| Warren Buffett, the Oracle of Omaha, is the most recognizable, revered and oft-quoted stock market investor of all time. We know him as a “value investor.” And because of Buffett, what we think of as “value investing” is one of the most recognized investment strategies. Identifying as a “value investor” somehow carries with it a certain cache — a badge of honor that’s difficult to criticize. Most of Buffett’s admirers have concluded that he simply has a God-given talent for identifying great companies that sell for less than they’re worth. The Oracle has never relied on “quant” models, computers or algorithms. What if I told you that you could perform just as well as Buffett if you simply use the value factor when selecting stocks? Here’s how we use it every day to find the best stocks within our Green Zone Ratings system. Suggested Stories: ZipRecruiter IPO Has Potential Post-COVID; Nvidia Earnings Preview What a $500M Bet Against Tesla Means for This Bubble Market

| Forbes calls it: "The battery that could change the world." Three dollar stock holds key patents. Investing Legend Matt McCall reveals, in his FREE video, the small company behind this brand new super battery that will drive the $3 Trillion electric car revolution. | |

Earnings Edge

Retail stocks are still in focus in this week's Earnings Edge, but more specifically, the mall trade. This may be dated, but the early 2000s were red-hot for both of the stocks I’m watching — Abercrombie & Fitch Co. (NYSE: ANF) and American Eagle Outfitters (NYSE: AEO). After years of turmoil and volatility, their stocks have revived with digital sales during the pandemic. This week is key to see if that momentum keeps going. Let’s dive in to see what we can expect from these two retail stocks… Click here for more in my Earnings Edge. Suggested Stories: Buy, Hold or Walk Away: AT&T’s $43B Move Triggers One Signal Biotech Barbell: The Best Way to Invest in a “Risky” Sector

| When gold is roaring higher — like it is now — most people buy bullion, coins or exchange-traded funds. But there's a way you can make MUCH more than you can in regular gold investments … with what I call A9 Gold Stocks. Not 1 in 1000 investors know about them… Yet they give you the chance to make up to NINE TIMES your gold gains. | |

Chart of the Day

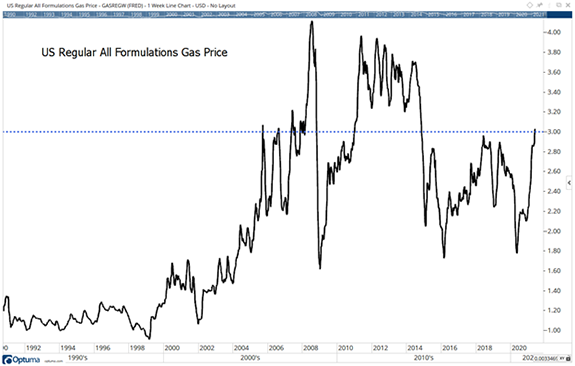

As the economic recovery continues, price pressures are growing. Consumers might call this inflation. The Federal Reserve is choosing to ignore it as transitory inflation. At the most recent Fed meeting, minutes indicate the Fed considered the issue of higher prices but believes the problem will resolve itself. But history isn’t on the Fed’s side in some cases. The chart below shows gasoline prices since the early 1990s. While the last price move above $3 in 2014 proved transitory, it lasted four years. Here’s what “transitory” inflation could mean for consumers like us going forward.

Suggested Stories: The Fed's Balance Sheet Doesn't Match Its Words 4% Inflation Is the Magic Number

|

1883: The Brooklyn Bridge, the largest suspension bridge at the time, opened to travelers. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar