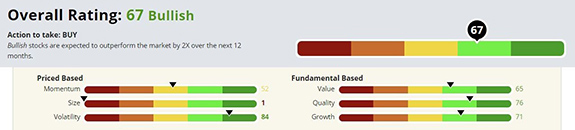

| As one of America’s largest cable and internet providers, Comcast Corp. (Nasdaq: CMCSA) got through the upheaval of 2020 mostly unscathed. Demand for high-speed internet and digital entertainment had never been higher. Comcast’s stock price reflects that optimism. Shares soared to as high as $58.58 last month before settling to about $53 as I write this. That’s 66% higher than its 52-week low. And CMCSA may be setting up for another ride higher as President Biden’s $2 trillion infrastructure bill makes its way through Congress. Click here to see what Biden’s “internet for all” initiative could mean for this “Bullish” comms stock.

Suggested Stories: Growth and Value? Find the Nasdaq 100's Best Buys Red-Hot Real Estate: One Fund for Easy Exposure + Dividends

| He believes the market potential of a new crypto-based tech is 6X bigger than bitcoin… and most investors have no idea it exists. | |

Marijuana Market Update

The legal cannabis market is expanding at a rapid pace. And that’s a good sign for the future of the cannabis industry and its underlying stocks. In recent weeks, I’ve covered cannabis legalization measures across the country and in Washington, D.C. Today, I examine the future of markets in states where adult-use cannabis is either legal or nearly legal. I’ve noticed some promising trends. Check them out in my Marijuana Market Update.

Suggested Stories: Newmont's Dividend Is Inflation-Proof — and Bullish to Boot Huge Semiconductor Demand Fuels This Stock's Growth

Chart of the Day

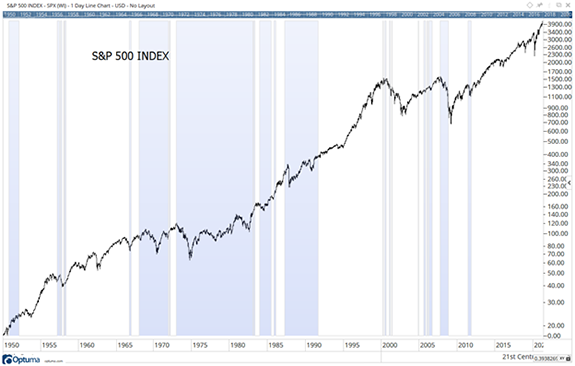

Inflation appears to be rising. In the most recent report, the Consumer Price Index jumped 2.6% compared to a year ago. When comparing prices to last year, some argue there should be an increase because the economy was at a standstill last spring. This makes year-over-year comparisons unreliable. But consumers are concerned about the impact of higher prices on their finances. Investors are joining them in that concern. And my chart today shows the S&P 500 performs worse during high inflation periods. The blue shading indicates times when the CPI exceeded 3.5%. Let’s see how inflation has impacted stocks in the past.

Suggested Stories: Biden's Afghanistan Withdrawal: What It Means for Oil Prices This Isn't 2008: Homebuilders Won't Meet Demand for Years

|

1999: Wayne Gretzky announced his retirement from the National Hockey League. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar