In This Issue: • Reality In Between Bites

• ETF Talk: Managed Risk Fund Provides Automatic Investment Rotation

• Real Conversations Matter

• The Best of Both Worlds (A Van Halen Tribute) | | These Three Patterns Are Making Fortunes in Volatile Markets There's a secret why the pros whet their appetites... When individual traders turn-tail and run. And it's really quite simple. When the markets get volatile, they switch to the three trades that love whipsaws... And I'm going to show you the three different setups that exploit every market swing you'll see.

Here's the thing... I'm not charging you a dime to discover how to quickly bag double and triple-digit wins when the market goes crazy. But I am going to ask you to not watch this unless you are serious enough to commit 30 minutes to it. That's how fast you can commit these three trading patterns to memory for life. I strongly suggest you get them now. | | | In the 1990s, the phrase "reality bites" became a popular saying that was used to describe the, often harsh and painful, experiences of life. You know, the sort of experiences that jolt you out of your youthful fantasies and bring you back into the real world. There was even a 1994 film of the same title starring Ethan Hawke and Winona Ryder, which I liked and continue to recommend. Yet, given the latest overly restrictive pandemic rules imposed on me in my home state of California, perhaps a new phrase will start being used to describe this harsh existence. That phrase is "Reality in between bites."

I say that, because a few days ago, Governor Gavin Newsom, who is always a man that is keen on grabbing the spotlight, tweeted out a new recommendation for California diners. That new recommendation was the following: "Going out to eat with members of your household this weekend? Don't forget to keep your mask on in between bites."

Wait, what? Now I need to keep my mask on in between bites at a restaurant?

In the fiery words of tennis great John McEnroe at the 1981 Wimbledon Championships, "You cannot be serious!"

Of course, what I've learned firsthand being a resident of the Golden State during his tenure, regardless of how ridiculous his proclamations may seem, is that Gov. Newsom isn't playing. He actually thinks that it's a good idea to keep taking your mask on and off during a meal at a restaurant.

In the image that accompanied the tweet (which can be seen above), the diner is wearing a mask, then is not wearing a mask while taking a bite and then is putting the mask on again. Yet, the verbiage in the tweet image also advises people to "minimize the number of times you take your mask off."

So, which is it? Minimize the number of times you take your mask off, or take your mask on and off in between bites? Moreover, the experts at the Centers for Disease Control and Prevention (CDC) recommend that you avoid touching your mask and taking it on and off repeatedly.

To me, this is absurdity taken to the height of ridiculousness. And while rational readers may be laughing at this draconian and contradictory proclamation, what is no laughing matter is the persistent cloud of authoritarianism that is being imposed in the name of public safety (not just in California, but around the world). This is a cloud which blocks the sunlight of freedom that is our birthright.

In a great article at Reason.com titled, "The Post-Pandemic 'New Normal' Looks Awfully Authoritarian," writer J.D. Tuccille points out that the very methods that liberal democracies around the world are using to fight the virus are the same tactics that authoritarian leaders use to dominate their people during non-crisis times.

"These authoritarian tools may become permanent because government officials are rarely punished for doing something, even if the something is awful and counterproductive," writes Tuccille.

Perhaps most importantly, Tuccille's article reminds us that there is an alternative to the blatantly authoritarian approach to COVID-19 mitigation, which is a goal that we all want. That alternative is the Swedish model, where the number of new infections are surprisingly low when compared to the rest of Europe and the United States.

As Tuccille points out, the Swedes refused to impose a draconian coronavirus lockdown last spring, as the country's health officials argued that limited restrictions were sufficient and would better protect against the economic damage. And while no one is arguing with the benefit of hindsight that Sweden or any other country did everything right, the country has seemed to come through difficult periods at least as well as other countries, and, as Tuccille puts it, "without disrupting life or indulging the power-grab fantasies of government officials."

"Sweden serves as an indication that respecting people's liberty doesn't inherently pose a health threat, and that a virus shouldn't be used as an automatic excuse for forcibly curtailing normal life. And, once the virus passes, there will be a minimum of authoritarian detritus for Sweden's residents to clear away," concluded Tuccille.

Unfortunately, California is no Sweden when it comes to authoritarian detritus, and the latest tweet from Gov. Newsom on the subject confirms just that. It also confirms for me that I reside in a state where reality bites, even in between bites. | | Forget the Election Chaos... Read THIS Instead There's no certainty to the election. The U.S. may not know the winner for weeks, even months. There's no "Fail-Safe."

Fortunately, there is one -- when it comes to your money.

As one of the world's top-ranked traders reports, "Everyone wants to see their money GROW during bull markets... and be assured it's completely SAFE -- not losing a cent -- in down markets."

So, no matter what happens come Nov. 3, you owe it to yourself to give Jim's "Fail-Safe" method a quick read. Click here for his findings. | | | ETF Talk: Managed Risk Fund Provides Automatic Investment Rotation

(Note: third in a series on hedged-equity, low-volatility ETFs)

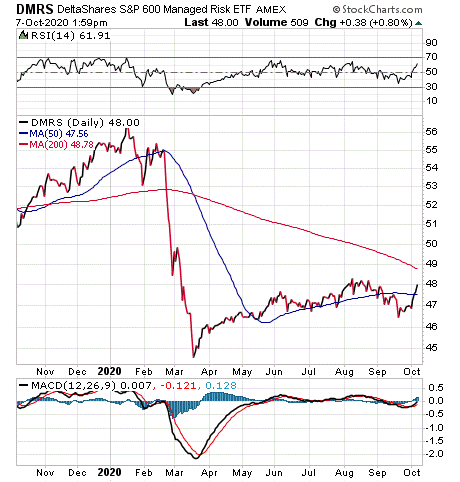

For investors who are seeking exchange-traded fund (ETF) investments with low volatility that can still produce quality returns, DeltaShares S&P 600 Managed Risk ETF (DMRS) provides an interesting strategy.

This fund strikes a balance between active and passive management by managing itself through a set of rules that governs how it changes its holdings. Specifically, the fund invests in small-cap stocks via the S&P 600, bonds and/or cash, depending on market conditions and how they trigger the fund's rules.

When volatility is low, DMRS shifts towards being a small-cap fund. It allocates more of its holdings to Treasury notes and bills as a hedge when volatility increases.

This fund is down 8.10% over the past 12 months. The reason for this appears to be a failure of its strategy, as it looks to have been invested in stocks when the market crashed in March and then shifted to less risky assets to avoid that volatility. This has resulted in a lukewarm recovery. That said, this is an exceptional circumstance which is not likely to occur often.

DMRS has an expense ratio of 0.45% and pays a 0.74% dividend yield, though the yield may be more subject to change than other funds due to shifts in strategy. It has just $33 million in assets under management, which means that it falls below my recommended threshold for investment. However, the fund's strategy is interesting and worth bringing to your attention.

Chart courtesy of StockCharts.com

The fund is currently more than 86% allocated to bonds. Apart from bonds, the fund's top holdings include Exponent Inc. (EXPO), Qualys Inc. (QLYS) and TopBuild Corp. (BLD). However, judging from the low weights allocated to these companies, it appears that DMRS is trying to distribute its stock investments as evenly as possible across the S&P 600 index.

For investors who feel that a managed, rules-based fund is a smart idea for automatically rotating investors into particular asset types, DeltaShares S&P 600 Managed Risk ETF (DMRS) is an interesting fund to investigate.

In closing, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk. | | Win Up to 87% of the Time -- Even in Volatile Markets My "5 Tips for Overcoming Market Volatility" can make you great returns in both good -- and volatile markets.

These strategies can turn even the most unstable markets into cash opportunities. Click here now to learn how protect and grow your money, regardless of market conditions. | | | ***************************************************************

In case you missed it…

Real Conversations Matter

The first presidential debate of 2020 took place last week, and if you came away from the roughly 90 minutes of verbal chaos as disappointed in the result as I was, then you're not alone.

Even my random late-night sampling of opinions from both sides of the political aisle revealed just how unsatisfied the exchanges were between President Trump and former Vice President Biden. Perhaps I am too optimistic, but I didn't think it was too much to ask that the two men vying for the de facto title of "Leader of the Free World" have an actual conversation.

Instead, the event was, as The Wall Street Journal editorial headline put it, "A Depressing Debate Spectacle." The subhead of the WSJ piece encapsulated what I think most people came away with after watching the event, and that is that, "Pro wrestlers are more presidential than either man Tuesday night."

Here is the money quote from the WSJ editorial:

"The event was a spectacle of insults, interruptions, endless cross-talk, exaggerations and flat-out lies even by the lying standards of current U.S. politics. Our guess is that millions of Americans turned away after 30 minutes, and we would have turned away too if we didn't do this for a living."

That pretty much sums up my opinion of the "debate," if you can call it that.

Yet, in some ways, I am grateful that I witnessed this epic failure of conversation last night. I say that, because it reaffirmed a principle that I live by, and one that I think is critical to making any kind of social progress. That premise is that real conversations matter.

Now, when I say, "real conversations," I am just slightly amplifying what the Oxford English Dictionary defines as: "a talk, especially an informal one, between two or more people, in which news and ideas are exchanged."

The operative concept here is the exchange of ideas, and the reason why this is so important, and the reason why I think real conversations matter so much, is because conversations are our best way to resolve conflict and to make social progress.

As philosopher and neuroscientist Sam Harris puts it: "We have a choice. We have two options as human beings. We have a choice between conversation and war. That's it. Conversation and violence."

In pandemic America 2020, we've already seen the failure of conversation result in social unrest, riots, looting, impeachment, science denial, history denial, racism, the rise of cancel culture, the siloing of news and information, radical left-wing lawlessness and the rise of radical right-wing hate groups. In short, our collective failure of conversation is laying the foundation for a future American dystopia that all but the most fervent nihilist would find disastrous.

Yet, before you conclude that I am a fatalist on this issue, I do think there is hope for a brighter, more articulate and more well-reasoned future. I say that, because I am actually encouraged by the outpouring of discontent regarding the dreadful presidential debate.

I also am encouraged by the rise of so many long-form conversations that have been facilitated in recent years by digital platforms such as podcasts, YouTube videos and streaming media services such as Spotify. The rise of the long-form conversation as a force in American media can be seen via the recent announcement of an exclusive deal between Joe Rogan and Spotify that is reportedly worth some $100 million.

Indeed, the appeal of long-form, real conversations of all sorts in recent years is, in part, responsible for me launching my own podcast, Way of the Renaissance Man. And not coincidentally, today also happens to mark the official launch of Season Three of the podcast.

In this kickoff episode, I am joined by my producer and media consultant, Heather Wagenhals.

In this real conversation, we take a deep dive into what precisely defines what I call the "Renaissance Man ethos." You might recall The Deep Woods issue of Aug. 19, with the lead story titled "Focus, Integration, Celebration." Well, those concepts in action are what make up the three pillars of the Renaissance Man ethos, and in this episode, you will discover exactly why.

Finally, we take a look back at some of the highlights of the first two seasons of the show to demonstrate the Renaissance Man ethos in action, and why so many of my fascinating guests embody the very best within us all.

I am extremely proud of the podcast and lifestyle website we've created, and we celebrate this pride of achievement in the Season Three kickoff episode. It also happens to be the 30th episode of the Way of the Renaissance Man podcast.

So, if you still have a bad taste in your mouth after last week's failure to have a real conversation, I invite you to cleanse your intellectual palate with the Renaissance Man.

*******************************************************************

The Best of Both Worlds (A Van Halen Tribute)

Whoa, you don't have to die an' go to heaven

Or hang around to be born again

Just tune in to what this place has got to offer

'Cause we may never be here again

I want the best of both worlds

An' honey I know what it's worth

If we could have the best of both worlds

A little heaven right here on earth

--Van Halen, "Best of Both Worlds"

This year has been horrible for the passing of music icons. In January, we suffered the loss of the greatest drummer, not just in rock history, but in human history, Neil Peart of RUSH. Yesterday, we learned of the passing of one of the greatest guitarists, not just in rock history, but in human history, Eddie Van Halen.

If you've ever picked up a guitar, you know that it's relatively easy to strum a few chords and sound okay. It's an entirely different proposition to create your own distinctive style that can be recognized around the world with the playing of just a few notes. Yet, that's what Eddie Van Halen did, and his revolutionary style is one of the many things that made him a genius.

There are quite a few songs that I love from the Van Halen discography, but I have to say that my favorite is on their 1986 album "5150," and it's titled "Best of Both Worlds." This was the first album featuring singer Sammy Hagar, who, for me, was the best frontman of the band (yes, I know that's heresy to David Lee Roth and early Van Halen fans, but that's how I see it).

As we see in the lyrics above, if we tune in to what the world has got to offer, it is possible to have a little heaven right here on earth. I love that sentiment, because it reminds us that life is the standard of value, and that it's up to each of us to live it, here and now.

So, thank you, Eddie Van Halen, for your incredible talent, your musical gifts to the world and for showing us that the best of both worlds really can be heaven right here on earth.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim.

In the name of the best within us,

Jim Woods | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Successful Investing, Intelligence Report, Bullseye Stock Trader, and The Deep Woods (formerly the Weekly ETF Report). Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Successful Investing, Intelligence Report, Bullseye Stock Trader, and The Deep Woods (formerly the Weekly ETF Report).

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar