The Greatest Economist Ever -- and the Winner Is… | | Sponsored Content Elon Musk Drops MASSIVE Bombshell The shrewd billionaire just made a VERY strange confession about the future of his electric car empire. The secret he reveals could also mint fortunes for smart, fast-moving investors. This has nothing to do with buying shares of Tesla. Click here for the stunning details. | | | "It was the reading of his book that made an 'economist' out of me." -- Ludwig von Mises

"I found it such a fascinating book, so satisfying." -- Friedrich Hayek

"No book since David Ricardo's Principles has had such a great influence on the development of economics as…" -- Knut Wicksell

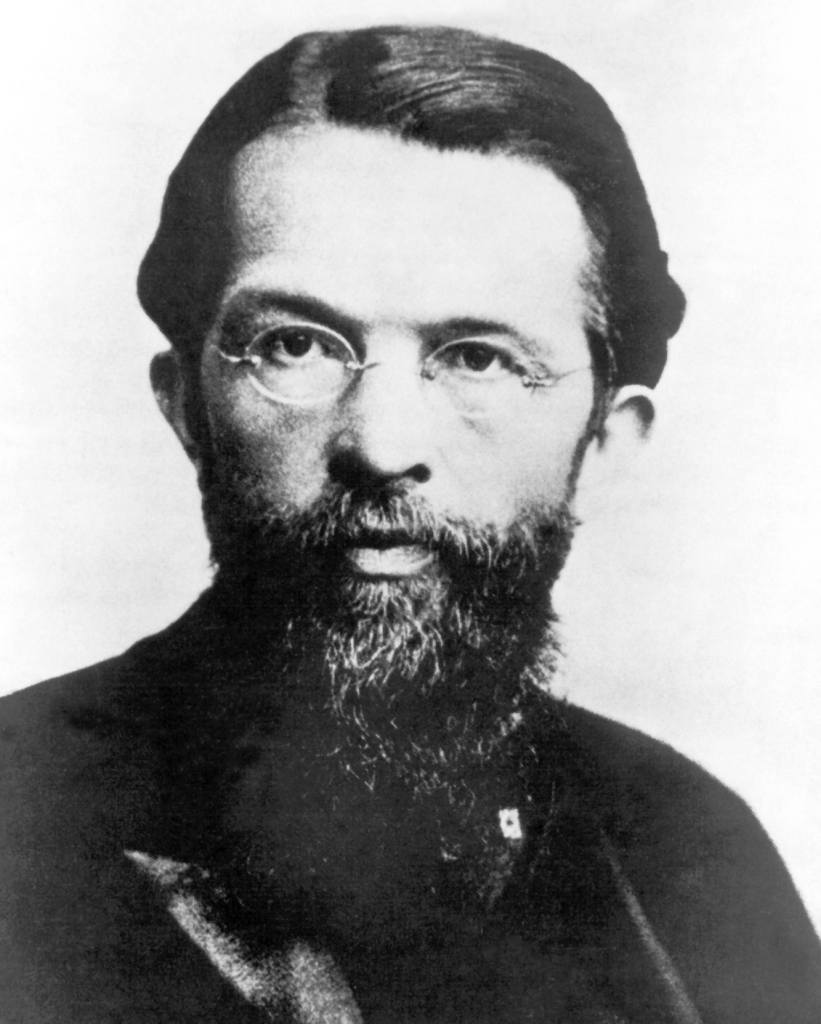

The revolutionary book that these three writers are talking about is Carl Menger's "Grundsätze der Volkswirtschaftslehre," published in 1871 in Vienna, Austria. It was not translated into English as "Principles of Economics" until 1950.

It was with this book that the Austrian School was born and made economics a real science. After Menger wrote his magnum opus, he became a distinguished professor at the University of Vienna. For several years he taught the crown prince of Austria and was a man of great influence. By the turn of the century, the Austrians were considered the most dominant school in economics and were the first to take on the Marxists. Menger died in 1921, deeply pessimistic about the future of Europe after World War I.

Carl Menger (1840-1921), and his followers, enhanced Adam Smith's positive vision of the capitalist system. In many ways, Menger was a revolutionary discoverer of both macroeconomics (through his time structure of production) and microeconomics (subjective demand and marginal analysis).

Therefore, I conclude that Carl Menger deserves to be considered the greatest economist who ever lived.

I dedicated my own book, "The Structure of Production" (New York University Press, 1990), to Menger. It was Menger who inspired my development of gross output (GO), a measure of spending at all stages of production that the government adopted in 2014.

Further, Menger was a financial reporter who covered the stock market in Vienna, and it is there that he discovered that prices of stocks and all goods and services are based on only a small number of buyers and sellers. Thus, he discovered the principle of marginal analysis that forms the basis of economic science today.

Menger also developed a better way to measure the standard of living in a country. The traditional approach is to calculate the average wage or income level. But Menger took a different route -- he looked at the quantity, quality and variety of goods and services bought by consumers to determine a person's, or country's, well-being.

I use this approach when I teach economics to students, and it's an eye-opener. For example, many economists claim that real wages for the average American have stagnated over the past 30 years.

Yet, if you look at the quantity, quality and variety of goods and services over the past 30 years, it is clear that almost everyone's living standards have increased dramatically.

I also use the Austrian theory of the business cycle in my forecasts about the economy and the stock market, based on the works of Ludwig von Mises, Friedrich Hayek and other followers of Menger. They taught that easy-money policies are inflationary and lead to the boom-bust cycle in the economy and in the stock market. | | Is $5K into $1 Million in Nine Months Really Possible? If you're Wall Street trader Bryan Perry, then the answer is a resounding YES.

With just 10 trades and ninemonths, Bryan showed his readers how to make more than $1 million in trading gains. In this short presentation, Bryan documents -- step by step -- how he pulled it off... PLUS his brand-new plan for what could be his next million-dollar haul.

Click here for the full account of these "Nine-Month Millionaires." | | | Celebrating the Austrian School of Economics

This year is the sesquicentennial (150th anniversary) of the Austrian School of Economics.

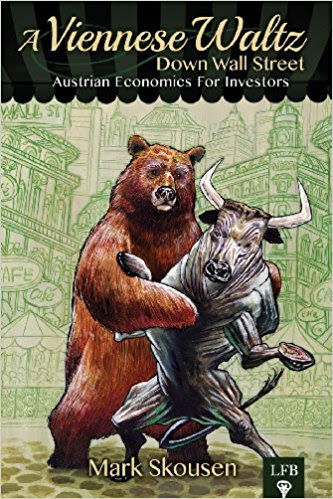

We are going to have a special session at FreedomFest about how investors can profit from the Austrian School of Economics, especially its business-cycle theory. If you want to get a head start, I suggest you buy a copy of my book "A Viennese Waltz Down Wall Street: Austrian Economics for Investors" available for only $20 postpaid at www.skousenbooks.com.

You may also want to check out my story of the great economic thinkers. My book "The Making of Modern Economics" includes three chapters on the Austrians -- Menger, Mises, Hayek and Schumpeter, among others. It includes pictures and lots of lively anecdotes. The price is only $35 at www.skousenbooks.com. | | Steal "THIS" From Wall Street (and Profit) Pay attention because I'm about to show you how you can make trades the EXACT same days that Wall Street does. You might think this is a sneaky little trick... but they make these trades on the same exact dates EVERY SINGLE YEAR.

Stop chasing after Wall Street trying to figure out what they're doing. Instead, place the SAME trades and the SAME time! Let me show you how -- inside this FREE Masterclass. Just click here to claim your free spot. | | | FreedomFest Closes in on 1,000 Attendees!

I'm pleased to announce that this year's FreedomFest is a hit. We made the bold decision to move from Sin City (Vegas) to the Badlands of South Dakota (Rapid City), and with Las Vegas still shut down, it appears to be a wise move. The dates: July 21-24.

Today, we hit 994 paid attendees, with seven months to go. (This is an exact number; we do not exaggerate attendance like many conferences.) One of our hotels (Holiday Inn) is already sold out. The "early bird" discount is only $399 per person, and $299 per guest, which is a great deal (it ends on March 31). To register and check out all our speakers, topics and special excursions, go to www.freedomfest.com or call Hayley at 1-855-850-3733, ext. 202. You will be glad you did.

See you in South Dakota. Fly there, drive there, bike there, RV there!

Good Investing, AEIOU,

Mark Skousen

Presidential Fellow, Chapman University

Wikipedia

Newsletter and trading services

Personal website

FreedomFest | | Read It and Weep: A 'Conscious Leader' is Destroyed in Orlando By Mark Skousen

Editor, Forecasts & Strategies

Every year I tell my Chapman University students the story of Harris Rosen, the "conscious capitalist" who is the founder of the highly successful Rosen Hotels and Resorts in Orlando, Florida.

Rosen is a practitioner of "democratic capitalism" who treats his employees like family. During the financial crisis of 2008, when tourists abandoned the Orlando resorts of Disney World and Universal, he never laid off a single team member. He drew upon his substantial retained earnings ($130 million) to keep his workers employed and active.

His decision showed foresight. His hotels recovered quickly when the financial crisis ended. He was written up as a hero in the New York Times. Click here to read.

I was so impressed that I invited him to speak at FreedomFest in 2014. Click here to read his great story.

Now, here's the tragic part.

For the first time in the 46-year history of Rosen Resorts, he is being forced to lay off hundreds of workers, permanently, as the convention business has collapsed, and has not returned.

Here's the heartbreaking story of the collapse of an empire, including Harris Rosen's letter to the mayor of Orange County:

I hate the headline:

"Rosen Hotels & Resorts lays off hundreds more employees due to COVID-19"

Followed by the subheading:

"Company continues facing financial hardships amid pandemic"

The press should not report the layoffs and bankruptcies are "due to COVID-19" when in fact it stems from over-zealous government officials and their lockdown mentality.

It is shocking to think about what could have happened if we had a real pandemic a la 1918. This one kills less than 1% of the population -- more people die from traffic accidents every year.

In addition to Rosen Resorts, the government (and the overzealous media) has crushed the cruise industry, which has had to mothball hundreds of cruise ships. Then there are restaurants, colleges, the entertainment industry and many others. Yet, nobody seems to care.

I'm still amazed that as powerful as the casino world is, the imperial governor of Nevada was able to shut down the entire city of Las Vegas with no complaints -- month after month, and still no conventions. I thought the world was run and controlled by monied interests, but I was wrong. Political power is much more potent than financial power. Washington is much more powerful than New York.

It is eye-opening and very scary.

Sometimes I often feel like John Adams in the musical "1776": "Does anybody care? Does anybody see what I see?" | | | About Mark Skousen, Ph.D.:

Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. Mark Skousen is an investment advisor, professional economist, university professor, author of more than 20 books, and founder of the annual FreedomFest conference. For the past 40+ years, Dr. Skousen has been investment director of the award-winning newsletter, Forecasts & Strategies. He also serves as investment director of four trading services: TNT Trader, Five Star Trader, Home Run Trader, and Fast Money Alert. | | | | | |

Tidak ada komentar:

Posting Komentar