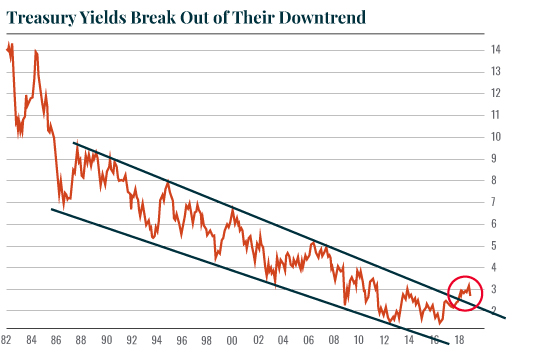

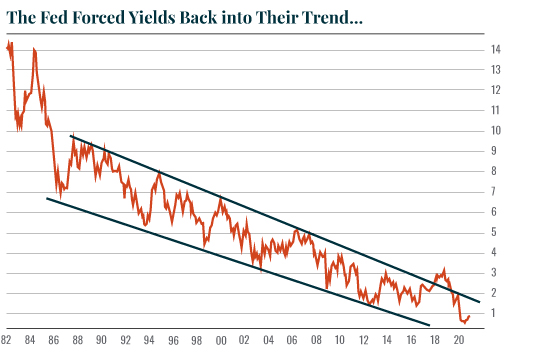

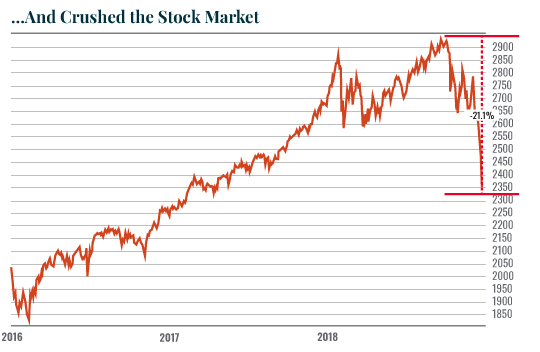

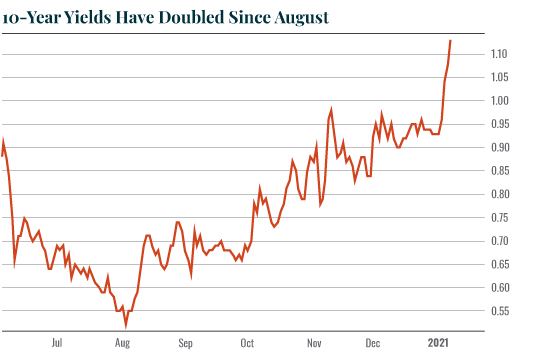

| At that time, the yield on the all-important 10-year U.S. Treasury Note broke out of its 30-plus year downward channel.  This forced Federal Reserve Chairman Jerome Powell to start aggressively normalizing Fed policy. Under his watch, the Fed began raising interest rates three to four times a year, while also shrinking the Fed’s balance sheet by hundreds of billions of dollars. As a result, Treasury yields plunged back within their downward channel…  …But the stock market also collapsed, with the S&P 500 losing over 20% in six weeks, culminating in a mini-crash in which stocks went STRAIGHT DOWN erasing two years’ worth of gains in a matter of days.  Bear in mind, the U.S. only had $21 trillion in debt at the time. We’ve added more than $5 trillion since then. Is It 2018 All Over Again? Put simply, the U.S. debt mountain is even more sensitive to interest rates today than it was in 2018. Which is why everyone should be paying attention to what’s happening in Treasury yields today.  As you can see, the yield on the 10-year U.S. Treasury has begun rising aggressively again. It’s more than DOUBLED since August 2020 alone. This is going to force the Fed into an impossible situation later this year (2021). They will be forced to either: - Allow bond yields to rise, which will blow up the debt markets, triggering a horrifying crash worse than 2008.

Or… - Let the U.S. dollar collapse.

I’ll detail what they’ll do in tomorrow’s article. Until then… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar