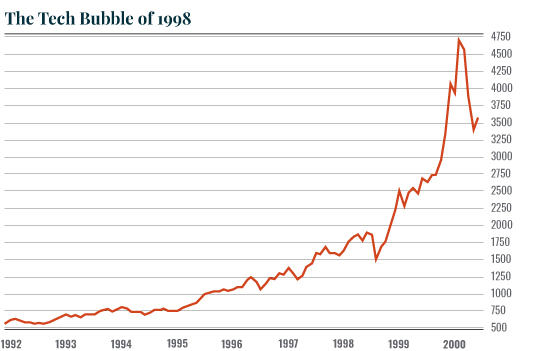

| Let’s Consider Some Historical Examples Tech stocks entered bubble territory in 1998. But if you’d sold then, you’d have missed out on two years’ worth of major market gains. You would also have needed the psychological strength to not care about the market roaring, and everyone around you getting rich for some TWO years.

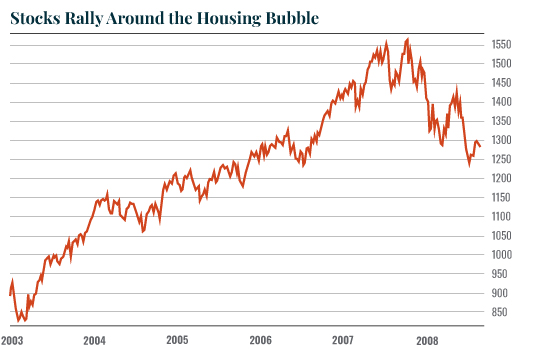

Let’s take a more recent example: the housing bubble. It was clear the housing market was in a bubble in 2006, if not 2005. And yet, stocks continued to bubble up until late 2007. Here again, if you had sold at the first signs of froth, you would have missed out on over a year’s worth of gains. You’d also have needed the psychological wherewithal to NOT care about everyone around you getting rich for months on end before you were eventually proven right.

Again, when you see a bubble, you should BUY and ride it for as long as possible. This current bubble is no exception. Don’t miss out on the gains, especially when inflation is igniting and stocks are bubbling. I’ll outline how to avoid the coming crash in tomorrow’s article. Until then… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar