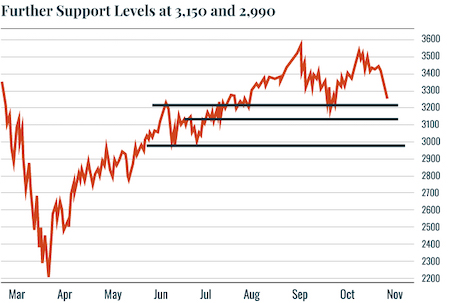

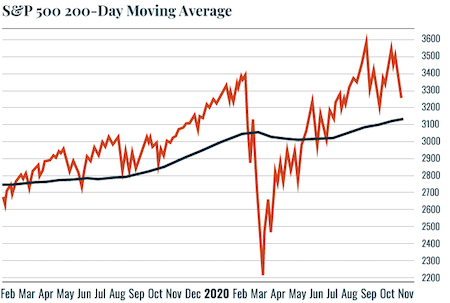

| The Difference Between Amateur and Veteran Investors An amateur investor would let his or her emotions get the better of them and start panicking. And he or she will lose money — even more than they need to. A successful investor, on the other hand, will use his or her discipline. And that means looking at charts to see what the markets are telling them. The S&P 500 has major support around 3,210. That represents its most recent low in September 2020. Provided we don’t break below that line, stocks are OK.  If that line doesn’t hold, stocks have support at 3,150, and 2,990. Each of those represent a potential bottom / level of consolidation for stocks.  Personally, I do not believe the S&P 500 will break below 3,150. That represents the 200-day moving average for this stock index. Historically, that line has served as major support for the S&P 500 during bull markets.  My point with this is that the best way to keep your emotions out of the picture when the market goes red, is to focus on the charts. Identify the levels at which you’ll decide to get out, and then simply watch and wait. That way you’ve got your emotions in check, and won’t panic and make an emotional mistake. Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar