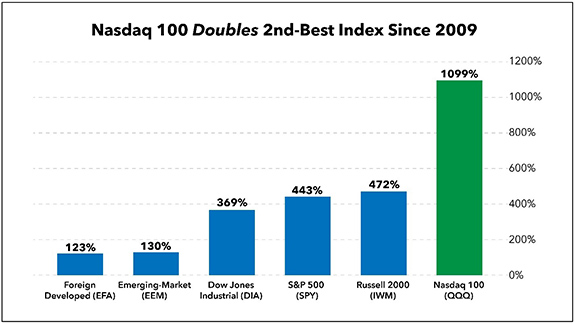

| On the surface, Intel Corp. (Nasdaq: INTC) and Dollar Tree Inc. (Nasdaq: DLTR) don’t have much in common. One is a high-tech chip maker. And one is a low-tech discount retailer. But they are both constituents of the Nasdaq 100 Index. That has been the place to be over the past 10 or so years. You can see that in the chart below:

The Nasdaq 100 has more than doubled the second-best performing index, the small-cap Russell 2000 (IWM) … and is up nearly 10-times more than foreign developed-market stocks (EFA)! Of course, these high-growth Nasdaq 100 stocks come with a hefty price tag (i.e., low value). But we can still find some companies that score well on growth and value. That’s where GARP (Growth At a Reasonable Price) comes in… Suggested Stories: This Dividend Is Inflation-Proof — and Bullish to Boot Huge Semiconductor Demand Fuels ChipMOS' Stock Growth

| There's a little-known way Trump could – one day – have his revenge. It involves a Federal Ruling he oversaw in the final year of his Presidency that could change America forever … unleash an estimated $15.1 trillion in new wealth … and create countless ways for everyday Americans to benefit. What is this little understood decision? And how will it impact you? | |

The Bull & The Bear

Real estate is on fire. It’s a seller’s market as supply is far outpaced by demand in the housing market. And demand for real estate stocks is also on the rise as investors find ways to invest outside of buying actual property. That leads to my selection for today’s The Bull & The Bear podcast. It’s a fund that provides diversified exposure to the red-hot real estate market. It even comes with a dividend bonus! Click here to find out what it is.

| Nobody is talking about this. But a fleet of cargo ships are soon expected to start cruising across the Atlantic. When they hit ports, they'll unload a breakthrough that'll leave you speechless. $15.7 trillion in new wealth could be created by 2030. And by taking one simple step, you can learn how make a fortune starting today. | |

Chart of the Day

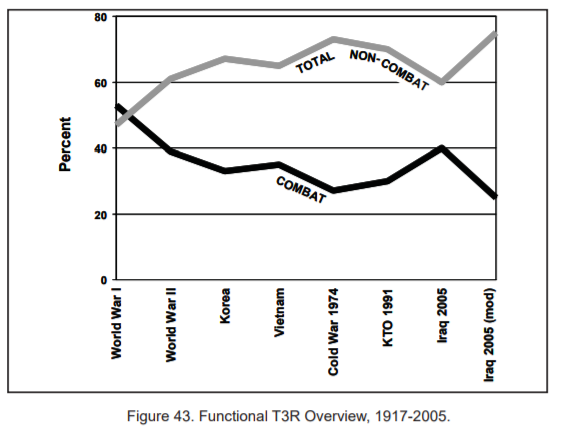

President Joe Biden plans to raise gas prices. That’s not exactly what he said this week, but his Afghanistan withdrawal will lead to higher gas prices. Biden is withdrawing from the country by September 11. That means there will be an increased flow of personnel and supplies in and out of the theater of operations. And my chart today shows why that will have a major impact on oil prices in the coming months.

Suggested Stories: Housing Isn't a Bubble: Homebuilders Won't Meet Demand for Years Why a Market Pullback Should Develop This Week

|

1912: The ocean liner Titanic sank in the North Atlantic after hitting an iceberg the evening before. Over 1,500 people died, and more than 700 people survived. |  |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar