| In May 2020, I recommended a biotech company to my Green Zone Fortunes subscribers. Its $1.3 billion market capitalization at the time placed it firmly in the “small-cap” camp of stocks. Though one year later, the stock has catapulted itself into “mid-cap” territory with a market cap of almost $4.5 billion. And I think it will be a “large-cap” behemoth ($10 billion-plus) within a few years. I’ll touch on that more in a bit. But first, let’s examine how my proprietary Green Zone Ratings system’s “size factor” played into this stock’s success over the last year. Click here to continue reading. Suggested Stories: Squarespace: A Tech IPO With a Twist + Post-COVID Target Earnings Biotech’s 30% Dip: Your Entry Point Into a Future Top Trend

| Could America become the world's No. 1 manufacturing power again? Sounds unbelievable, but one overlooked technology is making it possible. It's going to create 63 million middle-class jobs … and a $100 TRILLION mega-economic boom, according to the World Economic Forum. It's also going to create a new millionaire class of investors, thanks to one little-known stock at the forefront. | |

Earnings Edge

Two stocks on my Earnings Edge radar this week are tech company Cisco Systems Inc. (Nasdaq: CSCO) and manufacturing giant Deere & Company (NYSE: DE). These two stocks seem like total opposites on the surface. We have Deere in the agricultural and farm machinery industry with green tractors all over the Midwest. Then there’s Cisco and its data centers powering the opposite end of the spectrum with the communications equipment industry. But one is on the verge of leapfrogging the other and capitalizing on one of the biggest opportunities in a century — the space race. Click here to see how Deere is taking to the skies and what that means for its earnings. Suggested Stories: Uncharted Inflation Territory: Wild Data, Price Scares and Your Money A Bitcoin Nest Egg: Should Your IRA Meddle in Crypto?

| When gold is roaring higher — like it is now — most people buy bullion, coins or exchange-traded funds. But there's a way you can make MUCH more than you can in regular gold investments … with what I call A9 Gold Stocks. Not 1 in 1000 investors know about them… Yet they give you the chance to make up to NINE TIMES your gold gains. | |

Chart of the Day

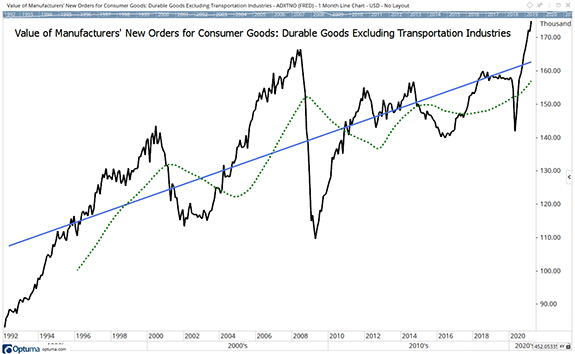

New orders for durable goods (kitchen appliances, computers, industrial machinery, etc.) are one of the few indicators that combine consumer and business confidence. This makes it an important leading economic indicator. Consumers make big purchases when they’re optimistic about the future. That’s especially true for financed purchases. Financing shows confidence in the ability to make payments. Pessimistic consumers delay purchases. Think of your household. If you’re worried about losing your job, you probably avoid new debt. This idea applies to the larger economy. Millions of households behave that way. The durable goods trend in the chart below is a great sign for the economy. Here’s why.

Suggested Stories: Late Payments Show We Threw Too Much Money at Americans The Problem With Economics Is Easy to See

|

1961: The Dow Jones Industrial Average closed above 700 points for the first time. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar