REIT ETFS Are Top Heavy in Tech | | Options Traders: MASSIVE Shift Incoming! In 1992 … 2008 … 2012 … 2016 … massive market shifts took place to transform some people's wealth...and now it's happening in 2020.

This shift in the market is just shy of what you might call an 'alternate reality.' A time where even entry-level traders can make earnings that last for generations.

Don Kaufman is calling this special window of time -- THE VOMMA ZONE. And he's showing everyone who'll take the time to listen how they can jump in on the wave.

Learn more about it HERE and get a personal insight from me in your inbox. | | | Back about 11 years ago when the economy was emerging from the Great Recession, the big opportunity of that time was to leverage whatever equity one had and buy distressed brick-and-mortar real estate.

The market was flooded with commercial and residential properties that had fallen into bankruptcy or had simply seen prices collapse under the weight of the financial sector meltdown. Fast forward to 2020 and the real estate market in the most desirable cities and suburbs has not only recovered but could be viewed as being in grossly overbought territory -- like dot.com valuations relative to personal incomes and businesses' free cash flow.

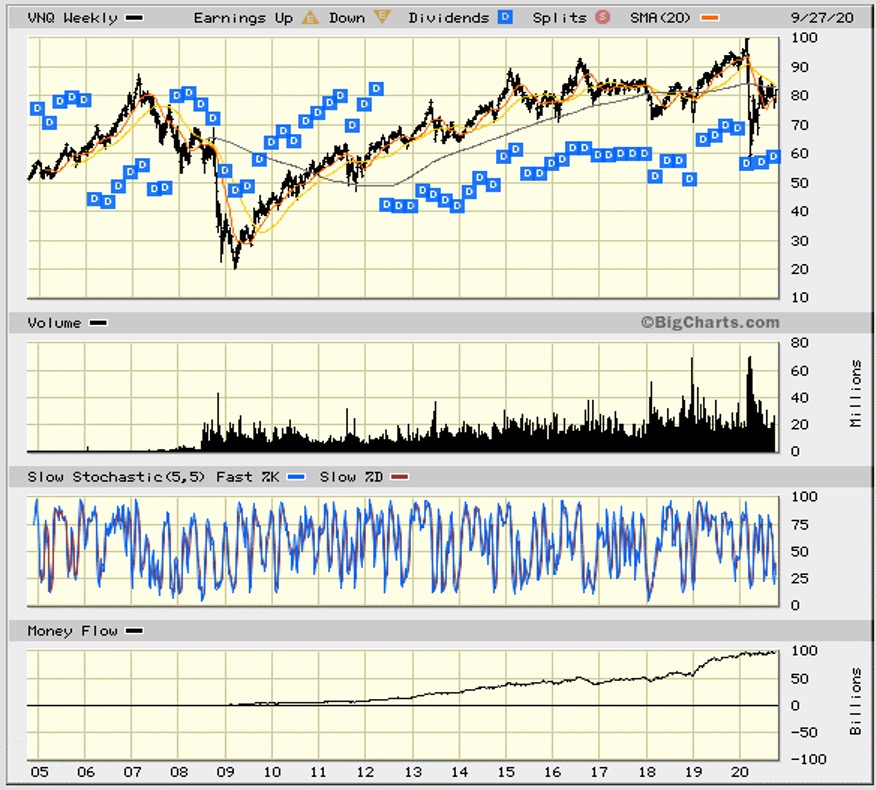

Granted, some air has come out of parts of the commercial real estate market due to the pandemic, but not homes and apartment buildings. Back in 2008, the largest real estate investment trust (REIT) exchange-traded funds (ETFs), such as the Vanguard Real Estate ETF (VNQ), were heavily weighted in retail properties, apartment properties and office buildings.

Right before the crash in mid-2008, the Vanguard Real Estate ETF (VNQ), was long in 98 holdings where 27% of total assets were invested in retail properties. (source: ETF.com Sept. 15, 2008) It seems to suggest the folks at Vanguard held a very bullish view of the consumer even as housing was in a free fall.

But the Monday after Lehman Brothers announced its bankruptcy filing, the bottom started falling out of the REIT sector and shares of VNQ tumbled thereafter, losing 70% of their value to $20 before finding a bid in early March 2009.

As the economy has recovered since that time, shares of VNQ hit an all-time high of $99.72 in February this year -- a five-fold return and almost as good as the S&P 500 return for the same period. | | Wall Street's 'Secret Income Source' Goes Ex-Dividend Days from Now A little-known investment that I recommend pays a fat dividend that you'll receive in regular MONTHLY installments.

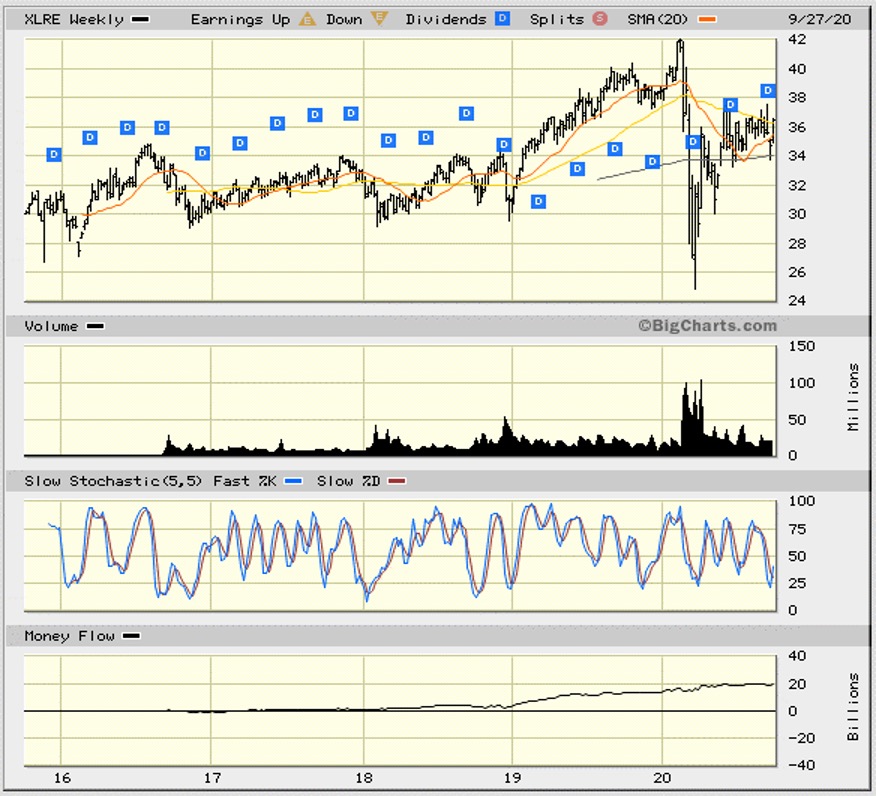

By enrolling in this investment in the next 24 hours, you'll be able to catch the next monthly payout for owning it less than 30 days! Click here now to collect the next outsized payout. | | | On Oct. 8, 2015, Standard & Poor listed its Real Estate Select Sector SPDR Fund (XLRE), which was designed to reflect the strongest sub-sectors of the universe of REITs. To date, shares of XLRE have outperformed the other four of the five largest REIT ETFs, with a gain of only 20% for the last five-year period.

From the two charts shown, it's quite obvious that, aside from collecting dividends, investors haven't faired very well in owning diversified REIT ETFs. The five largest REIT ETFs by market cap are:

Vanguard Real Estate Index Fund (VNQ) - $27.5 billion

Schwab US REIT ETF (SCHH) - $4.2 billon

iShares U.S. REIT Real Estate ETF (IYR) - $3.6 billion

Real Estate Select Sector SPDR Fund (XLRE) - $2.3 billion

iShares Cohen & Steers REIT ETF (ICF) - $1.8 billion | | Arizona Man Develops Coronavirus Kryptonite I wish I had news about a vaccine for this deadly disease, but that still looks a long way off. But this is certainly the next best thing… a "cure-all" for the daily damage the coronavirus is doing to your retirement prospects.

One Arizona man has found an easy way to bank himself huge, ongoing profits from all the craziness and volatility in today's stock market. What's his secret? Join him now for a live update and join him in feasting on this frenetic market! | | | What is most interesting is that at this point in the real estate cycle, almost all of these funds are heavily weighted in cell towers, data centers and logistics warehouses as top holdings. There is little weighting in residential apartments, health care, office buildings and retail properties when viewing the top 10 holdings of each REIT ETF noted.

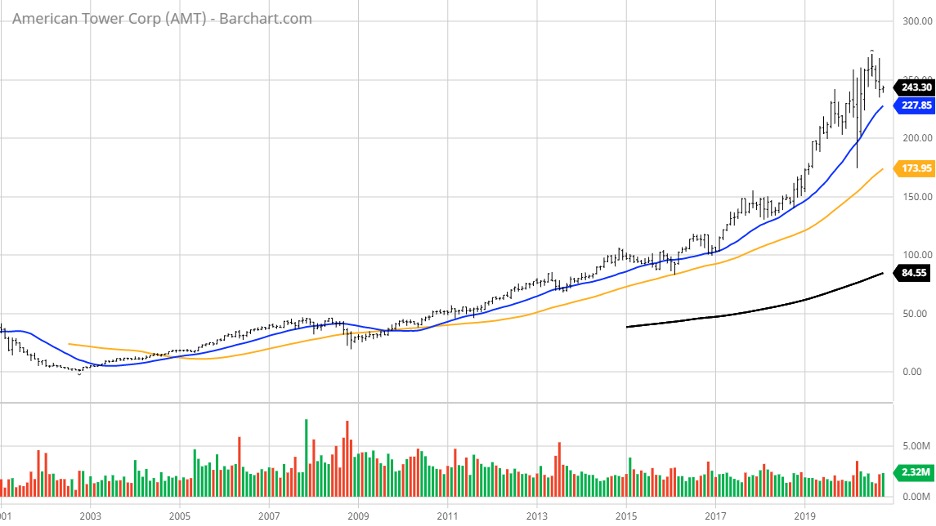

It doesn't mean they don't have exposure. They must, because if all they owned was cell towers, data centers and logistics warehouses, these stocks would be up between 100-300%, fully reflecting the performance of the stellar returns of stocks like American Tower Corp. (AMT), Prologis Inc. (PLD), Equinix Inc. (EQIX), Crown Castle International Corp. (CCI), Digital Realty Trust (DLR) and SBA Communications Corp. (SBAC) that I've highlighted in recent columns.

What's also interesting is that the number one holding in each of these five-biggest REIT ETFs is American Tower Corp. (AMT). The direction of where opportunities for future gains in real estate will come from has materially changed. Though these top five REIT ETFs had a great run from the 2009 lows to 2014, they have either pretty much flatlined or even lost value from 2015 to 2020, even as housing prices in many metropolitan areas strongly appreciated.

The takeaway from this broad observation is that investing in REIT ETFs should be viewed with caution. The better path to profits is the individual stock selection among those specialty REITs that are doing business in 5G, internet of things (IoT), big data enterprise, cloud computing and e-commerce logistics.

Until the pandemic is arrested and eliminated, letting the economy stand on its own without massive stimulus, there is no hurry to get back into brick-and-mortar retail, office, hospital, self-storage, long-term care and senior living properties. For now, stick with technology REITs and enjoy the ride. | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income

Editor, Quick Income Trader

Editor, Breakout Profits Alert

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. | | | | | |

Tidak ada komentar:

Posting Komentar