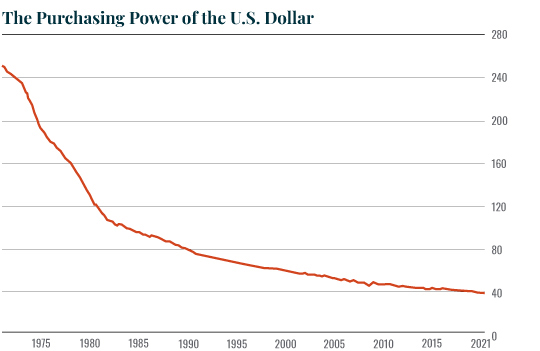

| Economics 101 We look to inflation hedges… things that cannot be printed. Remember, the basic rule economics is that the more of a given asset there is, the less each individual unit is worth. Think of sand. According to NPR, there are roughly five quadrillion grains of sand in the world. Because it’s so common, you can buy 50lbs of sand for less than $10. And the reality is that what you’re really paying for is the cost of labor and shipping that the sand company incurs to bag the stuff and ship it to you. The reality is sand is free provided you can get to a beach. By way of contrast, there are only 2.5 billion ounces of gold above ground today. That sounds like a HUGE amount of gold, but compared to sand? It’s infinitesimal. Not only is gold much rarer, but it’s much harder to get ahold of (you have to mine for it). As a result, a pound of gold is worth over $21,000. The same thing happens with money. The more of it you print, the less each unit is worth. That’s why the purchasing power of the U.S. dollar has been falling like a stone ever since the U.S. broke away from the Gold Standard in 1971. And why it will fall even MORE aggressively when the Fed is forced to engage in unlimited QE (unlimited money printing) to defend Treasuries in the coming months.  Some of the assets I’m looking at to profit from this include: - Gold, silver and other precious metals (palladium, platinum, rhodium and the like).

- Rare earths elements.

- Lithium, cobalt, and other commodities that are linked to green energy.

- Lumber and other commodities linked to housing which will boom as rates are forced even lower.

- Emerging markets.

I’ll outline a specific investment I like in Monday’s article. Until then… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar