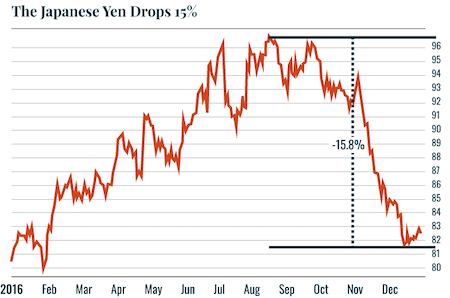

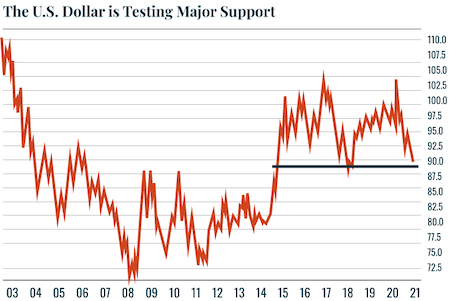

| The BoJ first cut interest rates to zero and launched its first Quantitative Easing (QE) program in 1999 and 2000 respectively. The Fed didn’t employ either of these policies until 2008. With that in mind, we can look to the BoJ for clues as to what the Fed will be trying next. In 2016, the BoJ announced it will engage in UNLIMITED QE in an effort to control bond yields. In its simplest rendering, the BoJ announced that any time the yield on the 10-year Japanese Government Bond rose above 0%, the BoJ would print NEW MONEY and use it to buy those bonds until yields fell back to 0% or below. Put another way, the BoJ announced it would print an unlimited amount of currency in order to control its bond market. The end result? Japan’s currency — the Japanese Yen — lost 15% in the span of a few months.  This is what’s coming to the U.S. later this year. Indeed, I believe the Fed will be forced to act, based on what bonds are doing, within the next six months. The current market is already signaling this. The U.S. Dollar Index ($USD) has already lost 12% of its value and is about to take out critical support (blue line in the chart below). Once it does this, we could easily see the $USD drop into the 70s.  We are talking about a $USD crash here. And it would ignite an EXPLOSIVE rally in precious metals, commodities, and other inflation hedges. We’ll get into how to profit from this in tomorrow’s article. Until then… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar