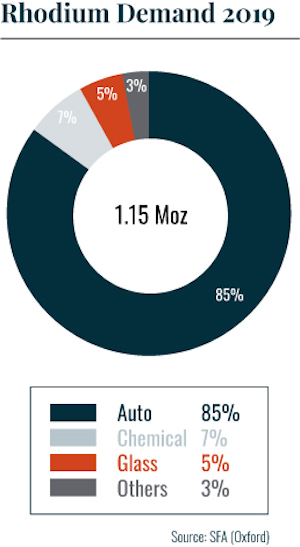

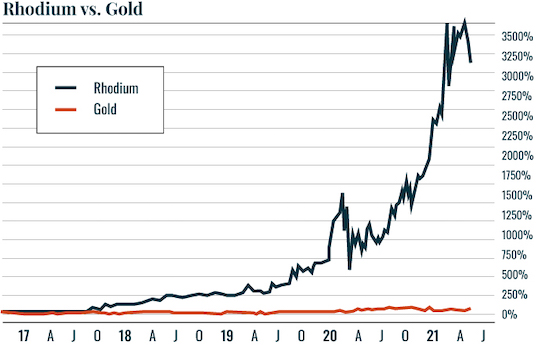

| An ounce of gold cost $1,850. An ounce of rhodium costs over $22,000! Indeed, rhodium is so rare that there isn’t a single primary deposit anywhere in the world. Instead, it is found as a byproduct of platinum or nickel mining. Now, one of the chief arguments against investing in gold is that it doesn’t experience any industrial demand. This is not the case with rhodium: The precious metal is a key component used in the creation of catalytic converters, which reduce emissions in automobiles. All told, this accounts for over 80% of global rhodium demand.  When you combine massive industrial demand with extreme rareness, you have a recipe for incredible gains. With that in mind, take a look at the chart below comparing the performance of rhodium against that of gold since 2017.  Again, this is just over the last three years! I recently told my Strategic Impact subscribers about a precious metals producer that is one of the largest rhodium producers in the world. In fact, it’s rhodium production alone accounted for nearly 25% of its revenues in 2020. (I share these little known, but (potentially) hugely profitable plays with them every month.) If you’d like to check out the other analysis and investment ideas Strategic Impact offers, and take a no risk trial subscription, you can check out my latest prediction here… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar