| I’m doing something a little different. Usually on Tuesday, I analyze a stock from our weekly hotlist and share the findings with you. I’m always on the lookout for great stocks that rate highly on chief investment strategist Adam O’Dell’s six-factor Green Zone Ratings system. And I’ve been writing about them for almost a year. While it’s fun to brag a little, I want to highlight how these stocks have performed so you know how powerful Adam’s system is. Click here to see some of our top stock performers of the last year and how you can use Green Zone Ratings to find even more. Pro tip: If you aren’t familiar with our weekly hotlist, click here to find out more. You can gain free access to this valuable feature today! Suggested Stories: Invest Like Buffett: Best Value Stocks Aren’t Just “Cheap” Is the Post-Pandemic Retail Trade Dead? (ANF, AEO Earnings Edge)

| The rich are getting nervous… According to CNBC, "The wealthy are investing like a market bubble is here (and) are making portfolio changes." But what changes? Former Wall Street insider and hedge fund manager Teeka Tiwari uncovered a growing trend amond America's 1%... Quietly and behind the scenes, some of the smartest, wealthiest investors in the country (including Warren Buffett) are making an important shift with their money. They're not rushing into cryptocurrencies... gold… tech stocks… or real estate. And they're not hiding in cash either. | |

I wrote last year that the 60/40 portfolio is dead. “Dead” might have been a little harsh. The market blasted higher over the year that followed. But there’s a good chance three factors today are hurting the returns of a portfolio invested in 60% stocks and 40% bonds: - Low bond yields.

- Inflation roaring higher.

- And stocks already sitting near all-time highs.

But what about an old relic of the 1980s, the Permanent Portfolio? Here’s how to make the most of this investing strategy in the post-COVID world. Suggested Stories: ZipRecruiter IPO Has Potential Post-COVID; Nvidia Earnings Preview Buy, Hold or Walk Away: AT&T’s $43B Move Triggers One Signal

| There's a huge shortage already sending shockwaves through U.S. industries… It's not oil, water or a rare-earth metal. It's something that the average American uses for nearly 11 hours a day, every day. A computer chip! Just about everything we come in contact with every day depends on these chips. That's why this semiconductor shortage is a "top and immediate priority" for President Biden. This is all part of a bigger trend we're seeing in the market. And that's great news according to Wall Street legend Ian King. King's research proves that not only will this Great American Tech Boom be bigger than ever … it's barreling down on us faster than anything we've seen before. | |

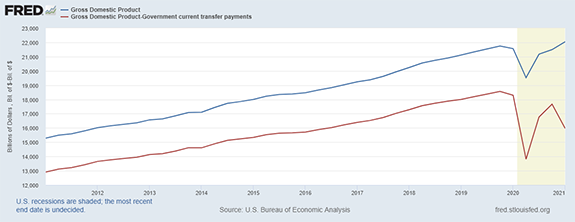

Chart of the Day

Looking at official data, it appears that the economy has fully recovered from the shutdown. Gross Domestic Product (GDP), a broad measure of economic recovery, is at an all-time high. Looking a little deeper, there are questions about whether or not the recovery is sustainable. The chart below shows that the economy would be faltering without government support. Click here to see why the economy is in worse shape without government support.

Suggested Stories: "Transitory" Inflation Isn't Always Short-Lived What a $500M Bet Against Tesla Means for This Bubble Market

|

1977: Luke Skywalker blew up the Death Star in "Star Wars." | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar