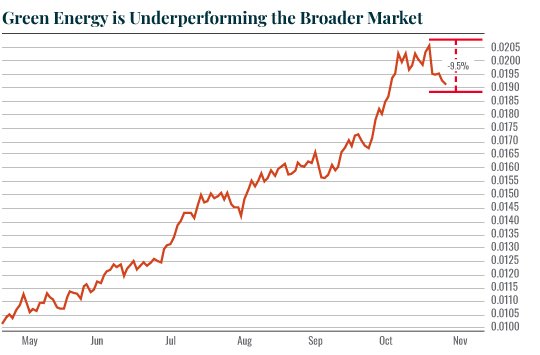

| Of course much of the market has been red lately, so I would also like to point out that underperformance has occurred relative to the broader stock market. The ratio between $PBW and the S&P 500 is down 9% meaning clean energy ETFs are down 9% relative to the rest of the market. That’s a heck of an underperformance. Again, this suggests Biden’s odds of winning the election have fallen dramatically.  Meanwhile, we see industrial metals, which are heavily pro-Trump due to his obsession with U.S. manufacturing and industrial production, remain in clear, strong uptrends. Looking at these charts it’s difficult to even see a corrective move. This suggests the odds of a Trump win have increased dramatically.  Taken together, these two developments STRONGLY suggest Donald Trump will win re-election. In fact, you could argue that based on these issues, the election won’t even be close. Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar