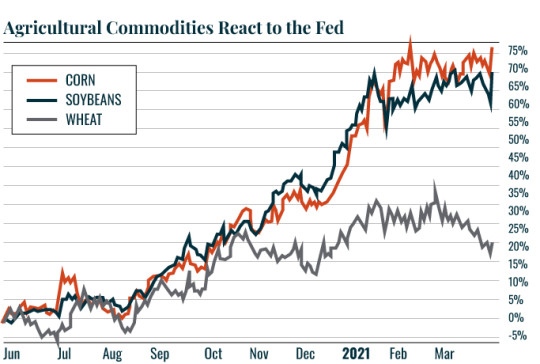

| Because the Fed has signaled that it is going to print some $1.4 trillion per year for the next two years to support the markets. By most measures, the U.S. economy is returning to normal. Despite this, the Fed has stated point blank that it will not tighten financial conditions until 2023 at the earliest. Over the same time period, the Fed plans to spend some $125-$150 billion per month in quantitative easing (QE). This comes to $1.4 trillion in money printing per year, or nearly $3 trillion in money printing over the next 24 months. This is roughly the GDP of the United Kingdom. You Can’t Fight the Fed It is VERY difficult to fight that much free money being handed out to Wall Street. The unintended consequence of this is that it is unleashing inflation. As I’ve stated multiple times before, the Fed’s OWN RESEARCH shows that food inflation is the best predictor of future inflation. With that in mind, take a look at what corn, soybeans and wheat are doing… and what they did yesterday while the Fed was arguing there are no signs of impending inflation.

Wheat, which is the worst performer, is up 20% in the last year. Corn and Soybeans are up over 60%. Both of those latter commodities were LIMIT UP yesterday by the way. So, what does this mean? The Fed wants a bull market at any cost. That bull market is going to be driven by a truly staggering amount of money printing from the Fed. And this has unleashed inflation. I’ll detail how to play this in Monday’s missive. Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar