| Why I sold Chipotle Despite Strong Earnings and Sales

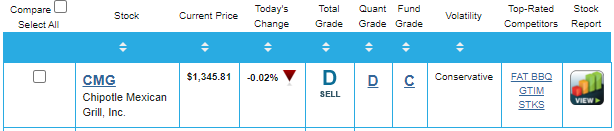

Louis Navellier | The first-quarter announcement season has been absolutely stunning for my Growth Investor stocks, which posted wave-after-wave of sales and earnings surprises. Of the 58 companies on my Growth Investor Buy List that have reported as of this writing, 79% have posted positive earnings surprises that have bested Wall Street’s estimates, with an average 34% surprise to the upside. Now, after reporting these outstanding numbers, most of my Growth Investor stocks subsequently firmed up and are now benefiting from institutional buying pressure that will likely get stronger in the coming days due to quarter-end window dressing. That’s when institutional investors tend to focus their attention on growth stocks, especially those with stunning forecasted earnings and sales growth. As regular Market360 readers know, I base my stock selections on superior fundamentals like a company’s sales and earnings. But there’s much more to it than that. In fact, the Quantitative Grade in my Portfolio Grader is one of the key factors I take into consideration before buying or selling any stock. The Quantitative grade is based on a stock’s Alpha (its return uncorrelated to the overall stock market) dividend by its standard deviation in the past 52 weeks. The bottom line is that my Quantitative Grade is a measure of buying pressure under a stock by institutional investors – the hedge funds and pension funds and sovereign funds and family offices of the world with massive amounts of capital to deploy into the market. Now, when I notice a stock’s Quantitative Grade begin to deteriorate, even if it may still have positive forecasted sales and earnings, I will not hesitate to sell it. At the end of the day, I’m a numbers guy, so I stick with the numbers. And if a stock’s Alpha has disappeared – a signal that institutional buying pressure has ebbed – I move on and look to buy more fundamentally superior stocks. Take Chipotle Mexican Grill, Inc. (CMG), which I added to the Growth Investor Buy List in May 2019. Chipotle Mexican Grill is a Mexican restaurant chain that prepares real food with real ingredients in a real kitchen in a fast food restaurant. Chipotle boasts that it only uses 51 ingredients to prepare its wildly popular Mexican dishes, which are made by hand. During the pandemic, Chipotle continued to satisfy folks’ cravings for Mexican food, offering online ordering, curbside pickup, in-store pickup and even delivery. The company also introduced its own version of drive-thru, “Chipotlanes,” at several locations. As a result, Chipotle’s business boomed over the past year. In fact, during the first quarter of fiscal year 2021, Chipotle noted that digital sales soared 133.9% year-over-year to $869.8 million. That accounted for slightly more than half of Chipotle’s total first-quarter sales of $1.7 billion. The company also opened 40 new restaurant locations, bringing its total restaurant count to 2,803. Chipotle reported that first-quarter earnings soared 74% year-over-year to $5.36 per share, topping estimates for $4.89 per share. Looking forward, Chipotle still has stunning forecasted earnings and sales growth. For the second quarter, analysts are expecting 1,530% year-over-year earnings growth and 40.9% year-over-year sales growth. Analysts have also upped earnings estimates over the past three months. However, as you can see below, despite these superior fundamentals, institutional investor attention is waning.

The stock’s Quantitative Grade slipped to a D-rating. As a result, CMG’s Total Grade dropped to a D-rating over the weekend, which is an automatic sell signal. So, I recommended that Growth Investor subscribers sell the stock into near-term strength on Monday for about a 99% gain. For Chipotle Mexican Grill, the institutional buying pressure could have ebbed due an acute labor shortage of low paid workers and/or the growing chicken shortage. Regardless of what caused institutional buying pressure to slip, I do not like to argue with institutional analysts, the news media and other catalysts that trigger institutional buying pressure under my Growth Investor stocks. And it is why I strongly recommend selling good stocks to buy better stocks with higher Quantitative Grades and more persistent institutional buying pressure. If you’d like to learn more about my Quantitative Grade and how I use it to recommend fundamentally superior stocks, just sign up for Growth Investor. I’ll be discussing the Quantitative Grade more in-depth in tomorrow’s Growth Investor Monthly Issue for June. I will also release three new High-Growth Investment recommendations, all of which earn an A-rating for their Quantitative Grade. In addition, the analyst community has revised their earnings estimates higher for each of these stocks over the past three months. Typically, positive analyst revisions precede future earnings surprises. Not only that but I will unveil my latest Top 5 Stock list and two brand-new Elite Dividend Payers stocks. If you’re interested, I encourage you to join me at Growth Investor today. The bottom line: The second quarter is shaping up to be even stronger than the first and I am especially excited that institutional buying pressure in our stocks will pick up during quarter-end window dressing in the second half of June. For full details, click here. Sincerely,

Louis Navellier

P.S. There’s a great divide opening up in America and investing in myGrowth Investor stocks will help get you on the right side of it. On one side is a new aristocracy that’s amassing more wealth more quickly than any other group in American history. For people like me, the one percent, life has never been better, more prosperous. On the other side, the opposite is happening. Wealth is flowing out of the pockets of ordinary Americans at an unprecedented rate. What’s happening is only going to gather in strength over the coming decades. It certainly won’t weaken. Few Americans even know that any of this is going on. I’ve never seen anyone from my side of the chasm step forward to explain any of these things. It’s why I put together this video. In it, I’ll lay out exactly what is happening, including several key steps every American should take right now. It doesn’t matter if you have $500 in savings or $5 million. You can benefit from the information in this video. It’s free to watch and by doing so I know you’ll be ahead of everyone else struggling to understand what is really going on. The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below: |

Tidak ada komentar:

Posting Komentar