between the VanEck Vectors Gold Miners ETF (GDX) and the price of gold bullion (GDX: $GOLD) When GDX outperforms gold, this line rises. And when GDX underperforms gold, this line falls. As you can see, since March of 2021, this line has been rising, which indicates GDX is outperforming gold by a significant margin.  Moreover, we have a clear rounded bottom (blue line in the chart above) forming here. That is a VERY bullish sign for this ratio. If it can break above resistance (the green line in the chart above) then we have confirmation that THE bottom is in for gold. When that happens, gold will begin its ascent to new all-time highs, eventually hitting north of $2,400 per ounce. Participating in a New Bull Market There are a number of ways to participate in a gold bull market. You can research mining stocks… You can invest in gold ETFs… Both have their advantages. But hands down the best way to participate in any coming rally is by owning physical gold bullion. I’ve mentioned this before, but the best way I know to buy gold bullion is via Hard Assets Alliance. (Full disclosure, we own a small share in the company.) It’s always been super-easy to buy, sell, and store your precious metals with them. But now they’ve made it even easier. It’s a one-of-a-kind investing service called Metalstream. So… if you’re interested in adding real gold to your investments ahead of any coming bull market, you can get more information on it here. Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar